Concept explainers

1.

Allocate the company’s service department costs using the direct method combined with dual allocation.

1.

Explanation of Solution

Service department: A service department is a division in an organization which is not involved directly in producing the goods or services of an organization. But, the service department also offers a service that aids the organization to take place the goods or services that are produced.

Allocate the company’s service department costs using the direct method combined with dual allocation as follows:

Variable costs:

| Provider of Service | Cost to be allocated (a) | Production Departments | |||

| Machining | Assembly | ||||

| Proportion (b) | Amount ($) | Proportion (c) | Amount | ||

| Human resource | $50,000 | $22,222 | $27,778 | ||

| Maintenance | 80,000 | 37,333 | 42,667 | ||

| Computer aided design | 50,000 | 37,500 | 12,500 | ||

| Total | $180,000 | $97,055 | $82,945 | ||

| Grand total | $830,000 | ||||

Table (1)

Note:

The proportions are based on short-run usage.

Fixed costs:

| Provider of Service | Cost to be allocated (a) | Production Departments | |||

| Machining | Assembly | ||||

| Proportion (b) | Amount ($) | Proportion (c) | Amount | ||

| Human resource | $200,000 | $82,353 | $117,647 | ||

| Maintenance | 150,000 | 100,000 | 50,000 | ||

| Computer aided design | 300,000 | 240,000 | 60,000 | ||

| Total | $650,000 | $422,353 | $227,647 | ||

| Grand total | $650,000 | ||||

Table (2)

Note:

The proportions are based on long-run usage.

Total cost allocated:

| Particulars | Machining | Assembly |

| Variable costs | $ 97,055 | $ 82,945 |

| Fixed costs | 422,353 | 227,647 |

| Total costs | $519,408 | $310,592 |

| Grand total | 830,000 | |

Table (3)

2.

Allocate the company’s service department costs using the step-down method combined with dual allocation.

2.

Explanation of Solution

Allocate the company’s service department costs using the step-down method combined with dual allocation:

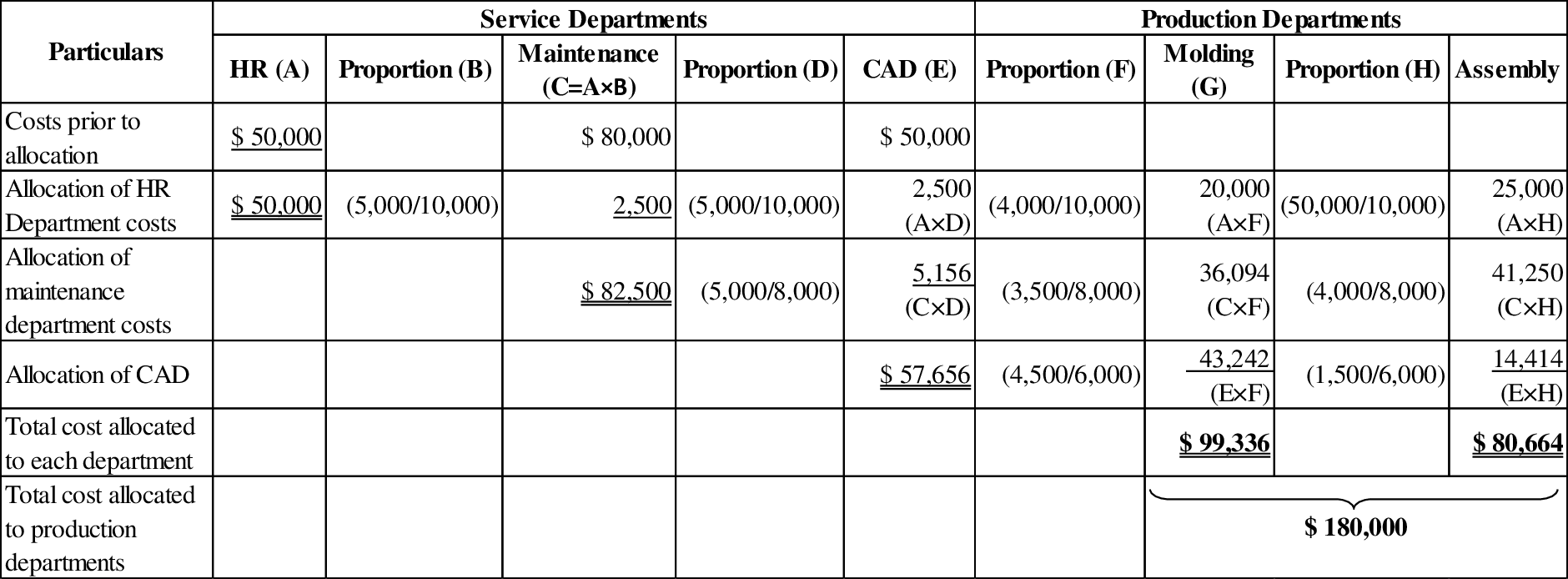

Variable costs:

Table (4)

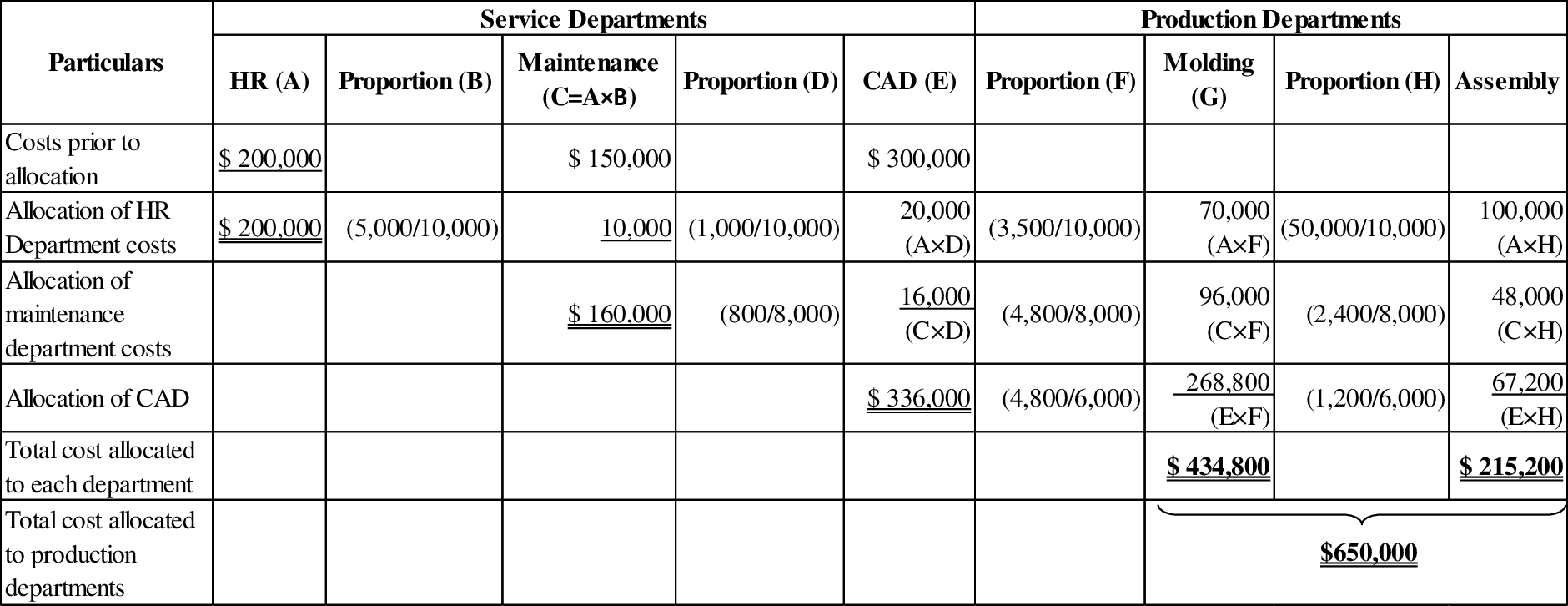

Fixed costs:

Table (5)

Total cost allocated:

| Particulars | Machining | Assembly |

| Variable costs | $ 99,336 | $80,664 |

| Fixed costs | 434,800 | 215,200 |

| Total costs | $534,136 | $295,864 |

| Grand total | 830,000 | |

Table (6)

Want to see more full solutions like this?

Chapter 17 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Delphi Corporation disposed of an asset at the end of the sixth year of its estimated life for $9,200 cash. The asset's life was originally estimated to be 8 years. The original cost was $42,600 with an estimated residual value of $3,400. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal? Answerarrow_forwardanswer ?? Financial accoutningarrow_forwardHow much is direct labor cost?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardDelphi Corporation disposed of an asset at the end of the sixth year of its estimated life for $9,200 cash. The asset's life was originally estimated to be 8 years. The original cost was $42,600 with an estimated residual value of $3,400. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal? HELParrow_forwardPlease help me solve this financial accounting problem with the correct financial process.arrow_forward

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardCase Study of Financial Accounting: The growing emphasis on environmental, social, and governance (ESG) factors in corporate reporting has prompted discussions about the integration of sustainability measures into traditional financial accounting frameworks. Evaluate the potential benefits and challenges of incorporating non-financial performance indicators into standard accounting practices. Additionally, consider the implications for comparability and the reporting of a company's overall performance and value creation.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning