Concept explainers

Labor Mix and Yield Variances

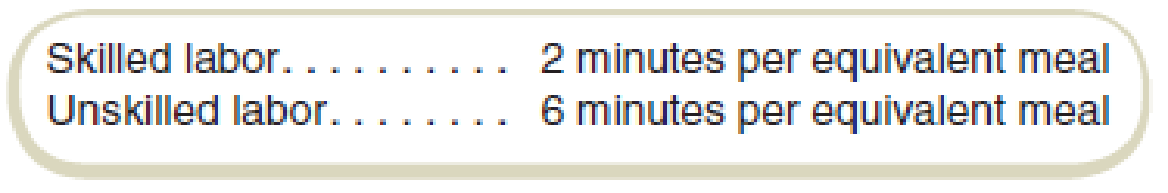

Matt’s Eat ’N Run has two categories of direct labor: unskilled, which costs $10 per hour, and skilled, which costs $20 per hour. Management has established standards per “equivalent friendly meal,” which has been defined as a typical meal consisting of a hamburger, a drink, and french fries. Standards have been set as follows:

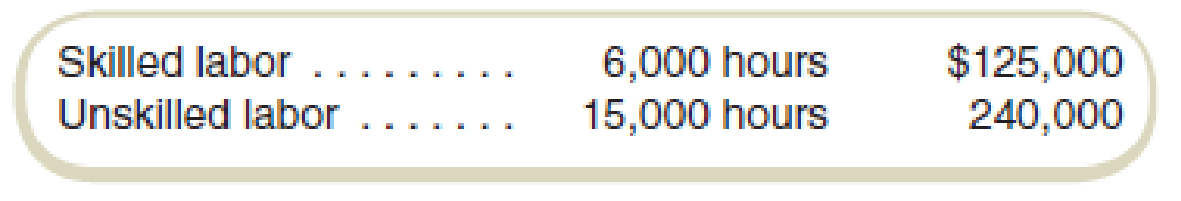

For the year, Matt’s sold 180,000 equivalent friendly meals and incurred the following labor costs:

Required

- a. Compute labor price and efficiency variances.

- b. Compute labor mix and yield variances.

a.

Compute materials price and Materials efficiency variances.

Answer to Problem 29E

The value of materials price variance is $5,000 U and ,materials efficiency variance is $0 for skilled labor, and for unskilled labor, the materials price variance is $90,000 U and materials efficiency variance is $30,000 F.

Explanation of Solution

Materials price variance:

Materials price variance is resultant materials price that has been computed or derived at the end of the accounting period for which the computations are being done.

Materials efficiency variance:

Materials efficiency variance is the resultant Materials efficiency that has been computed or derived at the end of the accounting period for which the computations are being done.

Compute the materials price variance:

| Particulars | Skilled labor | Unskilled labor |

| Materials variance: | ||

| Actual | $125,000 | $240,000 |

| Standard | $120,000 | $150,000 |

|

Materials variance | $5,000 U | $90,000 U |

Table: (1)

Compute the Materials efficiency variance:

| Particulars | Skilled labor | Unskilled labor |

|

Materials mix variance: | ||

| Actual | $120,000 | $150,000 |

| Standard | $105,000 | $157,500 |

|

Materials mix variance | $15,000U | $7,500F |

| Materials yield variance: | ||

| Actual | $105,000 | $157,500 |

| Standard | $120,000 | $180,000 |

|

Materials yield variance | $15,000F | $22,500F |

|

Materials efficiency variance | $0 | $30,000F |

Table: (2)

| Measure | Skilled labor | Unskilled labor |

| AQ | 6,000 | 15,000 |

| SP | $20.00 | $10.00 |

| ASQ | 5,250(1) | 15,750(2) |

| SQ | 6,000(3) | 18,000(4) |

Table: (3)

Thus, the value of materials price variance is $5,000 U and materials efficiency variance is $0 for skilled labor and for unskilled labor, the materials price variance is $90,000U and materials efficiency variance is $30,000F.

Working note 1:

Compute the ASQ for Skilled labor:

Working note 2:

Compute the ASQ for unskilled labor:

Working note 3:

Compute the SQ of Skilled labor:

Working note 4:

Compute the SQ of Unskilled labor:

b.

Compute materials mix and materials yield variances.

Answer to Problem 29E

The value of materials mix and materials yield variances of skilled labor is $15,000 U and $15,000 F respectively, and the value of materials mix and materials yield variances of unskilled labor $7,500 and $22,500 respectively.

Explanation of Solution

Materials mix variance:

Materials mix variance is the resultant market Materials mix that has been computed or derived at the end of the accounting period for which the computations are being done for two or more than two products.

Materials yield variance:

Materials yield variance is the resultant difference between the costs of finished goods expected from a specific amount of raw material that has been computed or derived at the end of the accounting period for which the computations are being done.

Compute the materials mix variance and materials yield variance for skilled labor and unskilled labor:

| Particulars | Skilled labor | Unskilled labor |

|

Materials mix variance: | ||

| Actual | $120,000 | $150,000 |

| Standard | $105,000 | $157,500 |

|

Materials mix variance | $15,000 U | $7,500 F |

| Materials yield variance: | ||

| Actual | $105,000 | $157,500 |

| Standard | $120,000 | $180,000 |

|

Materials yield variance | $15,000 F | $22,500 F |

|

Materials efficiency variance | $0 | $30,000 F |

Table: (4)

| Measure | Skilled labor | Unskilled labor |

| AQ | 6,000 | 15,000 |

| SP | $20.00 | $10.00 |

| ASQ | 5,250(1) | 15,750(2) |

| SQ | 6,000(3) | 18,000(4) |

Table: (5)

Thus, the value of materials mix and materials yield variances of skilled labor are $15,000 U and $15,000 F respectively, and the value of materials mix and materials yield variances of unskilled labor $7,500 and $22,500 respectively.

Want to see more full solutions like this?

Chapter 17 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardNet income for The year?arrow_forwardAihua Manufacturing Inc. has two divisions. Division A has a profit of $225,000 on sales of $4,500,000. Division B is only able to make $78,000 on sales of $650,000. Based on the profit margins (returns on sales), which division is superior?arrow_forward

- Can you help me solve this financial accounting question using valid financial accounting techniques?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardGibson Inc. has provided the following data for the month of December. The balance in the Finished Goods inventory account at the beginning of the month was $94,200 and at the end of the month was $89,750. The cost of goods manufactured for the month was $412,800. The actual manufacturing overhead cost incurred was $142,300 and the manufacturing overhead cost applied to jobs was $148,500. The adjusted cost of goods sold that would appear on the income statement for December is __. Provide answerarrow_forward

- Michael Jones's capital statement reveals that his drawings during the year were $55,000. He made an additional capital investment of $35,000, and his share of the net income for the year was $28,000. His ending capital balance was $240,000. What was Michael Jones's beginning capital balance? a. $232,000 b. $202,000 c. $162,000 d. $202,000arrow_forwardWhat will net income be?arrow_forwardEric Industries' break-even point in units is 2,500. The sales price per unit is $35, and the variable cost per unit is $25. If the company sells 6,800 units, what will net income be?arrow_forward

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardLumo Co had the following transactions in 2020arrow_forwardNordica Chemicals produces joint products M and N from Compound Z in a single operation. 800 liters of Compound Z, costing $2,400, produce 500 liters of Product M, selling for $3.50 per liter, and 300 liters of Product N, selling for $6.00 per liter. The portion of the $2,400 cost that should be allocated to Product M using the value basis of allocation is____.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,