1.

Determine the total required initial cash outlay related with new manufacturing equipment.

1.

Explanation of Solution

Determine the total required initial cash outlay related with new manufacturing equipment.

| Particulars | Amount |

| Cost of new equipment and installation | $12,000,000 |

| Training | $3,000,000 |

| Total investment required | $15,000,000 |

Table (1)

2.

Compute total expected change in cost of quality over the next 3 years.

2.

Explanation of Solution

Compute Estimated total annual cost of quality (COQ) if no change is made.

| Particulars | Amount | Amount |

| Rework | $2,400,000 | |

| Repair | $1,125,000 | |

| Appraisal: | ||

| Fixed | $600,000 | |

| Variable inspection | $150,000 | $750,000 |

| Foregone contribution from lost sales: | ||

| Contribution margin per unit | $7,700 | |

| Multiply: Lost sales (units) | 750 | $5,775,000 |

| Total current cost of quality (COQ) per year | $10,050,000 |

Table (2)

Determine the expected three-year increase or decrease in total COQ:

| Particulars | Amount |

| Current COQ | $10,050,000 |

| Less: Warranty repair costs (1) | ($187,500) |

| Pre-tax savings in COQ | $9,862,500 |

| Multiply: Life of the project | 3 years |

| Gross savings over three-year period | $29,587,500 |

| Less: Appraisal and inspection cost incurred, Year 1 | ($750,000) |

| Net decrease(increase) in quality costs over 3- year period. | $28,837,500 |

Table (3)

Working note 1: Calculate the warranty repair costs:

3. a

Explain whether Corporation W should invest in new process and compute the cumulative change in pretax

3. a

Explanation of Solution

Explain whether Corporation W should invest in new process and compute the cumulative change in pretax cash flow assuming the implementation of new system.

The cost of the new process is $15,000,000 and the expected three-year savings amount to $28,837,500. This amounts to a net pre-tax cash flow increase of $13,837,500 over the three-year period.

3. b

Determine the payback period for the proposed investment.

3. b

Explanation of Solution

As shown below, the payback period for this proposed investment is between 1 and 2 years (assuming that the pre-tax cash flows occur evenly throughout the year).

| Year | Amount | Cumulative net cash flow (Pre-tax) |

| 0 | ($ 15,000,000.00) | ($ 15,000,000.00) |

| 1 | $ 9,112,500.00 (2) | ($ 5,887,500.00) |

| 2 | $ 9,862,500.00 | $ 3,975,000.00 |

| 3 | $ 9,862,500.00 | $ 13,837,500.00 |

Table (4)

Working note (2): Determine the amount for Year 1:

3. c

Compute the estimated pretax

3. c

Explanation of Solution

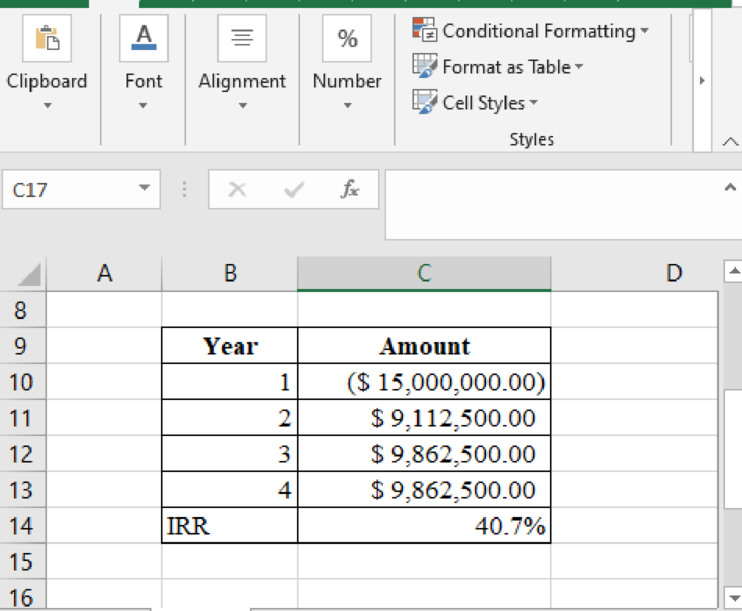

The estimated pre-tax internal

Table (5)

Note: The IRR has been calculated by using the excel formula (=IRR (C10:C13,0.25)).

Thus, the estimated pretax internal rate of return (IRR) for the proposed investment is 40.7%

4.

Identify the additional factors that should be considered prior to the making of financial decision.

4.

Explanation of Solution

The additional factors that should be considered before making the final decision are given below:

- 1. Accuracy of cost estimates, including:

- Contribution margin per unit

- Cost of current repair and rework

- Cost of repair with the new

process - Cost of the new process

- 2. Reliability of estimations of:

- • Rate of rework and rate of repair.

- • Lost sales.

- • Amount of time before the current equipment becomes obsolete.

- 3. Reaction of competitors and the Time value of money factor (discount rate) for capital budgeting decision making.

5.

Explain whether the statement made by member of the board of directors are agreeable or not.

5.

Explanation of Solution

The member of the board might be right if the financial payoff of the new process is ignored and if the company is going to operate for only three years. The sale of high-end product having higher quality by the company is vital for a long-term success.

In more concrete financial terms, the company needs to consider the factors given below:

- Potential opportunity costs: The company has to decide the possibility of losing customers over time such that these customers may be completely unwilling to consider buying anything ever again from the company, even if it is a new model.

- Pricing: In the absence of investment, the company has to assess its ability for maintaining the price competition if the rivals of the company are incurring lower costs due to lower failures. The competitors might sell products at lower prices and gain market share if Corporation W doesn’t match (or beat) their pricing.

In short, Corporation W is producing a high-end product; it is competing based on differentiation, but it is not necessary that the company doesn’t have competitors also competing as differentiators.

Want to see more full solutions like this?

Chapter 17 Solutions

Loose Leaf for Cost Management: A Strategic Emphasis

- Marino Snacks Co. had its highest total cost of $84,000 in July and its lowest total cost of $60,000 in November. The company produces a single product. Production volume was 14,000 units in July and 9,000 units in November. What is the fixed cost per month? HELParrow_forwardWhat is the estimated inventory balance at June 30 ?arrow_forward!!???arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education