Concept explainers

Various stock transactions; correction of

• LO18–4

IFRS

Part A

During its first year of operations, the McCollum Corporation entered into the following transactions relating to shareholders’ equity. The corporation was authorized to issue 100 million common shares, $1 par per share.

Required:

Prepare the appropriate journal entries to record each transaction.

| Jan. 9 | Issued 40 million common shares for $20 per share. |

| Mar. 11 | Issued 5,000 shares in exchange for custom-made equipment. McCollum’s shares have traded recently on the stock exchange at $20 per share. |

Part B

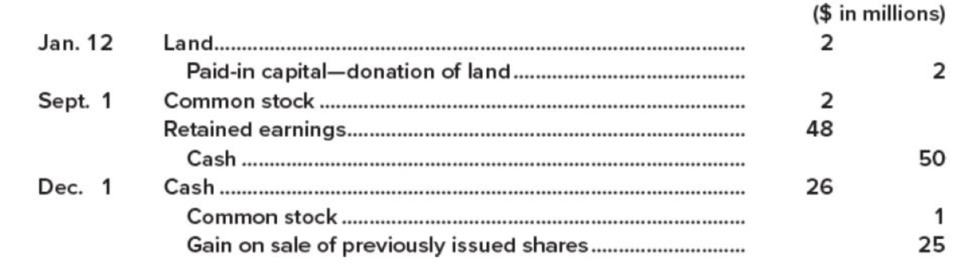

A new staff accountant for the McCollum Corporation recorded the following journal entries during the second year of operations. McCollum retires shares that it reacquires (restores their status to that of authorized but unissued shares).

Required:

Prepare the journal entries that should have been recorded for each of the transactions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

GEN CMB(LL)INTRM ACCTG

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Essentials of MIS (13th Edition)

Management (14th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning