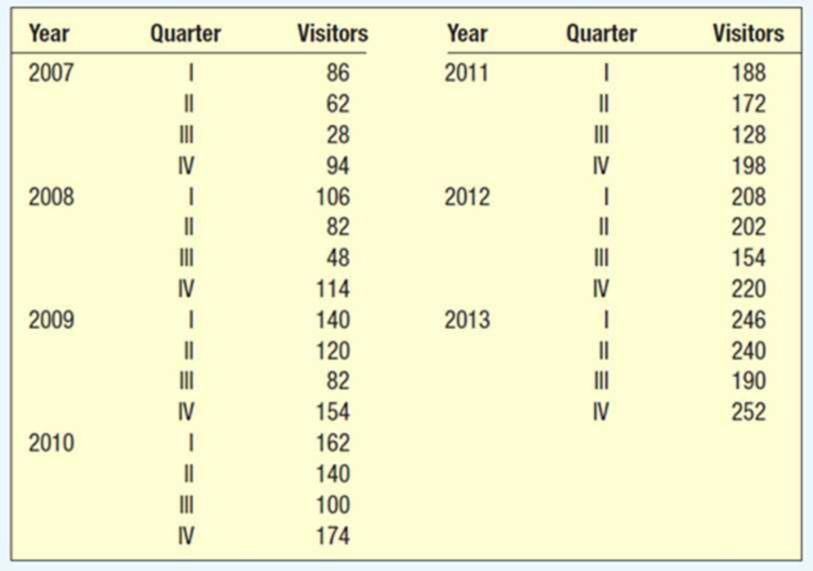

Ray Anderson, owner of Anderson Ski Lodge in upstate New York, is interested in forecasting the number of visitors for the upcoming year. The following data are available, by quarter, from the first quarter of 2007 to the fourth quarter of 2013. Develop a seasonal index for each quarter. How many visitors would you expect for each quarter of 2014, if Ray projects that there will be a 10% increase from the total number of visitors in 2013? Determine the trend equation, project the number of visitors for 2014, and seasonally adjust the forecast. Which forecast would you choose?

Obtain a seasonal index for each of the four quarters.

Find the number of visitors expected for each quarters of 2014 if there is 10% increase in the total number of visitors in 2013.

Obtain the trend equation.

Predict the number of visitors for 2014.

Find the seasonally adjusted forecasts.

Identify the best forecast.

Answer to Problem 33CE

The seasonal indexes for the four quarters are 1.2046, 1.0206, 0.6297, and 01.1451.

The number of visitors for each quarter of 2017 if there is 10% increase in the total number of visitors in 2013 is 255.25 visitors per quarter.

The trend equation is

The number of visitors for 2017 are 242.0171, 248.634, 255.2509, and 261.8678.

The seasonally adjusted forecasts are 291.5338, 253.7559, 160.7315, and 299.8648.

The best forecast is the fourth quarter of 2017.

Explanation of Solution

Four-year moving average:

Centered moving average:

Specific seasonal index:

| Year | Quarter | Visitors |

Four-quarter moving average |

Centered Moving average | Specific seasonal |

| 2007 | 1 | 86 | |||

| 2 | 62 | ||||

| 3 | 28 | 70 | 0.4 | ||

| 4 | 94 | 67.5 | 75 | 1.253333 | |

| 2008 | 1 | 106 | 72.5 | 80 | 1.325 |

| 2 | 82 | 77.5 | 85 | 0.964706 | |

| 3 | 48 | 82.5 | 91.75 | 0.523161 | |

| 4 | 114 | 87.5 | 100.75 | 1.131514 | |

| 2009 | 1 | 140 | 96 | 109.75 | 1.275626 |

| 2 | 120 | 105.5 | 119 | 1.008403 | |

| 3 | 82 | 114 | 126.75 | 0.646943 | |

| 4 | 154 | 124 | 132 | 1.166667 | |

| 2010 | 1 | 162 | 129.5 | 136.75 | 1.184644 |

| 2 | 140 | 134.5 | 141.5 | 0.989399 | |

| 3 | 100 | 139 | 147.25 | 0.679117 | |

| 4 | 174 | 144 | 154.5 | 1.126214 | |

| 2011 | 1 | 188 | 150.5 | 162 | 1.160494 |

| 2 | 172 | 158.5 | 168.5 | 1.020772 | |

| 3 | 128 | 165.5 | 174 | 0.735632 | |

| 4 | 198 | 171.5 | 180.25 | 1.098474 | |

| 2012 | 1 | 208 | 176.5 | 187.25 | 1.110814 |

| 2 | 202 | 184 | 193.25 | 1.045278 | |

| 3 | 154 | 190.5 | 200.75 | 0.767123 | |

| 4 | 220 | 196 | 210.25 | 1.046373 | |

| 2013 | 1 | 246 | 205.5 | 219.5 | 1.120729 |

| 2 | 240 | 215 | 228 | 1.052632 | |

| 3 | 190 | 224 | |||

| 4 | 252 | 232 |

The quarterly indexes are as follows:

| I | II | III | IV | |

| 2007 | 0.4 | 1.253333 | ||

| 2008 | 1.325 | 0.964706 | 0.523161 | 1.131514 |

| 2009 | 1.275626 | 1.008403 | 0.646943 | 1.166667 |

| 2010 | 1.184644 | 0.989399 | 0.679117 | 1.126214 |

| 2011 | 1.160494 | 1.020772 | 0.735632 | 1.098474 |

| 2012 | 1.110814 | 1.045278 | 0.767123 | 1.046373 |

| 2013 | 1.120729 | 1.052632 | ||

| Mean | 1.1962 | 1.0135 | 0.6253 | 1.1371 |

Seasonal index:

Here,

Therefore, the following is obtained:

The seasonal indexes are as follows:

| I | II | III | IV | |

| 2007 | 0.4 | 1.253333 | ||

| 2008 | 1.325 | 0.964706 | 0.523161 | 1.131514 |

| 2009 | 1.275626 | 1.008403 | 0.646943 | 1.166667 |

| 2010 | 1.184644 | 0.989399 | 0.679117 | 1.126214 |

| 2011 | 1.160494 | 1.020772 | 0.735632 | 1.098474 |

| 2012 | 1.110814 | 1.045278 | 0.767123 | 1.046373 |

| 2013 | 1.120729 | 1.052632 | ||

| Mean | 1.1962 | 1.0135 | 0.6253 | 1.1371 |

| Seasonal Index |

The total number of visitors in the year 2013 is

The 10% of 928 visitors is

The number of visitors in the year 2017 is

Therefore, the number of visitors in each quarter of 2017 is

Trend equation:

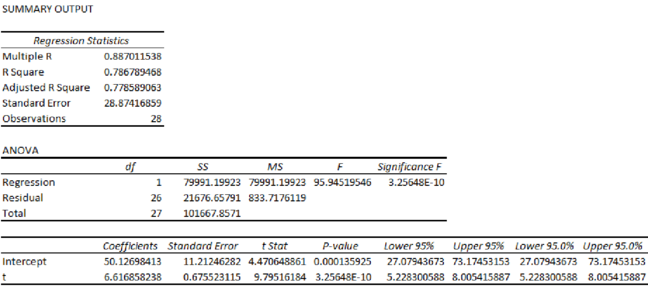

Step-by-step procedure to obtain the regression using the Excel:

- Enter the data for Year, Visitors and t in Excel sheet.

- Go to Data Menu.

- Click on Data Analysis.

- Select Regression and click on OK.

- Select the column of Visitors under Input Y Range.

- Select the column of t under Input X Range.

- Click on OK.

Output for the regression obtained using the Excel is as follows:

From the output, the regression equation is

Projection of the number of visitors for 2017:

The t value for the first quarter of 2014 is 29.

The t value for the second quarter of 2014 is 30.

The t value for the third quarter of 2014 is 31.

The t value for the fourth quarter of 2014 is 32.

Seasonally adjusted forecast:

| Estimated Visitors | Seasonal Index | |

| 242.0171 | 1.2046 | 291.5338 |

| 248.634 | 1.0206 | 253.7559 |

| 255.2509 | 0.6297 | 160.7315 |

| 261.8678 | 1.1451 | 299.8648 |

The seasonal index for the fourth quarter is high when compared to the remaining three quarters. Hence, the forecast for the fourth quarter is the best.

Want to see more full solutions like this?

Chapter 18 Solutions

Loose Leaf for Statistical Techniques in Business and Economics (Mcgraw-hill/Irwin Series in Operations and Decision Sciences)

- Faye cuts the sandwich in two fair shares to her. What is the first half s1arrow_forwardQuestion 2. An American option on a stock has payoff given by F = f(St) when it is exercised at time t. We know that the function f is convex. A person claims that because of convexity, it is optimal to exercise at expiration T. Do you agree with them?arrow_forwardQuestion 4. We consider a CRR model with So == 5 and up and down factors u = 1.03 and d = 0.96. We consider the interest rate r = 4% (over one period). Is this a suitable CRR model? (Explain your answer.)arrow_forward

- Question 3. We want to price a put option with strike price K and expiration T. Two financial advisors estimate the parameters with two different statistical methods: they obtain the same return rate μ, the same volatility σ, but the first advisor has interest r₁ and the second advisor has interest rate r2 (r1>r2). They both use a CRR model with the same number of periods to price the option. Which advisor will get the larger price? (Explain your answer.)arrow_forwardQuestion 5. We consider a put option with strike price K and expiration T. This option is priced using a 1-period CRR model. We consider r > 0, and σ > 0 very large. What is the approximate price of the option? In other words, what is the limit of the price of the option as σ∞. (Briefly justify your answer.)arrow_forwardQuestion 6. You collect daily data for the stock of a company Z over the past 4 months (i.e. 80 days) and calculate the log-returns (yk)/(-1. You want to build a CRR model for the evolution of the stock. The expected value and standard deviation of the log-returns are y = 0.06 and Sy 0.1. The money market interest rate is r = 0.04. Determine the risk-neutral probability of the model.arrow_forward

