a.

To show: The adjustments to be made in capital accounts of Ace Products in order to payout a stock dividend of 10%.

Introduction:

Stock Dividend:

When a company pays dividends to its shareholders not in cash but in the form of additional shares, such a dividend is termed as stock dividend. This form is generally paid out when company falls short of cash.

a.

Answer to Problem 18P

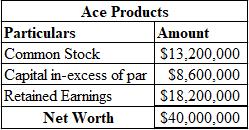

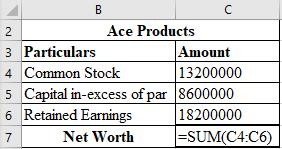

The adjustments that would be made to the capital account for payment of 10% stock dividend are as follows:

Explanation of Solution

The calculation used for making required adjustments to capital account is shown below:

Working Notes:

Calculation of Stock Dividend in numbers:

Calculation of additional capital in-excess of par:

Calculation of Capital in-excess of par:

Calculation of closing balance of

b.

To show: The adjustments to be made to the EPS as well as the stock price of Ace Products, assuming the P/E ratio to remain the same.

Introduction:

Earnings per share (EPS):

It is the profit earned by shareholders on each share. A higher EPS indicates higher value of the company because investors are ready to pay higher price for one share of the company.

Stock Price:

The highest price of one share of a company that an investor is willing to pay is termed as the stock’s price. It is current price used for the trading of such share.

b.

Answer to Problem 18P

The EPS of Ace Products after stock dividend is $1.82 and the price of its stocks is $18.20.

Explanation of Solution

Calculation of the EPS of Ace Products after stock dividends:

Calculation of the price of stock:

Working Note:

Calculation of Number of shares after stock dividend:

c.

To calculate: The number of shares a shareholder would have if he originally owns 70 shares.

Introduction:

Stockholder:

Also termed as a shareholder, the person who own shares or capital stock in a corporation is the stockholder. In other words, a shareholder is the one who partly owns a company, limited to the amount of his shares.

c.

Answer to Problem 18P

The number of shares that a shareholder originally holding 70 shares will after the declaration of stock dividend have 77 shares.

Explanation of Solution

Calculation of the number of shares of one of the shareholders after stock dividend:

d.

To calculate: The worth of the total investments of an investor before as well as after the stock dividend, the P/E ratio being constant.

Introduction:

Stock Dividend:

When a company pays dividends to its shareholders not in cash but in the form of additional shares, such a dividend is termed as stock dividend. This form is generally paid out when company falls short of cash.

d.

Answer to Problem 18P

The P/E ratio remaining constant, the worth of the total investments of an investor before the declaration of stock dividends is $1,400 and after the stock dividend is $1,401.

Explanation of Solution

Calculation of the value of an investors total investments before the declaration of stock dividends:

Calculation of the value of an investors total investments after the declaration of stock dividends:

Want to see more full solutions like this?

Chapter 18 Solutions

Foundations Of Financial Management

- Beta Company Ltd issued 10% perpetual debt of Rs. 1,00,000. The company's tax rate is 50%. Determine the cost of capital (before tax as well as after tax) assuming the debt is issued at 10 percent premium. helparrow_forwardFinance subject qn solve.arrow_forwardPlease help with questionsarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education