FUND.ACCT.PRIN.

25th Edition

ISBN: 9781260247985

Author: Wild

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 19, Problem 14E

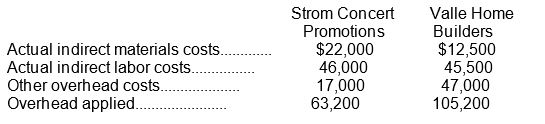

Exercise 19-14 Adjusting factory

Record the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

How do you account for depreciation using the double-declining balance method?

Define fixed costs, variable costs, and give two examples of each.

How would you account for a bad debt expense using the allowance method? Need help

Chapter 19 Solutions

FUND.ACCT.PRIN.

Ch. 19 - Jobs and job lots C1 Determine which of the...Ch. 19 - Job cost sheets C2 Clemens Cars's job cost sheet...Ch. 19 - Documents in job order costing P1 P2 P3 The left...Ch. 19 - Raw materials journal entries P1 During the...Ch. 19 - Prob. 5QSCh. 19 - Prob. 6QSCh. 19 - Prob. 7QSCh. 19 - Prob. 8QSCh. 19 - Prob. 9QSCh. 19 - Prob. 10QS

Ch. 19 - Prob. 11QSCh. 19 - Prob. 12QSCh. 19 - Jab order costing of services A1 An advertising...Ch. 19 - Job order costing of services A1 An advertising...Ch. 19 - Job cost sheet C2 Eco Skate makes skateboards from...Ch. 19 - Prob. 16QSCh. 19 - Prob. 17QSCh. 19 - Prob. 18QSCh. 19 - Prob. 19QSCh. 19 - Prob. 20QSCh. 19 - Prob. 21QSCh. 19 - Prob. 22QSCh. 19 - Prob. 23QSCh. 19 - Prob. 24QSCh. 19 - Exercise 19-1 Job order production C1 Match each...Ch. 19 - Exercise 19-2 Job cost computation C2 The...Ch. 19 - Exercise 19-3 Analysis of cost flows C2 As of the...Ch. 19 - Exercise 19-4 Recording product costs P1 P2 P3...Ch. 19 - Exercise 19-5 Manufacturing cost flows P1 P2 P3...Ch. 19 - Exercise 19-6 Recording events in job order...Ch. 19 - Exercise 19-7 Cost flows in a jab order costing...Ch. 19 - Exercise 19-8 Journal entries for materials P1 Use...Ch. 19 - Exercise 19-9 Journal entries for labor P2 Use...Ch. 19 - Exercise 19-10 Journal entries for overhead P3 Use...Ch. 19 - Exercise 19-11 Overhead rate; costs assigned to...Ch. 19 - Exercise 19-12 Analyzing costs assigned to work in...Ch. 19 - Exercise 19-13 Adjusting factory overhead P4 Refer...Ch. 19 - Exercise 19-14 Adjusting factory overhead P4...Ch. 19 - Prob. 15ECh. 19 - Prob. 16ECh. 19 - Exercise 19-17 Overhead rate calculation,...Ch. 19 - Exercise 19-18 Job order costing for services A1...Ch. 19 - Exercise 19-19 Job order costing of services A1...Ch. 19 - Exercise 19-20 Direct materials journal entries P1...Ch. 19 - Prob. 21ECh. 19 - Prob. 22ECh. 19 - Prob. 23ECh. 19 - Prob. 24ECh. 19 - Prob. 25ECh. 19 - Prob. 26ECh. 19 - Prob. 27ECh. 19 - Prob. 28ECh. 19 - Prob. 29ECh. 19 - Prob. 30ECh. 19 - Prob. 31ECh. 19 - Problem 19-1A Production costs computed and...Ch. 19 - Problem 19-2 A Source documents, journal entries,...Ch. 19 - Prob. 3PSACh. 19 - Prob. 4PSACh. 19 - Problem 19-5A Production transactions, subsidiary...Ch. 19 - Problem 19-1B Production costs computed and...Ch. 19 - Prob. 2PSBCh. 19 - Prob. 3PSBCh. 19 - Problem 19-4B Overhead allocation and adjustment...Ch. 19 - Problem 19-5B Production transactions, subsidiary...Ch. 19 - The computer workstation furniture manufacturing...Ch. 19 - The General Ledger tool in Connect automates...Ch. 19 - Manufacturers and merchandisers can apply...Ch. 19 - Prob. 2AACh. 19 - Apple and Samsung compete in the global...Ch. 19 - Prob. 1DQCh. 19 - Some companies use labor cost to apply factory...Ch. 19 - Prob. 3DQCh. 19 - In a job order costing system, what records serve...Ch. 19 - What journal entry is recorded when a materials...Ch. 19 - Prob. 6DQCh. 19 - Google uses a "time ticket" for some employees....Ch. 19 - What events cause debits to be recorded in the...Ch. 19 - Prob. 9DQCh. 19 - Assume that Apple produces a batch of 1,000...Ch. 19 - 11. Why must a company use predetermined overhead...Ch. 19 - How would a hospital apply job order costing?...Ch. 19 - Harley-Davidson manufactures 30 custom-made,...Ch. 19 - Prob. 14DQCh. 19 - Prob. 15DQCh. 19 - Assume that your company sells portable housing to...Ch. 19 - Assume that you are preparing for a second...Ch. 19 - Prob. 3BTNCh. 19 - Consider the activities undertaken by a medical...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Classify the following account: Prepaid Insurance – Asset, Liability, Equity, Revenue, or Expense?arrow_forwardJournalize the following transaction: Purchased equipment worth $10,000, paying $4,000 in cash and the balance on credit.arrow_forwardExplain the difference between accrued expense and prepaid expense with examples. No aiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License