Concept explainers

(a)

To calculate:

The total value added arrived due to the decisions taken by all the managers.

Introduction:

The total value added is computed by calculating excess (deficit) return ascertained by return as per manager's weights over the return as per MSCI weights.

Answer to Problem 12PS

The total value added is

Explanation of Solution

Given Information:

Results for a given month are in the following table:

| Country | Weights (MSCI) | Weights (Manager's) | Manager's return in Country | Return of stock index for that Country |

| U.K. | ||||

| Japan | ||||

| U.S. | ||||

| Germany |

The formula for total value added is:

Now, Return as per manager's weight is:

Return as per MSCI weight is:

Thus, as per the above calculation, the total value added for all managers' decision is:

(b)

To calculate:

The value added arrived due to the decisions taken by her country allocations.

Introduction:

The value added by allocation of country decision is computed by calculating excess (deficit) weight of manager's portfolio over the portfolio of MSCI and get it multiplied with MSCI return.

Answer to Problem 12PS

The value added is

Explanation of Solution

Given Information:

Results for a given month are in the following table:

| Country | Weights (MSCI) | Weights (Manager's) | Manager's return in Country | Return of stock index for that Country |

| U.K. | ||||

| Japan | ||||

| U.S. | ||||

| Germany |

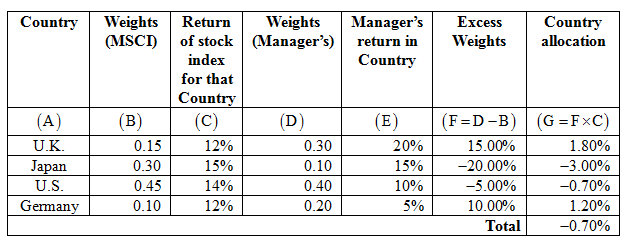

The following table is showing computation of value added:

Thus, the value added for country allocation is

(c)

To calculate:

The value added arrived due to the ability of the stock selection within the country.

Introduction:

The value added by ability of stock selection is computed by calculating excess (deficit) return of manager's return over the return of MSCI and get it multiplied with weights of manager's portfolio.

Answer to Problem 12PS

The value added is

Explanation of Solution

Given Information:

Results for a given month are in the following table:

| Country | Weights (MSCI) | Weights (Manager's) | Manager's return in Country | Return of stock index for that Country |

| U.K. | ||||

| Japan | ||||

| U.S. | ||||

| Germany |

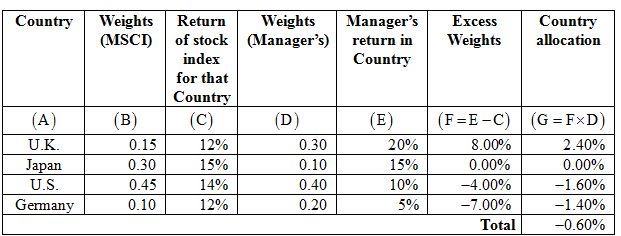

The following table is showing computation of value added:

Thus, the value added for country allocation is

(d)

To determine:

The value added arrived due to the decisions taken by her country allocations and ability of the stock selection within the country is equal, under or over performance with the total value added computed on all manager's decision.

Introduction:

The total value added is computed by calculating excess (deficit) return ascertained by return as per manager's weights over the return as per MSCI weights

The value added by allocation of country decision is computed by calculating excess (deficit) weight of manager's portfolio over the portfolio of MSCI and get it multiplied with MSCI return

The value added by ability of stock selection is computed by calculating excess (deficit) return of manager's return over the return of MSCI and get it multiplied with weights of manager's portfolio.

Answer to Problem 12PS

The total of value added of country allocation decision and stock selection is equal to total value added.

Explanation of Solution

The total of value added of country allocation decision and stock selection is equal to total value added is confirmed by as follows:

Thus, the contributions of both value added is confirmed to be equal to total value added.

Want to see more full solutions like this?

Chapter 18 Solutions

ESSEN OF INVESTMENTS CONNECT AC

- critically discuss the hockey stick model of a start-up financing. In your response, explain the model and discibe its three main stages, highlighting the key characteristics of each stage in terms of growth, risk, and funding expectations.arrow_forwardSolve this problem please .arrow_forwardSolve this finance question.arrow_forward

- solve this question.Pat and Chris have identical interest-bearing bank accounts that pay them $15 interest per year. Pat leaves the $15 in the account each year, while Chris takes the $15 home to a jar and never spends any of it. After five years, who has more money?arrow_forwardWhat is corporate finance? explain all thingsarrow_forwardSolve this finance problem.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education