Concept explainers

a. 1

Prepare a schedule showing units started and completed in the Molding Department during June.

a. 1

Explanation of Solution

It is a method of cost accounting used by an enterprise with processes categorised by continuous production. The cost for manufacturing those products are assigned to the manufacturing department before the averaged over units are being produced.

Prepare a schedule showing units started and completed in the Molding Department during June.

| Particulars | Units |

| Flow of physical units: Molding Department | |

| Units in beginning inventory, June 1 | 3,000 |

| Units started in June | 50,000 |

| Units in process during June | 53,000 |

| Units in ending inventory, June 30 | (1,000) |

| Units transferred to Finishing Department in June | 52,000 |

| Units in beginning inventory, June 1 | (3,000) |

| Units started and completed in June | 49,000 |

(Table 1)

Therefore, the units started and completed in the Molding Department during June is 49,000.

a. 2

Compute the equivalent units of direct materials and conversion for the Molding Department in June.

a. 2

Explanation of Solution

Compute the equivalent units of direct materials and conversion for the Molding Department in June.

| Particulars | Input Resources | |

| Direct Materials | Conversion | |

| To finish units in process on June 1: | ||

| Direct materials (3,000 units require 30% to complete) | 900 | |

| Conversion (3,000 units require 60% to complete) | 1,800 | |

| To start and complete 49,000 units in June | 49,000 | 49,000 |

| To start units in process on June 30: | ||

| Direct materials (1,000 units 80% complete) | 800 | |

| Conversion (1,000 units 20% complete) | 200 | |

| Equivalent units of resources in June | 50,700 | 51,000 |

(Table 2)

Therefore, the equivalent units of direct materials and conversion for the Molding Department in June are 50,700 and 51,000 respectively.

a. 3

Calculate the cost per equivalent unit of input resource for the Molding Department during June.

a. 3

Explanation of Solution

Calculate the cost per equivalent unit of input resource for the Molding Department during June.

| Particulars | Direct Materials in $ | Conversion Cost in $ |

| Cost per equivalent unit in June : | ||

| Costs incurred by Molding Department in June (A) | 912,600 | 612,000 |

| Equivalent units in June (B) | 50,700 | 51,000 |

| Cost per equivalent unit in June (A÷B) | 18 | 12 |

(Table 3)

Therefore, the cost per equivalent unit of input resource for the Molding Department during June is $18 per unit and $12 per unit respectively.

a. 4

Prepare

a. 4

Explanation of Solution

Prepare journal entry to record the transfer of units from the Molding Department to the Finishing Department during June.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

|

Work in process: Finishing Department (4) | 1,560,000 | ||

| Work in process: Molding Department | 1,560,000 | ||

| (To record the transfer of 52,000 units to the Finishing department in June) |

(Table 4)

- Work in process: Finishing department is an asset and there is an increase in the value of an asset. Hence, debit the work in process: finishing department by $1,560,000.

- Work in process: Molding department is an asset and there is a decrease in the value of an asset. Hence, credit the work in process: molding department by $1,560,000.

Working Notes:

Calculate the cost of beginning inventory:

(1)

Calculate the cost of direct materials during the month June:

(2)

Calculate the cost of conversion during the month June:

(3)

Calculate the total cost of units transferred:

| Particulars | Amount in $ |

| Cost of beginning inventory, June 1 (1) | 52,200 |

| June direct materials cost (2) | 898,200 |

| June conversion cost (3) | 609,600 |

| Total cost of units transferred | 1,560,000 |

(Table 5)

(4)

a.5

Compute the costs assigned to ending inventory in the Molding Department on June 30.

a.5

Explanation of Solution

Compute the costs assigned to ending inventory in the Molding Department on June 30.

| Particulars | Amount in $ |

| Work in Process: Molding Department, June 30: | |

| Direct materials cost (5) | 14,400 |

| Conversion cost (6) | 2,400 |

| Ending inventory in process, June 30 | 16,800 |

(Table 6)

Working Notes:

Calculate the cost of direct materials during the month end of June 30:

(5)

Calculate the cost of conversion during the month end of June 30:

(6)

b. 1

Prepare a schedule showing units started and completed in the Finishing Department during June.

b. 1

Explanation of Solution

Prepare a schedule showing units started and completed in the finishing Department during June.

| Particulars | Units |

| Flow of physical units: Finishing Department | |

| Units in beginning inventory, June 1 | 5,000 |

| Units started in June | 52,000 |

| Units in process during June | 57,000 |

| Units in ending inventory, June 30 | (2,000) |

| Units transferred to Finishing Department in June | 55,000 |

| Units in beginning inventory, June 1 | (5,000) |

| Units started and completed in June | 50,000 |

(Table 7)

Therefore, the units started and completed in the Finishing Department during June is 50,000

b. 2

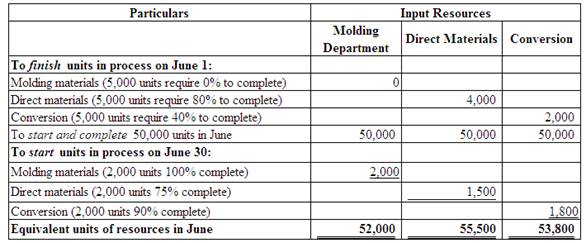

Compute the equivalent units of direct materials and conversion for the Finishing Department in June.

