Concept explainers

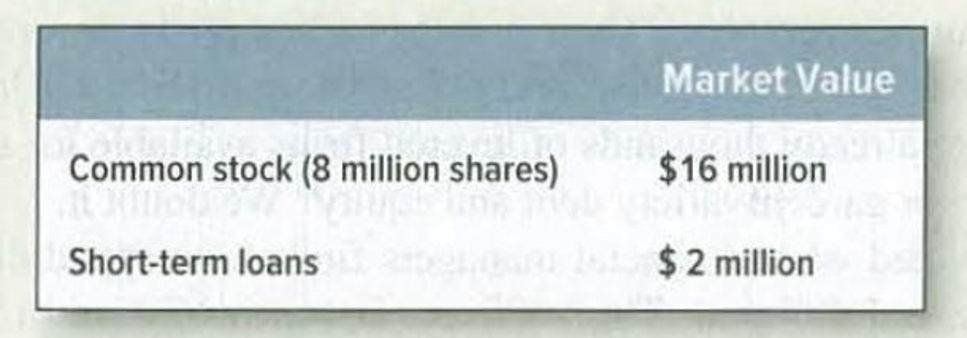

Homemade leverage* Ms. Kraft owns 50,000 shares of the common stock of Copperhead Corporation with a market value of $2 per share, or $100,000 overall. The company is currently financed as follows:

Copperhead now announces that it is replacing $1 million of short-term debt with an issue of common stock. What action can Ms. Kraft take to ensure that she is entitled to exactly the same proportion of profits as before?

To discuss: The action has to be taken by person K to ensure she is entitled to exactly the same proportion of profits as before.

Explanation of Solution

The market value of company C is very higher than the book value and the computation of ownership percent and borrowing amount is as follows:

The person K has 0.625% holding in the firm and which proposes the following:

- Increase common stock to $17 million.

- Decrease the short-term debt by $1 million.

Person K set of the change ion firms capital structure by borrowing $6,250 and acquiring more shares of company C.

Want to see more full solutions like this?

Chapter 17 Solutions

PRIN.OF CORPORATE FINANCE

Additional Business Textbook Solutions

Marketing: An Introduction (13th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Business Essentials (12th Edition) (What's New in Intro to Business)

Engineering Economy (17th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Financial Accounting, Student Value Edition (5th Edition)

- Which of the following best describes the concept of leverage in finance? A) Using borrowed funds to increase the potential return on investment B) Reducing risk by diversifying assets C) A method to avoid paying taxes D) Increasing the company’s profit margin no aiarrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statementarrow_forwardWhich of the following is a capital budgeting technique used to evaluate an investment project? A) Net Present Value (NPV) B) Return on Assets (ROA) C) Price-to-Earnings Ratio (P/E) D) Dividend Yield No aiarrow_forward

- What does the term 'liquidity' refer to in finance? A) The ability to quickly convert an asset into cash B) The total value of a company’s assets C) The volatility of a market D) The difference between liabilities and assets no aiarrow_forwardWhich of the following is a characteristic of a high-risk investment? A) Low returns B) Stable performance C) Potential for high returns with greater uncertainty D) Guaranteed returnsarrow_forwardWhat does the term 'liquidity' refer to in finance? A) The ability to quickly convert an asset into cash B) The total value of a company’s assets C) The volatility of a market D) The difference between liabilities and assets need help.arrow_forward

- I need help in this question now! What does a company’s price-to-earnings (P/E) ratio indicate? A) The return on investment for shareholders B) The company’s profitability relative to its stock price C) The company’s debt relative to its equity D) The company’s dividend payout ratioarrow_forwardI need answer quickly What does a company’s price-to-earnings (P/E) ratio indicate? A) The return on investment for shareholders B) The company’s profitability relative to its stock price C) The company’s debt relative to its equity D) The company’s dividend payout ratioarrow_forwardThe term 'beta' in stock market analysis measures: A) The total value of a company’s stocks B) A stock’s sensitivity to the overall market C) The dividend yield of a stock D) A stock’s price-to-earnings ratio i need help in this question!arrow_forward

- Which of the following is a capital budgeting technique used to evaluate an investment project? A) Net Present Value (NPV) B) Return on Assets (ROA) C) Price-to-Earnings Ratio (P/E) D) Dividend Yieldarrow_forwardThe term 'beta' in stock market analysis measures: A) The total value of a company’s stocks B) A stock’s sensitivity to the overall market C) The dividend yield of a stock D) A stock’s price-to-earnings ratioCould you explain this question properly!arrow_forwardThe term 'beta' in stock market analysis measures: A) The total value of a company’s stocks B) A stock’s sensitivity to the overall market C) The dividend yield of a stock D) A stock’s price-to-earnings ratioarrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning