Concept explainers

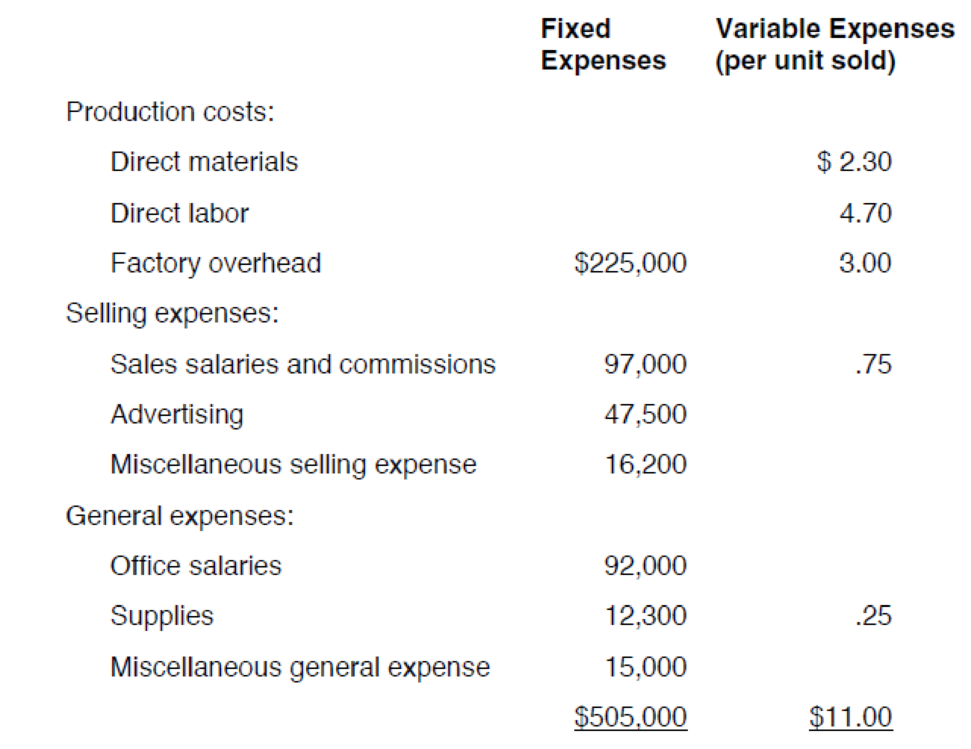

Poleski Manufacturing, which maintains the same level of inventory at the end of each year, provided the following information about expenses anticipated for next year:

The selling price of Poleskiʼs single product is $16. In recent years, profits have fallen and Poleskiʼs management is now considering a number of alternatives. Poleski wants to have a net income next year of $250,000, but expects to sell only 120,000 units unless some changes are made.

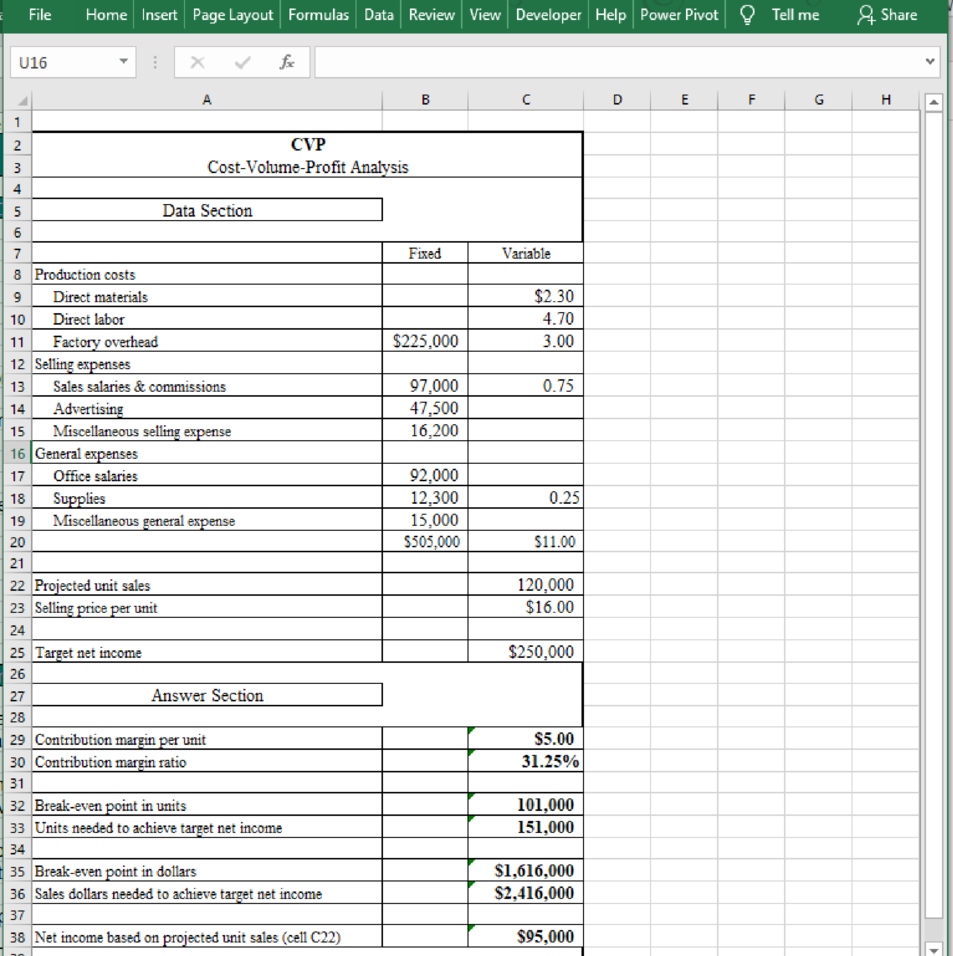

The president of Poleski has asked you to calculate the companyʼs projected net income (assuming 120,000 units are sold) and the sales needed to achieve the companyʼs net income objective for next year. Also, compute Poleskiʼs contribution margin per unit, contribution margin ratio, and break-even point for next year. The worksheet CVP has been provided to assist you. Note that the data from the problem have already been entered into the Data Section of the worksheet.

Compute the projected net income of the company and the sales required to attain the net income objective for next year. Calculate contribution margin per unit, contribution margin ratio, and break-even point for next year.

Explanation of Solution

The projected net income, sales required to attain the net income, contribution margin per unit, contribution margin ratio, and break-even pointfor next year are calculated as follows:

Table (1)

Want to see more full solutions like this?

Chapter 18 Solutions

Excel Applications for Accounting Principles

- Please show me how to solve this financial accounting problem using valid calculation techniques.arrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- how much overhead cost would be assigned to product G98X using the activity based costing system ?arrow_forwardThe closing price of a stock is $74.55, and the net earnings per share are $3.50. The stock's P/E ratio is .arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning