Concept explainers

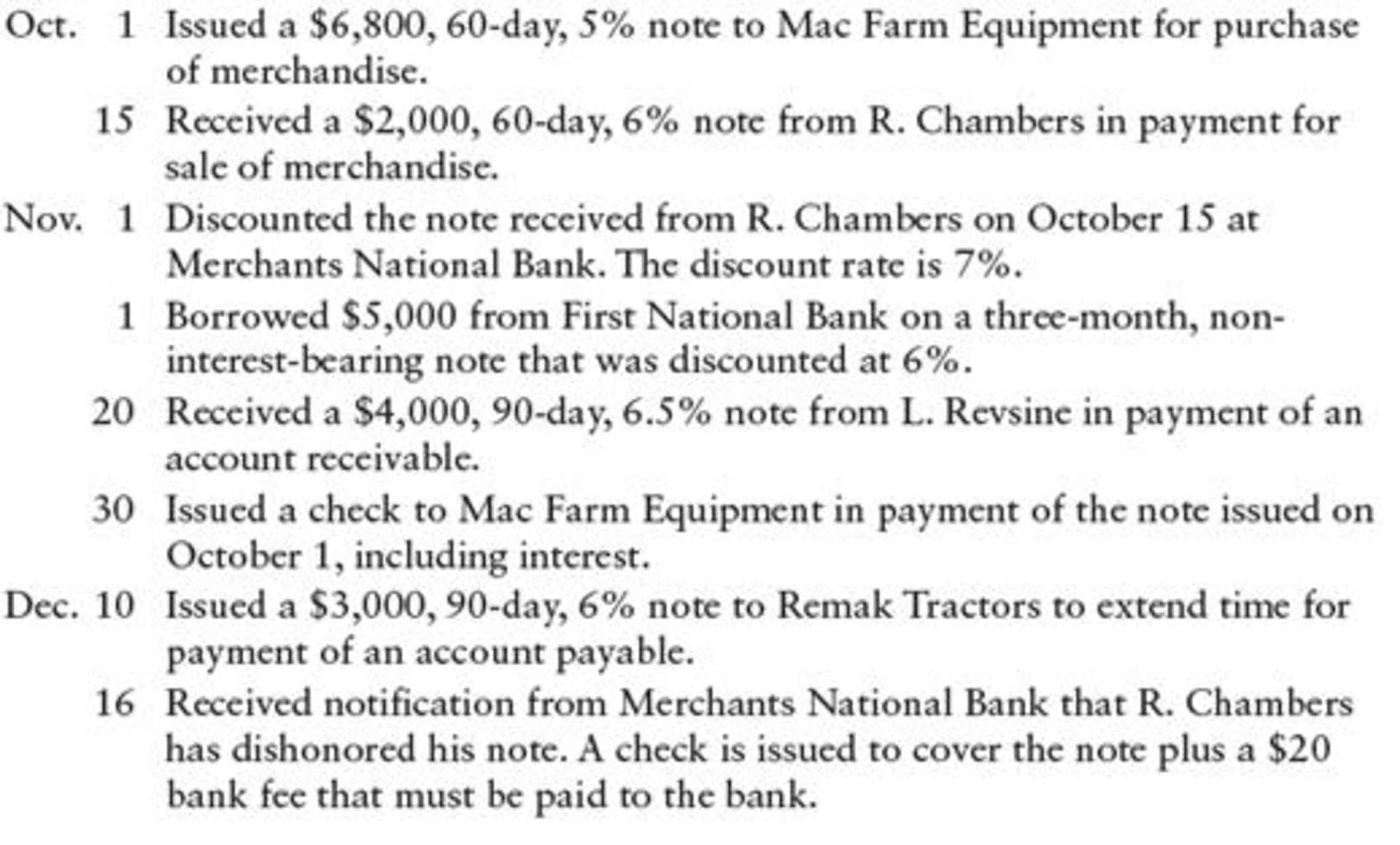

Eddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--:

REQUIRED

- 1. Prepare general

journal entries for the transactions. - 2. Prepare necessary

adjusting entries for the notes outstanding on December 31.

1.

Prepare journal entry to record the following transactions.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

Prepare journal entry to record the following transactions.

| Date | Account titles and Explanation | Debit | Credit |

| October 1 | Purchases | $6,800 | |

| Notes payable | $6,800 | ||

| (To record note issued for inventory purchases) | |||

| October 15 | Notes receivable | $2,000 | |

| Sales | $2,000 | ||

| (To record note received for merchandise for sale) | |||

| November 1 | Cash (1) | $2,003.11 | |

| Notes receivable | $2,000 | ||

| Interest revenue (2) | $3.11 | ||

| (To record discount on notes receivable) | |||

| November 1 | Cash (4) | $4,925 | |

| Discount on notes payable (3) | $75 | ||

| Notes payable | $5,000 | ||

| (To record issued note for bank loan) | |||

| November 20 | Notes receivable | $4,000 | |

| Accounts receivable - L.R | $4,000 | ||

| (To record received note to settle account) | |||

| November 30 | Notes payable | $6,800 | |

| Interest expense (5) | $56.67 | ||

| Cash | $6,856.67 | ||

| (To record paid note with interest at maturity) | |||

| December 10 | Accounts payable - RT | $3,000 | |

| Notes payable | $3,000 | ||

| (To record issued note to settle account) | |||

| December 16 | Accounts receivable - R.C (6) | $2,040 | |

| Cash | $2,040 | ||

| (To record paid bank for dishonoured note) |

Table (1)

Working notes:

(1) Calculate cash proceeds.

(2) Calculate interest expense.

(3) Calculate discount on notes payable.

(4) Calculate cash proceeds.

(5) Calculate interest expenses.

(6) Calculate accounts receivable.

2.

Prepare adjusting entries for the notes outstanding on 31st December.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Prepare adjusting entries for the notes outstanding on 31st December.

| Date | Account titles and Explanation | Debit | Credit |

| December 31 | Interest expense (7) | $50 | |

| Discount on notes payable | $50 | ||

| (To record adjusting entry for interest expense) | |||

| December 31 | Interest expense (8) | $10.50 | |

| Accrued interest payable | $10.50 | ||

| (Record adjusting entry for interest expense) | |||

| December 31 | Accrued interest receivable | $29.61 | |

| Interest revenue (9) | $29.61 | ||

| (To record adjusting entry for interest revenue) |

Table (2)

Working notes:

(7) Calculate interest expense.

(8) Calculate interest expense.

(9) Calculate interest revenue.

Want to see more full solutions like this?

Chapter 17 Solutions

Bundle: College Accounting, Chapters 1-15, 22nd + Study Guide with Working Papers + CengageNOWv2™, 1 term Printed Access Card

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning