Concept explainers

a.

To calculate: The amount of FCFE per share for the year 2016 using the data given in the table.

Introduction:

FCFE: When expanded, it is

a.

Answer to Problem 3CP

The free cash flow earning(FCFE) per share will be

Explanation of Solution

The information given to us is as follows:

Table 18A

Sundanci actual 2010 and 2011 financial statements

for fiscal years ending May 31

(Amount in million $, except per share data)

| Income statement | 2010 | 2011 |

| Revenue |  |  |

| 23 | |

| Other operating costs |  |  |

| Income before taxes |  |  |

| Taxes |  |  |

| Net Income |  |  |

| Dividends |  |  |

| Earnings per share |  |  |

| Dividend per share |  |  |

| Common shares outstanding (millions) |  |  |

| 2010 | 2011 | |

| Current assets |  |  |

| Net property, plant and equipment |  |  |

| Total assets |  |  |

| Current liabilities |  |  |

| Long term debt | 0 | 0 |

| Total liabilities |  |  |

| Shareholder’s equity |  |  |

| Total liabilities and equity |  |  |

| Capital expenditures |  |  |

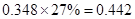

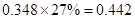

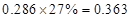

Sundanci FCFE will grow at  for two year and

for two year and  thereafter.

thereafter.

Capital expenditures, depreciation and working capital are expected to increase proportionately with FCFE.

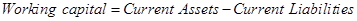

Note 1: Calculation of increase in working capital:

Therefore, when there is an increase in working capital, it implies that the there is an increase in current assets and current liabilities.

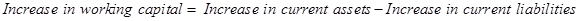

Let us now calculate the increase in working capital.

The value of currents assets has increased from Similarly, even the current liabilities have increased from

Similarly, even the current liabilities have increased from  million dollars. So, let us consider the difference amounts for calculations.

million dollars. So, let us consider the difference amounts for calculations.

Therefore the net increase in working capital will be

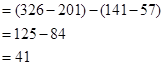

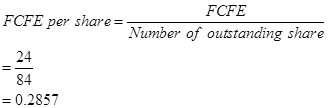

Calculation of FCFE per share:

Number of outstanding shares=84 (as per the given information.)

Number of outstanding shares=84 (as per the given information.)

or 0.286 when rounded off.

Therefore, free cash flow equity per share will be

b.

To calculate: The current value of a share of Sundanci stock using the two-stage FCFE model.

Introduction:

DDM model: DDM model refers to

b.

Answer to Problem 3CP

The current value of the share is

Explanation of Solution

The information given to us is as follows:

Table 18A

Sundanci actual 2010 and 2011 financial statements

for fiscal years ending May 31

(Amount in million $, except per share data)

| Income statement | 2010 | 2011 |

| Revenue |  |  |

| Depreciation |  |  |

| Other operating costs |  |  |

| Income before taxes |  |  |

| Taxes |  |  |

| Net Income |  |  |

| Dividends |  |  |

| Earnings per share |  |  |

| Dividend per share |  |  |

| Common shares outstanding (millions) |  |  |

| Balance sheet | 2010 | 2011 |

| Current assets |  |  |

| Net property, plant and equipment | 474 | 489 |

| Total assets | 675 | 815 |

| Current liabilities | 57 | 141 |

| Long term debt | 0 | 0 |

| Total liabilities | 57 | 141 |

| Shareholder’s equity | 618 | 674 |

| Total liabilities and equity | 675 | 815 |

| Capital expenditures | 34 | 38 |

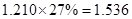

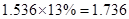

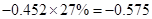

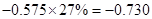

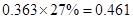

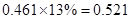

Sundanci FCFE will grow at 27% for two year and 13% thereafter.

Capital expenditures, depreciation and working capital are expected to increase proportionately with FCFE.

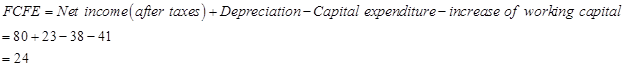

Usage of two-stage FCFE model is simple. We have to first calculate the FCFE per share in the year 2012 and 2013. We have to proceed with calculation using the given information that there is a growth rate of 27%. Then, we have to calculate the terminal value in 2013 which has a continuous growth of 13%. Finally, this value has to be discounted at current period by the required

Let us now calculate the current value of a share.

| Income statement | Actual | Estimated | |||

| 2011 | 2012 | 2013 | 2014 | ||

| Growth

rate | 27%- | 27% | 13% | ||

| Per share value | Per share value | Per share value | |||

| Net

Income | 80 |  |  |  |  |

| Add: Depreciation | 23 |  |  |  |  |

| Less:

Capital expenditure | -38 |  |  |  |  |

| Less: Increase in working capital | -41 |  |  |  |  |

| FCFE | 24 |  |  |  |  |

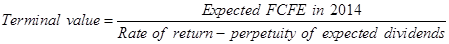

Let us now calculate the terminal value.

The rate of return 14% and perpetuity dividends 13% are converted into decimals by dividing it by 100.

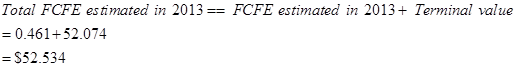

Having done, let us now calculate the total FCFE estimated in 2013.

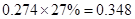

Let us now discount the FCFE to derive the FCFE per share value.

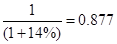

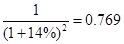

Since, we are given that the required rate of return is 14%, let us use the PV factor of 14%

So, when we are calculating the PV factor for 2012, it will be 1.

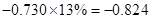

For 2013 PV factor=

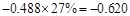

For 2014 PV factor=

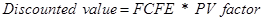

So, now we have to calculate the discounted value.

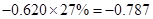

For 2013 Discounted value

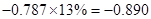

For 2014 discounted value

Therefore, the current value of the share=40.742.

c.

To describe: The limitation of two-state DDM model calculated by using and than by not using the two-stage FCFE model.

Introduction:

DDM Model: DDM model refers to dividend discount model. It is supposed to be a quantitative method useful in estimating the company’s stock price.

c.

Answer to Problem 3CP

The assumption of continuous growth sounds unrealistic resulting in a number of limitations on usage.

Explanation of Solution

The whole concept of DDM is based on the theory that the present- day’s price is worth the sum of all of its future dividend payments which are later discounted back to is

- The shares of a company cannot be valued using DDM model since distribution of dividends is not possible. With the help of FCFE model, the value of the firm can be predicted even though dividends are not distributed.

- When both models i.e., FCFE model and DDM, we can observe one thing. The assumption of continuous growth rate sounds unrealistic. Practically seen, the growth rate keeps on changing and it is highly impossible for it to be stable for a long time. Estimation of the time when the growth rate will be constant is not possible. This results in difficulty in calculation of required rate of return.

Want to see more full solutions like this?

Chapter 18 Solutions

EBK INVESTMENTS

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning