PRINCIPLES OF CORPORATE FINANCE

13th Edition

ISBN: 9781264052059

Author: BREALEY

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 17, Problem 20PS

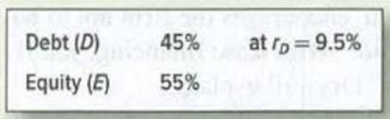

After-tax WACC* Gaucho Services starts life with all-equity financing and a

- a. Use MM’s proposition 2 to calculate the new cost of equity. Gaucho pays taxes at a marginal rate of Tc = 40%.

- b. Calculate Gaucho’s after-tax weighted-average cost of capital.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is EBITDA, and why is it often used as a proxy for cash flow?

What is the difference between alpha and beta in investment analysis? Need help

What is a derivative, and how is it used for hedging? Need help

Chapter 17 Solutions

PRINCIPLES OF CORPORATE FINANCE

Ch. 17 - Homemade leverage Ms. Kraft owns 50,000 shares of...Ch. 17 - Homemade leverage Companies A and B differ only in...Ch. 17 - Corporate leverage Suppose that Macbeth Spot...Ch. 17 - Corporate leverage Reliable Gearing currently is...Ch. 17 - MMs propositions True or false? a. MMs...Ch. 17 - MMs propositions What is wrong with the following...Ch. 17 - Prob. 7PSCh. 17 - MM proposition 1 Executive Cheese has issued debt...Ch. 17 - Prob. 9PSCh. 17 - Prob. 10PS

Ch. 17 - MM proposition 2 Spam Corp. is financed entirely...Ch. 17 - MM proposition 2. Increasing financial leverage...Ch. 17 - Prob. 13PSCh. 17 - MM proposition 2 Look back to Section 17-1....Ch. 17 - MM proposition 2 Hubbards Pet Foods is financed...Ch. 17 - MM proposition 2 Imagine a firm that is expected...Ch. 17 - MM proposition 2 Archimedes Levers is financed by...Ch. 17 - MM proposition 2 Look back to Problem 17. Suppose...Ch. 17 - Prob. 19PSCh. 17 - After-tax WACC Gaucho Services starts life with...Ch. 17 - After-tax WACC Omega Corporation has 10 million...Ch. 17 - After-tax WACC Gamma Airlines has an asset beta of...Ch. 17 - Prob. 23PSCh. 17 - Investor choice People often convey the idea...Ch. 17 - Investor choice Suppose that new security designs...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the 4% rule in retirement planning in finance? no aiarrow_forwardWhat is the 4% rule in retirement planning in finance?arrow_forward(Calculating NPV) Carson Trucking is considering whether to expand its regional service center in Moab, Utah. The expansion will require the expenditure of $10,000,000 on new service equipment and will generate annual net cash inflows from reduced costs of operations equal to $2,500,000 per year for each of the next 8 years. In year 8, the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $1 million. Thus, in year 8, the investment cash inflow will total $3,500,000. Calculate the project's NPV using a discount rate of 9 percent. If the discount rate is 9 percent, then the project's NPV is (round your answer to the nearest dollar) Sarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial leverage explained; Author: The Finance story teller;https://www.youtube.com/watch?v=GESzfA9odgE;License: Standard YouTube License, CC-BY