1.

Calculate the effect of change in inventory on the value stream profits of DVD and TV and replace the controllable margin.

1.

Explanation of Solution

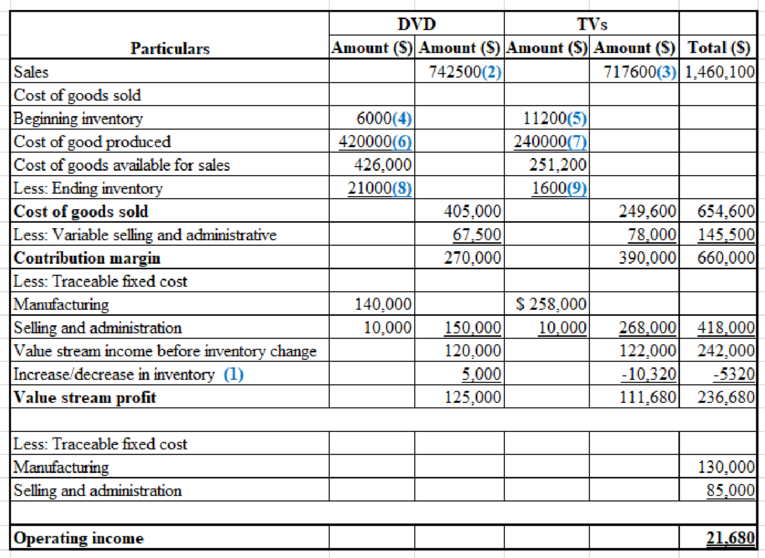

Calculate the effect of change in inventory on the value stream profits of DVD and TV and replace the controllable margin.

| Particulars | DVD Group | TV Group | ||||

| Beginning inventory | 200 | 700 | ||||

| Price | $55 | $46 | ||||

| Sold | $13,500 | $15,600 | ||||

| Actual production | 14,000 | 15,000 | ||||

| Budgeted production | 14,000 | 15,000 | ||||

| Ending inventory | 700 (1) | 100 (2) | ||||

| Particulars | DVD group ($) | TV group ($) | Total | |||

| Unit variable cost | ||||||

| Manufacturing | 30 | 16 | ||||

| Selling and administrative | 5 | 5 | ||||

| Traceable fixed cost | ||||||

| Manufacturing | 140,000 | 258,000 | 398,000 | |||

| Selling and administrative | 10,000 | 10,000 | 20,000 | |||

| Non traceable fixed cost | ||||||

| Manufacturing | 130,000 | |||||

| Selling and administrative | 85,000 | |||||

| Change in inventory | 5,000 (1.1) | (10,320) (2.1) | ||||

Table (1)

Therefore, the ending inventory is 700 units for DVD group and 100 units for TV group respectively.

Therefore, the value stream profit of TVs is $236,680.

Working notes:

1) Calculate the ending inventory of DVD group:

2) Calculate the ending inventory of TV group:

1.1) Calculate the change in inventory of DVD and TV group:

For DVDs

2.1) For TVs

2) Calculate the sales for DVDs:

3) Calculate the sales for TVs

4) Calculate the beginning inventory for DVDs:

5) Calculate the beginning inventory for TVs:

6) Calculate the cost of goods produced for DVDs:

7) Calculate the cost of goods produced for TVs:

8) Calculate the ending inventory for DVDs:

9) Calculate the ending inventory for TVs

2.

Provide information on the results obtained from the value stream income statement.

2.

Explanation of Solution

The value stream income statement is prepared with the full costing income statement. The value of change in inventory has increased by $5,000 for the DVDs and decreased by $10,320 for the TVs. Non traceable fixed cost are not allocated but are subtracted from the profits to get an operating income of $21,680.

The income statement show that both are profitable but the TVs are relatively less when compared to DVDs, the reason is that there is a negative change in the value of inventory that is $10,320 while DVDs have an increase of $5,000.

3.

Describe the benefits of using value stream for evaluating profits.

3.

Explanation of Solution

The value stream income statement comprises of both variable and full costing income statement, which shows the effect of change in inventory. This provides the management the additional information for more complete and informative evaluation of products.

Want to see more full solutions like this?

Chapter 18 Solutions

Cost Management: A Strategic Emphasis

- Please given correct answer for General accounting question I need step by step explanationarrow_forwardI am looking for the most effective method for solving this financial accounting problem.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education