b. 2

Explanation of Solution

(Figure 4)

b. 3

Calculate the cost per equivalent unit of input resource for the Finishing Department during June.

b. 3

Explanation of Solution

Calculate the cost per equivalent unit of input resource for the Finishing Department during June.

| Particulars | Input Resources | ||

| Molding materials in $ | Direct Materials in $ | Conversion in $ | |

| Cost per equivalent unit in June | |||

| Costs charged to Finishing Department in June (A) | 1,560,000 | 222,000 | 430,400 |

| Equivalent units in June (B) | 52,000 | 55,500 | 53,800 |

| Cost per equivalent unit in June (A÷B) | 30 | 4 | 8 |

(Table 8)

Note:

Total cost of Molding Department $1,560,000 is transferred to the Finishing Department in June.

b.4

Prepare journal entry to record the transfer of units from the Finishing Department to Finished goods inventory during June.

b.4

Explanation of Solution

Prepare journal entry to record the transfer of units from the Finishing Department to Finished goods inventory during June.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Finished goods inventory | 2,310,000 | ||

|

Work in process: Finishing Department (9) | 2,310,000 | ||

| (To record the transfer of 55,000 units to the Finishing goods in June) |

(Table 9)

- Finished goods inventory is an asset and there is an increase in the value of an asset. Hence, debit the finished goods inventory by $2,310,000.

- Work in process: Molding department is an asset and there is a decrease in the value of an asset. Hence, credit the work in process: molding department by $2,310,000.

Working Notes:

Calculate the cost of beginning inventory:

(5)

Calculate the cost of molding department during the month June:

(6)

Calculate the cost of direct materials during the month June for finishing department:

(7)

Calculate the cost of conversion during the month June for finishing department:

(8)

Calculate the total cost of units transferred:

| Particulars | Amount in $ |

| Cost of beginning inventory, June 1 (5) | 178,000 |

| June molding materials (6) | 1,500,000 |

| June direct materials cost (7) | 216,000 |

| June conversion cost (8) | 416,000 |

| Total cost of units transferred | 2,310,000 |

(Table 10)

(9)

a.5

Compute the costs assigned to ending inventory in the Finishing Department on June 30.

a.5

Explanation of Solution

Compute the costs assigned to ending inventory in the Finishing Department on June 30.

| Particulars | Amount in $ |

| Work in Process: Finishing department, June 30: | |

| Molding materials (10) | 60,000 |

| Direct materials cost (11) | 6,000 |

| Conversion cost (12) | 14,400 |

| Ending inventory in process, June 30 | 80,400 |

(Table 11)

Working Notes:

Calculate the cost of molding materials during the month end of June 30 for finishing department:

(10)

Calculate the cost of direct materials during the month end of June 30 for finishing department:

(11)

Calculate the cost of conversion during the month end of June 30 for finishing department:

(12)

Want to see more full solutions like this?

Chapter 18 Solutions

Gen Combo Looseleaf Financial And Managerial Accounting; Connect Access Card

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI am looking for a reliable way to solve this financial accounting problem using accurate principles.arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forward

- Can you demonstrate the proper approach for solving this financial accounting question with valid techniques?arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardA company had an income of $60,000 using absorption costing for a given period. Beginning and ending inventories for that period were 13,000 units and 18,000 units, respectively. Ignoring income taxes, if the fixed overhead application rate was $3.00 per unit, what was the income using variable costing? A. $75,000. B. $60,000. C. $45,000. D. Not sufficient information to determine.arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardAn asset has a book value of $22,500 on December 31, Year 4. The asset has been depreciated at a straight-line rate of $5,000 per year. If the asset is sold on December 31, Year 4 for $19,000, what should the company record? • a. A loss on sale of $3,500 • b. A gain on sale of $3,500 . c. Neither a gain nor a loss is recognized . • d. A loss on sale of $1,000 e. A gain on sale of $1,000arrow_forwardThe audited accounts of Rattle Limited for year-end December 31, 2013, show a profit of $2,400,000 after charging the following: Depreciation $380,000 Legal fees $723,000 Bad debts $67,000 Donations $55,400 Accrued interest $51,000 Foreign travel $75,000 Repair and maintenance $216,000 Premium on insurance $88,000 Other Information: a. - Legal fees of $723,000 are for expenses in respect of the recovery of debts. b. - The company made donations of $55,400 to a registered charity. c. - The bad debt expense is a percentage of debtors at year-end. d. - Foreign travel expense was for a trip by the marketing manager to meet with potential buyers. e. - The capital allowances have been calculated at $142,000 f. - The premium paid of $88,000 was on insurance for the business’ property. g. - There were acquisition expenses of $45,000 associated with the expansion of the business. What is Rattle Ltd.’s corporate tax liability?…arrow_forward

- A company's income statement for September reports a net income of $75,000. During the same month, the company paid $15,000 in dividends. If the beginning stockholders' equity was $0, what is the ending balance in stockholders' equity?arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education