- Several markets (Japan, Switzerland) introduced negative interest rates on their money market. In this problem, we will consider an annual interest rate r < 0. We consider a stock modeled by an N-period CRR model where each period is 1 year (At = 1) and the up and down factors are u and d. (a) We consider an American put option with strike price K and expiration T. Prove that if <0, the optimal strategy is to wait until expiration T to exercise.arrow_forwardWe consider an N-period CRR model where each period is 1 year (At = 1), the up factor is u = 0.1, the down factor is d = e−0.3 and r = 0. We remind you that in the CRR model, the stock price at time tn is modeled (under P) by Sta = So exp (μtn + σ√AtZn), where (Zn) is a simple symmetric random walk. (a) Find the parameters μ and σ for the CRR model described above. (b) Find P Ste So 55/50 € > 1). StN (c) Find lim P 804-N (d) Determine q. (You can use e- 1 x.) Ste (e) Find Q So (f) Find lim Q 004-N StN Soarrow_forwardIn this problem, we consider a 3-period stock market model with evolution given in Fig. 1 below. Each period corresponds to one year. The interest rate is r = 0%. 16 22 28 12 16 12 8 4 2 time Figure 1: Stock evolution for Problem 1. (a) A colleague notices that in the model above, a movement up-down leads to the same value as a movement down-up. He concludes that the model is a CRR model. Is your colleague correct? (Explain your answer.) (b) We consider a European put with strike price K = 10 and expiration T = 3 years. Find the price of this option at time 0. Provide the replicating portfolio for the first period. (c) In addition to the call above, we also consider a European call with strike price K = 10 and expiration T = 3 years. Which one has the highest price? (It is not necessary to provide the price of the call.) (d) We now assume a yearly interest rate r = 25%. We consider a Bermudan put option with strike price K = 10. It works like a standard put, but you can exercise it…arrow_forward

- In this problem, we consider a 2-period stock market model with evolution given in Fig. 1 below. Each period corresponds to one year (At = 1). The yearly interest rate is r = 1/3 = 33%. This model is a CRR model. 25 15 9 10 6 4 time Figure 1: Stock evolution for Problem 1. (a) Find the values of up and down factors u and d, and the risk-neutral probability q. (b) We consider a European put with strike price K the price of this option at time 0. == 16 and expiration T = 2 years. Find (c) Provide the number of shares of stock that the replicating portfolio contains at each pos- sible position. (d) You find this option available on the market for $2. What do you do? (Short answer.) (e) We consider an American put with strike price K = 16 and expiration T = 2 years. Find the price of this option at time 0 and describe the optimal exercising strategy. (f) We consider an American call with strike price K ○ = 16 and expiration T = 2 years. Find the price of this option at time 0 and describe…arrow_forward2.2, 13.2-13.3) question: 5 point(s) possible ubmit test The accompanying table contains the data for the amounts (in oz) in cans of a certain soda. The cans are labeled to indicate that the contents are 20 oz of soda. Use the sign test and 0.05 significance level to test the claim that cans of this soda are filled so that the median amount is 20 oz. If the median is not 20 oz, are consumers being cheated? Click the icon to view the data. What are the null and alternative hypotheses? OA. Ho: Medi More Info H₁: Medi OC. Ho: Medi H₁: Medi Volume (in ounces) 20.3 20.1 20.4 Find the test stat 20.1 20.5 20.1 20.1 19.9 20.1 Test statistic = 20.2 20.3 20.3 20.1 20.4 20.5 Find the P-value 19.7 20.2 20.4 20.1 20.2 20.2 P-value= (R 19.9 20.1 20.5 20.4 20.1 20.4 Determine the p 20.1 20.3 20.4 20.2 20.3 20.4 Since the P-valu 19.9 20.2 19.9 Print Done 20 oz 20 oz 20 oz 20 oz ce that the consumers are being cheated.arrow_forwardT Teenage obesity (O), and weekly fast-food meals (F), among some selected Mississippi teenagers are: Name Obesity (lbs) # of Fast-foods per week Josh 185 10 Karl 172 8 Terry 168 9 Kamie Andy 204 154 12 6 (a) Compute the variance of Obesity, s²o, and the variance of fast-food meals, s², of this data. [Must show full work]. (b) Compute the Correlation Coefficient between O and F. [Must show full work]. (c) Find the Coefficient of Determination between O and F. [Must show full work]. (d) Obtain the Regression equation of this data. [Must show full work]. (e) Interpret your answers in (b), (c), and (d). (Full explanations required). Edit View Insert Format Tools Tablearrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Trigonometry (MindTap Course List)TrigonometryISBN:9781305652224Author:Charles P. McKeague, Mark D. TurnerPublisher:Cengage Learning

Trigonometry (MindTap Course List)TrigonometryISBN:9781305652224Author:Charles P. McKeague, Mark D. TurnerPublisher:Cengage Learning Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt