Concept explainers

a.

Prepare a schedule showing: (1) the number of mat sets transferred from the Cutting Department to the Coating Department in May, and (2) the number of mat sets started and completed by the Cutting Department in May.

a.

Explanation of Solution

It is a method of cost accounting used by an enterprise with processes categorised by continuous production. The cost for manufacturing those products are assigned to the manufacturing department before the averaged over units are being produced.

Prepare a schedule showing: (1) the number of mat sets transferred from the Cutting Department to the Coating Department in May, and (2) the number of mat sets started and completed by the Cutting Department in May.

| Particulars | Units |

| Flow of physical units: Cutting Department | |

| Units in beginning inventory, May1 | 8,000 |

| Units started by cutting department in May | 50,000 |

| Total units in process during May | 58,000 |

| Units in ending inventory, May 31 | (10,000) |

| Units transferred to Coating Department in May | 48,000 |

| Units in beginning inventory, May 1 | (8,000) |

| Units started and completed in May | 40,000 |

(Table 1)

Therefore, the units transferred from cutting department to the coating department is 48,000 units and the units started and completed by the cutting department during May is 40,000 units respectively.

b.

Compute the equivalent units of input resources for the Cutting Department in May.

b.

Explanation of Solution

Compute the equivalent units of input resources for the Cutting Department in May.

| Particulars | Input Resources | |

| Direct Materials | Conversion | |

| To finish beginning inventory in process on May 1: | ||

| Direct materials (8,000units require 0% to complete) | 0 | |

| Conversion (8,000 units require 20% to complete) | 1.600 | |

| To start and complete 40,000 units in May | 40,000 | 40,000 |

| To start ending inventory in process on May 31: | ||

| Direct materials (10,000 units 100% complete) | 10,000 | |

| Conversion (10,000 units 20% complete) | 2,000 | |

| Equivalent units of resources in May | 50,000 | 43,600 |

(Table 2)

Therefore, the equivalent units of input resources for the Cutting Department in May are 50,000 and 43,600 units respectively.

c.

Compute the cost per equivalent unit of input resource for the Cutting Department in May.

c.

Explanation of Solution

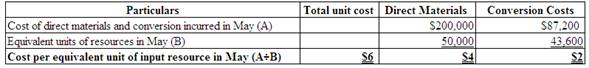

Compute the cost per equivalent unit of input resource for the Cutting Department in May.

(Figure 1)

Therefore, the cost per equivalent unit of input resource for the Cutting Department for the month of May is $4 and $2 per unit respectively.

d.

Prepare

d.

Explanation of Solution

Prepare journal entry to transfer the cost of completed mat sets from the Cutting Department to the Coating Department in May.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

|

Work in process: Coating Department (3) | 288,000 | ||

| Work in process: Cutting Department | 288,000 | ||

| (To record the transfer of 48,000 units to the coating department in May ) |

(Table 3)

- Work in process: Coating department is an asset and there is an increase in the value of an asset. Hence, debit the work in process: coating department by $288,000.

- Work in process: Cutting department is an asset and there is a decrease in the value of an asset. Hence, credit the work in process: cutting department by $288,000.

Working Notes:

Calculate the cost of direct materials during the month May:

(1)

Calculate the cost of conversion during the month May:

(2)

Calculate the total cost of units transferred:

| Particulars | Amount in $ |

| Cost of beginning inventory, May 1 | 44,800 |

| May direct materials cost (1) | 160,000 |

| May conversion cost (2) | 83,200 |

| Total cost of units transferred in May | 288,000 |

(Table 5)

(3)

Calculate the total cost assigned to the Cutting Department’s ending inventory on May 31.

Explanation of Solution

Calculate the total cost assigned to the Cutting Department’s ending inventory on May 31.

| Particulars | Amount in $ |

| Work in Process: Cutting department, May 31: | |

| Direct materials cost (4) | 40,000 |

| Conversion cost (5) | 4,000 |

| Ending inventory in process, May 31 | 44,000 |

(Table 5)

Therefore, the total cost assigned to the Cutting Department’s ending inventory on May 31 is $44,000.

Working Notes:

Calculate the cost of direct materials during the month end of May 31 for cutting department:

(4)

Calculate the cost of conversion during the month end of May 31 for cutting department:

(5)

Want to see more full solutions like this?

Chapter 18 Solutions

FINANCIAL ACCOUNTING (LOOSELEAF)

- I need guidance with this financial accounting problem using the right financial principles.arrow_forwardgeneral accountingarrow_forwardJob 786 was one of the many jobs started and completed during the year. The job required $8,400 in direct materials and 35 hours of direct labor time at a total direct labor cost of $9,300. If the job contained five units and the company billed at 70% above the unit product cost on the job cost sheet, what price per unit would have been charged to the customer? Need Answerarrow_forward

- Lincoln Enterprises had total assets of$880,000 and total liabilities of $540,000 at the beginning of the year. During the year, total liabilities increased by $100,000, and stockholders' equity decreased by $60,000. What is the amount of total assets at the end of the year?arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education