Connect Access Card For Fundamental Accounting Principles

24th Edition

ISBN: 9781260158526

Author: John J Wild

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 12E

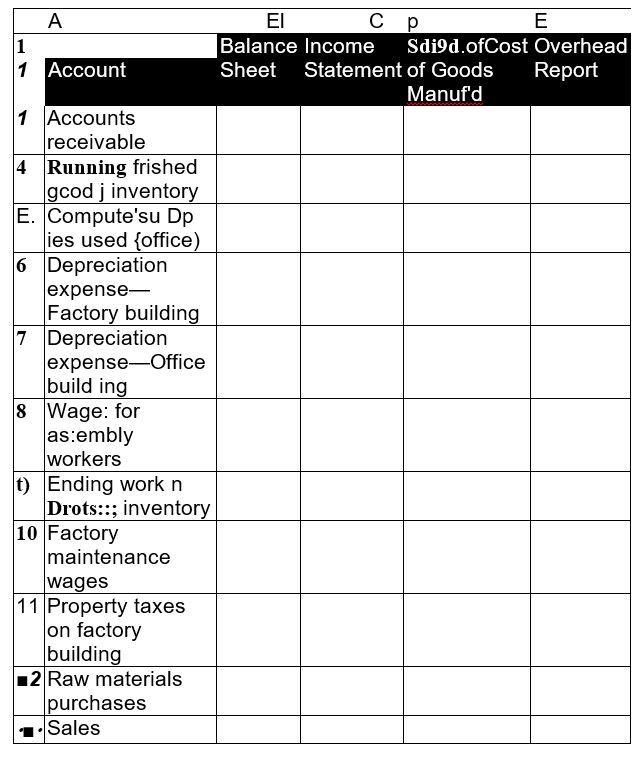

Exercise 18-12 Components of accounting reports P2

For each of the following accounts for a manufacturing company, place a / in the appropriate column indicating that it appears on the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

accounting question

Please provide the accurate answer to this general accounting problem using valid techniques.

Accounting question

Chapter 18 Solutions

Connect Access Card For Fundamental Accounting Principles

Ch. 18 - Prob. 1DQCh. 18 - Prob. 2DQCh. 18 - Prob. 3DQCh. 18 - Prob. 4DQCh. 18 - Prob. 5DQCh. 18 - Prob. 6DQCh. 18 - Prob. 7DQCh. 18 - Prob. 8DQCh. 18 - Prob. 9DQCh. 18 - Prob. 10DQ

Ch. 18 - Prob. 11DQCh. 18 - Prob. 12DQCh. 18 - Prob. 13DQCh. 18 - Prob. 14DQCh. 18 - Prob. 15DQCh. 18 - Prob. 16DQCh. 18 - Prob. 17DQCh. 18 - Prob. 18DQCh. 18 - Prob. 19DQCh. 18 - List the four components of a schedule of cost of...Ch. 18 - Prepare a proper title for the annual schedule of...Ch. 18 - Prob. 22DQCh. 18 - Prob. 23DQCh. 18 - Prob. 24DQCh. 18 - Prob. 25DQCh. 18 - Prob. 1QSCh. 18 - Prob. 2QSCh. 18 - Fixed and variable costs C2 Listed below are...Ch. 18 - Prob. 4QSCh. 18 - Prob. 5QSCh. 18 - Prob. 6QSCh. 18 - Prob. 7QSCh. 18 - Prob. 8QSCh. 18 - Prob. 9QSCh. 18 - Prob. 10QSCh. 18 - Prob. 11QSCh. 18 - Prob. 12QSCh. 18 - Prob. 13QSCh. 18 - Prob. 14QSCh. 18 - Prob. 15QSCh. 18 - Prob. 16QSCh. 18 - Prob. 17QSCh. 18 - Prob. 1ECh. 18 - Prob. 2ECh. 18 - Prob. 3ECh. 18 - Prob. 4ECh. 18 - Prob. 5ECh. 18 - Prob. 6ECh. 18 - Prob. 7ECh. 18 - Prob. 8ECh. 18 - Prob. 9ECh. 18 - Prob. 10ECh. 18 - Prob. 11ECh. 18 - Exercise 18-12 Components of accounting reports P2...Ch. 18 - Prob. 13ECh. 18 - Prob. 14ECh. 18 - Prob. 15ECh. 18 - Prob. 16ECh. 18 - Prob. 17ECh. 18 - Prob. 18ECh. 18 - Prob. 19ECh. 18 - Prob. 1APSACh. 18 - Prob. 2APSACh. 18 - Prob. 3APSACh. 18 - Prob. 4APSACh. 18 - Problem 18-5A Inventory computation and reporting...Ch. 18 - Prob. 1BPSBCh. 18 - Prob. 2BPSBCh. 18 - Prob. 3BPSBCh. 18 - Prob. 4BPSBCh. 18 - Prob. 5BPSBCh. 18 - Prob. 18SPCh. 18 - Prob. 1AACh. 18 - Prob. 2AACh. 18 - Prob. 3AACh. 18 - Prob. 1BTNCh. 18 - Prob. 2BTNCh. 18 - Prob. 3BTNCh. 18 - Prob. 4BTNCh. 18 - Prob. 5BTNCh. 18 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forward

- I need help with this general accounting question using the proper accounting approach.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardPlease help me solve this general accounting problem with the correct financial process.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License