To determine: The Offer Price per share.

Introduction:

The term dividends allude to that portion of proceeds of an organization which is circulated by the organization among its investors. It is the remuneration of the investors for investments made by them in the shares of the organization. A dividend policy is an organization's way to deal with disseminating revenues back to its proprietors or investors. In the event that an organization is in a development stage, it might conclude that it won't pay profits, but instead re-contribute its

Answer to Problem 1MC

Solution: The Offer Price per share is $39.17.

Explanation of Solution

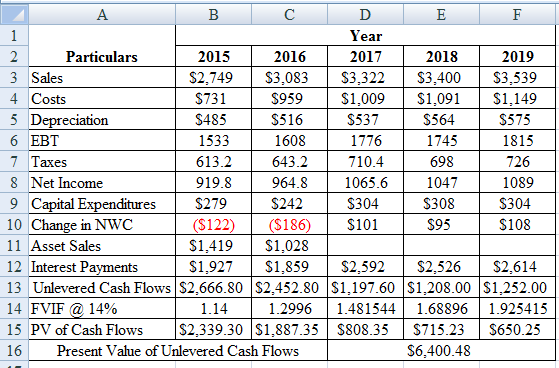

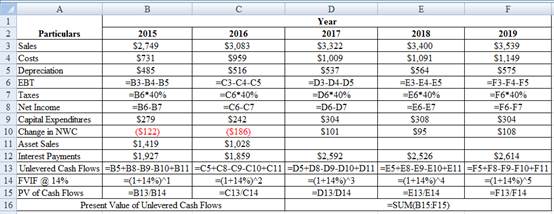

Determine the Present Value of Unlevered Cash Flows for the initial 5 years

Using a excel spreadsheet we calculate the present value of unlevered cash flows for the initial 5 years as,

Excel Spreadsheet:

Excel Workings:

Therefore the Present Value of Unlevered Cash Flows for the initial 5 years is $6,400.48

Determine the Unlevered Value of Cash Flow in Year 5

Therefore the Unlevered Value of Cash Flow in Year 5 is $12,341.14

Determine the Terminal Value at the end of Year 5

Therefore the Terminal Value at the end of Year 5 is $6,409.60

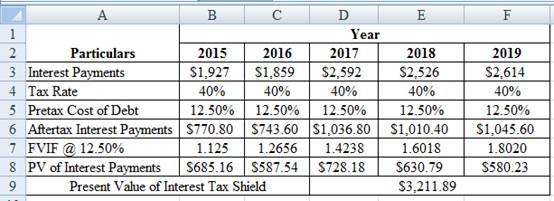

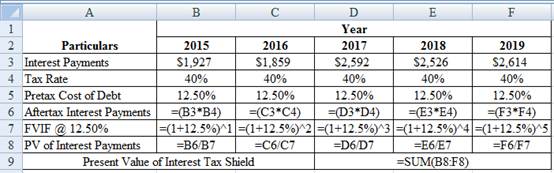

Determine the Present Value of Interest Tax Shield

Using a excel spreadsheet we calculate the present value of interest tax shield as,

Excel Spreadsheet:

Excel Workings:

Therefore the Present Value of Interest Tax Shield is $3,211.89

Determine the Levered

Therefore the Levered Cost of Equity using MM Proposition II with Corporate Taxes is 14.90%

Determine the WACC after Year 5

Therefore the WACC after Year 5 is 13.12%

Determine the Terminal Value of Levered Company after Year 5

Therefore the Terminal Value of Levered Company after Year 5 is $13,470.06

Determine the Interest Tax Shield after Year 5

Therefore the Interest Tax Shield after Year 5 is $1,128.92

Determine the Present Value of Interest Tax Shield after Year 5

Therefore the Present Value of Interest Tax Shield after Year 5 is $626.47

Determine the Value of Unlevered Cash Flows

Therefore the Value of Unlevered Cash Flows is $12,810.08

Determine the Value of Interest Tax Shield

Therefore the Value of Interest Tax Shield is $3,838.36

Determine the Offer Price per share

Therefore the Offer Price per share is $39.17,

Want to see more full solutions like this?

Chapter 18 Solutions

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- what do you know about finance? explain all no aiarrow_forwardWhat is corporate finance? how many types of corporate finance??arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2,350,000. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $3,310,000 in annual sales, with costs of $2,330,000. Assume the tax rate is 23 percent and the required return on the project is 11 percent. What is the project's NPV? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forward

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning