FUND.ACCT.PRIN.(LOOSELEAF)-W/ACCESS

24th Edition

ISBN: 9781260260724

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 12E

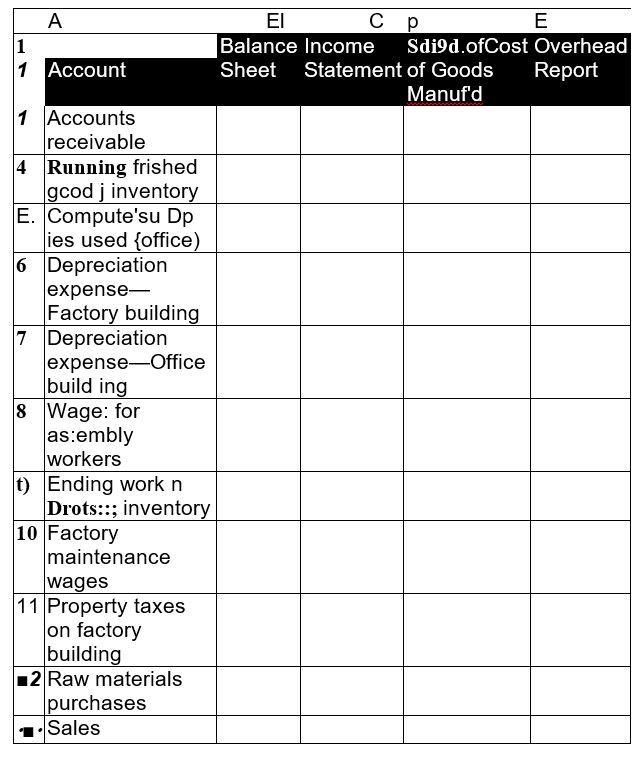

Exercise 18-12 Components of accounting reports P2

For each of the following accounts for a manufacturing company, place a / in the appropriate column indicating that it appears on the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

accounting question

Please provide the accurate answer to this general accounting problem using valid techniques.

Accounting question

Chapter 18 Solutions

FUND.ACCT.PRIN.(LOOSELEAF)-W/ACCESS

Ch. 18 - Prob. 1DQCh. 18 - Prob. 2DQCh. 18 - Prob. 3DQCh. 18 - Prob. 4DQCh. 18 - Prob. 5DQCh. 18 - Prob. 6DQCh. 18 - Prob. 7DQCh. 18 - Prob. 8DQCh. 18 - Prob. 9DQCh. 18 - Prob. 10DQ

Ch. 18 - Prob. 11DQCh. 18 - Prob. 12DQCh. 18 - Prob. 13DQCh. 18 - Prob. 14DQCh. 18 - Prob. 15DQCh. 18 - Prob. 16DQCh. 18 - Prob. 17DQCh. 18 - Prob. 18DQCh. 18 - Prob. 19DQCh. 18 - List the four components of a schedule of cost of...Ch. 18 - Prepare a proper title for the annual schedule of...Ch. 18 - Prob. 22DQCh. 18 - Prob. 23DQCh. 18 - Prob. 24DQCh. 18 - Prob. 25DQCh. 18 - Prob. 1QSCh. 18 - Prob. 2QSCh. 18 - Fixed and variable costs C2 Listed below are...Ch. 18 - Prob. 4QSCh. 18 - Prob. 5QSCh. 18 - Prob. 6QSCh. 18 - Prob. 7QSCh. 18 - Prob. 8QSCh. 18 - Prob. 9QSCh. 18 - Prob. 10QSCh. 18 - Prob. 11QSCh. 18 - Prob. 12QSCh. 18 - Prob. 13QSCh. 18 - Prob. 14QSCh. 18 - Prob. 15QSCh. 18 - Prob. 16QSCh. 18 - Prob. 17QSCh. 18 - Prob. 1ECh. 18 - Prob. 2ECh. 18 - Prob. 3ECh. 18 - Prob. 4ECh. 18 - Prob. 5ECh. 18 - Prob. 6ECh. 18 - Prob. 7ECh. 18 - Prob. 8ECh. 18 - Prob. 9ECh. 18 - Prob. 10ECh. 18 - Prob. 11ECh. 18 - Exercise 18-12 Components of accounting reports P2...Ch. 18 - Prob. 13ECh. 18 - Prob. 14ECh. 18 - Prob. 15ECh. 18 - Prob. 16ECh. 18 - Prob. 17ECh. 18 - Prob. 18ECh. 18 - Prob. 19ECh. 18 - Prob. 1APSACh. 18 - Prob. 2APSACh. 18 - Prob. 3APSACh. 18 - Prob. 4APSACh. 18 - Problem 18-5A Inventory computation and reporting...Ch. 18 - Prob. 1BPSBCh. 18 - Prob. 2BPSBCh. 18 - Prob. 3BPSBCh. 18 - Prob. 4BPSBCh. 18 - Prob. 5BPSBCh. 18 - Prob. 18SPCh. 18 - Prob. 1AACh. 18 - Prob. 2AACh. 18 - Prob. 3AACh. 18 - Prob. 1BTNCh. 18 - Prob. 2BTNCh. 18 - Prob. 3BTNCh. 18 - Prob. 4BTNCh. 18 - Prob. 5BTNCh. 18 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forward

- I need help with this general accounting question using the proper accounting approach.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardPlease help me solve this general accounting problem with the correct financial process.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License