INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

9th Edition

ISBN: 9781260216141

Author: SPICELAND

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 19.10P

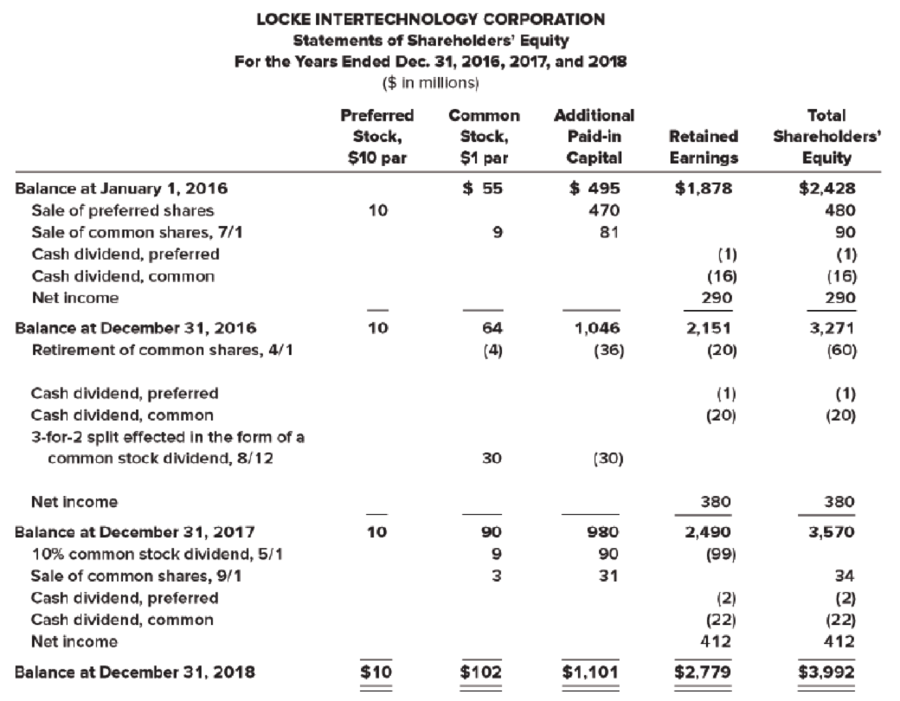

EPS from statement of shareholders’ equity

• LO19–4 through LO19–6

Comparative Statements of Shareholders’ Equity for Locke Intertechnology Corporation were reported as follows for the fiscal years ending December 31, 2016, 2017, and 2018.

Required:

Infer from the statements the events and transactions that affected Locke Intertechnology Corporation’s shareholders’ equity and compute earnings per share as it would have appeared on the income statements for the years ended December 31, 2016, 2017, and 2018. No potential common shares were outstanding during any of the periods shown.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the accurate answer to this general accounting problem using appropriate methods.

None

Please provide the solution to this general accounting question with accurate financial calculations.

Chapter 19 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

Ch. 19 - Prob. 19.1QCh. 19 - Prob. 19.2QCh. 19 - The Tax Code differentiates between qualified...Ch. 19 - Stock option (and other share-based) plans often...Ch. 19 - What is a simple capital structure? How is EPS...Ch. 19 - Prob. 19.6QCh. 19 - Blake Distributors had 100,000 common shares...Ch. 19 - Why are preferred dividends deducted from net...Ch. 19 - Prob. 19.9QCh. 19 - The treasury stock method is used to incorporate...

