Concept explainers

(a)

To calculate:

The total value added arrived due to the decisions taken by all the managers.

Introduction:

The total value added is computed by calculating excess (deficit) return ascertained by return as per manager's weights over the return as per MSCI weights.

Answer to Problem 12PS

The total value added is

Explanation of Solution

Given Information:

Results for a given month are in the following table:

| Country | Weights (MSCI) | Weights (Manager's) | Manager's return in Country | Return of stock index for that Country |

| U.K. | ||||

| Japan | ||||

| U.S. | ||||

| Germany |

The formula for total value added is:

Now, Return as per manager's weight is:

Return as per MSCI weight is:

Thus, as per the above calculation, the total value added for all managers' decision is:

(b)

To calculate:

The value added arrived due to the decisions taken by her country allocations.

Introduction:

The value added by allocation of country decision is computed by calculating excess (deficit) weight of manager's portfolio over the portfolio of MSCI and get it multiplied with MSCI return.

Answer to Problem 12PS

The value added is

Explanation of Solution

Given Information:

Results for a given month are in the following table:

| Country | Weights (MSCI) | Weights (Manager's) | Manager's return in Country | Return of stock index for that Country |

| U.K. | ||||

| Japan | ||||

| U.S. | ||||

| Germany |

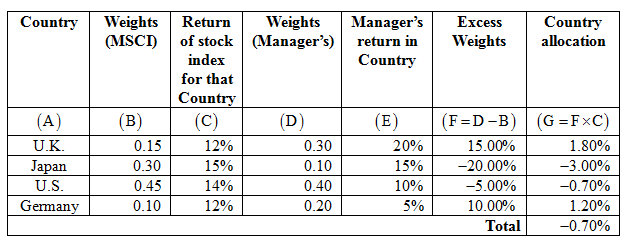

The following table is showing computation of value added:

Thus, the value added for country allocation is

(c)

To calculate:

The value added arrived due to the ability of the stock selection within the country.

Introduction:

The value added by ability of stock selection is computed by calculating excess (deficit) return of manager's return over the return of MSCI and get it multiplied with weights of manager's portfolio.

Answer to Problem 12PS

The value added is

Explanation of Solution

Given Information:

Results for a given month are in the following table:

| Country | Weights (MSCI) | Weights (Manager's) | Manager's return in Country | Return of stock index for that Country |

| U.K. | ||||

| Japan | ||||

| U.S. | ||||

| Germany |

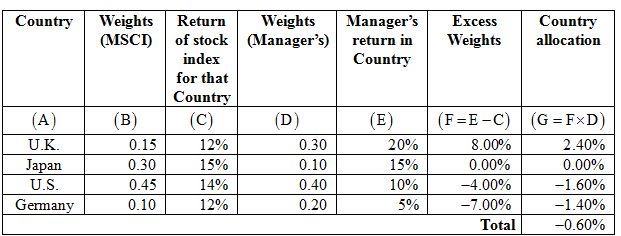

The following table is showing computation of value added:

Thus, the value added for country allocation is

(d)

To determine:

The value added arrived due to the decisions taken by her country allocations and ability of the stock selection within the country is equal, under or over performance with the total value added computed on all manager's decision.

Introduction:

The total value added is computed by calculating excess (deficit) return ascertained by return as per manager's weights over the return as per MSCI weights

The value added by allocation of country decision is computed by calculating excess (deficit) weight of manager's portfolio over the portfolio of MSCI and get it multiplied with MSCI return

The value added by ability of stock selection is computed by calculating excess (deficit) return of manager's return over the return of MSCI and get it multiplied with weights of manager's portfolio.

Answer to Problem 12PS

The total of value added of country allocation decision and stock selection is equal to total value added.

Explanation of Solution

The total of value added of country allocation decision and stock selection is equal to total value added is confirmed by as follows:

Thus, the contributions of both value added is confirmed to be equal to total value added.

Want to see more full solutions like this?

Chapter 18 Solutions

ESSEN.OF INVESTMENTS(LOOSE)W/CONNECT<BI>

- What does the payback period refer to?arrow_forwardWhich of the following bonds offers the highest current yield? a. A(n) 3.78%, 19-year bond quoted at 38.893. b. A(n) 6.30%, 28-year bond quoted at 64.822. c. A(n) 1.89%, 23-year bond quoted at 19.447. The current yield of the bond in part a is ☐ %. (Round to two decimal places.) ...arrow_forwardExplain working capital? explain.arrow_forward

- You have the opportunity to purchase a 24-year, $1,000 par value bond that has an annual coupon rate of 11%. If you require a YTM of 7.7%, how much is the bond worth to you? The price of the bond is $ ☐ . (Round to the nearest cent.)arrow_forwardYou are considering investing $880 in Higgs B. Technology Inc. You can buy common stock at $25.88 per share; this stock pays no dividends. You can also buy a convertible bond ($1,000 par value) that is currently trading at $880 and has a conversion ratio of 30. It pays $52 per year in interest. If you expect the price of the stock to rise to $36.72 per share in one year, which instrument should you purchase? The holding period return on the purchase of the common stock would be %. (Round to two decimal places.)arrow_forwardHow can you determine the value/worth of a company?arrow_forward

- An investor is in the 24% tax bracket and lives in a state with no income tax. He is trying to decide which of two bonds to purchase. One is a(n) 9.03% corporate bond that is selling at par. The other is a municipal bond with a 6.44% coupon that is also selling at par. If all other features of these two bonds are comparable, which should the investor select? Why? Would your answer change if this were an in-state municipal bond and the investor lived in a place with high state income taxes? Explain. O A. The investor should select the corporate bond. Since the fully taxable equivalent yield of 8.47% is less than the 9.03% return on the corporate bond, the corporate issue offers a higher return and is the better buy. The decision very likely would change if this were an "in-state" municipal bond and the investor lived in a state with high income taxes. An "in-state" municipal bond would not only shield the investor from federal taxes but also from high state income taxes. OB. The…arrow_forwardHii Please solve this question by using appropriate method.arrow_forwardneed solhelp by real expert and true answer.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education