Ch. 19 - The potentially dilutive effect of convertible...Ch. 19 - How is the potentially dilutive effect of...Ch. 19 - Prob. 19.13QCh. 19 - If stock options and restricted stock are...Ch. 19 - Wiseman Electronics has an agreement with certain...Ch. 19 - Prob. 19.16QCh. 19 - When the income statement includes discontinued...Ch. 19 - Prob. 19.18QCh. 19 - Prob. 19.19QCh. 19 - (Based on Appendix B) LTV Corporation grants SARs...Ch. 19 - Prob. 19.1BECh. 19 - Prob. 19.2BECh. 19 - Stock options LO192 Under its executive stock...Ch. 19 - Prob. 19.4BECh. 19 - Prob. 19.5BECh. 19 - Prob. 19.6BECh. 19 - Prob. 19.7BECh. 19 - Prob. 19.8BECh. 19 - Prob. 19.9BECh. 19 - Performance-based options LO192 Refer to the...Ch. 19 - Prob. 19.11BECh. 19 - Prob. 19.12BECh. 19 - EPS; nonconvertible preferred shares LO197 At...Ch. 19 - Prob. 19.14BECh. 19 - Prob. 19.15BECh. 19 - Prob. 19.16BECh. 19 - Prob. 19.1ECh. 19 - Prob. 19.2ECh. 19 - Prob. 19.3ECh. 19 - Prob. 19.4ECh. 19 - Prob. 19.5ECh. 19 - Prob. 19.6ECh. 19 - Prob. 19.7ECh. 19 - Prob. 19.8ECh. 19 - Prob. 19.9ECh. 19 - Prob. 19.10ECh. 19 - Prob. 19.11ECh. 19 - EPS; shares issued; stock dividend LO195, LO196...Ch. 19 - Prob. 19.13ECh. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - EPS; net loss; nonconvertible preferred stock;...Ch. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - Prob. 19.17ECh. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - EPS; shares issued; stock options LO196 through...Ch. 19 - EPS; convertible preferred stock; convertible...Ch. 19 - Prob. 19.22ECh. 19 - Prob. 19.23ECh. 19 - Prob. 19.24ECh. 19 - Prob. 19.25ECh. 19 - EPS; concepts; terminology LO195 through LO1913...Ch. 19 - FASB codification research LO192 The FASB...Ch. 19 - Prob. 19.28ECh. 19 - Prob. 19.29ECh. 19 - Prob. 19.30ECh. 19 - Restricted stock units; cash settlement Appendix...Ch. 19 - Stock options; forfeiture; exercise LO192 On...Ch. 19 - Stock options; graded vesting LO192 January 1,...Ch. 19 - Stock options; graded vesting; measurement using a...Ch. 19 - Stock options; graded vesting; IFRS LO192, LO1914...Ch. 19 - Prob. 19.5PCh. 19 - Prob. 19.6PCh. 19 - Prob. 19.7PCh. 19 - Prob. 19.8PCh. 19 - EPS from statement of retained earnings LO194...Ch. 19 - EPS from statement of shareholders equity LO194...Ch. 19 - EPS; non convertible preferred stock; treasury...Ch. 19 - EPS; non convertible preferred stock; treasury...Ch. 19 - EPS; non convertible preferred stock; treasury...Ch. 19 - EPS; convertible preferred stock; convertible...Ch. 19 - EPS; antidilution LO194 through LO1910, LO1913...Ch. 19 - EPS; convertible bonds; treasury shares LO194...Ch. 19 - Prob. 19.17PCh. 19 - Prob. 19.18PCh. 19 - EPS; options; restricted stock; additional...Ch. 19 - Prob. 19.1BYPCh. 19 - Communication Case 192 Stock options; basic...Ch. 19 - Prob. 19.3BYPCh. 19 - Real World Case 195 Share-based plans; Walmart ...Ch. 19 - Prob. 19.6BYPCh. 19 - Prob. 19.7BYPCh. 19 - Analysis Case 198 EPS concepts LO194 through...Ch. 19 - Prob. 19.9BYPCh. 19 - Prob. 19.10BYPCh. 19 - Communication Case 1911 Dilution LO199 I thought...Ch. 19 - Real World Case 1912 Reporting EPS; discontinued...Ch. 19 - Analysis Case 1913 Analyzing financial statements;...Ch. 19 - Analysis Case 1915 Kelloggs EPS; PE ratio;...Ch. 19 - Prob. 19.16BYPCh. 19 - Prob. 1CCTCCh. 19 - Air FranceKLM Case IFRS LO199 Air FranceKLM (AF),...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License