Concept explainers

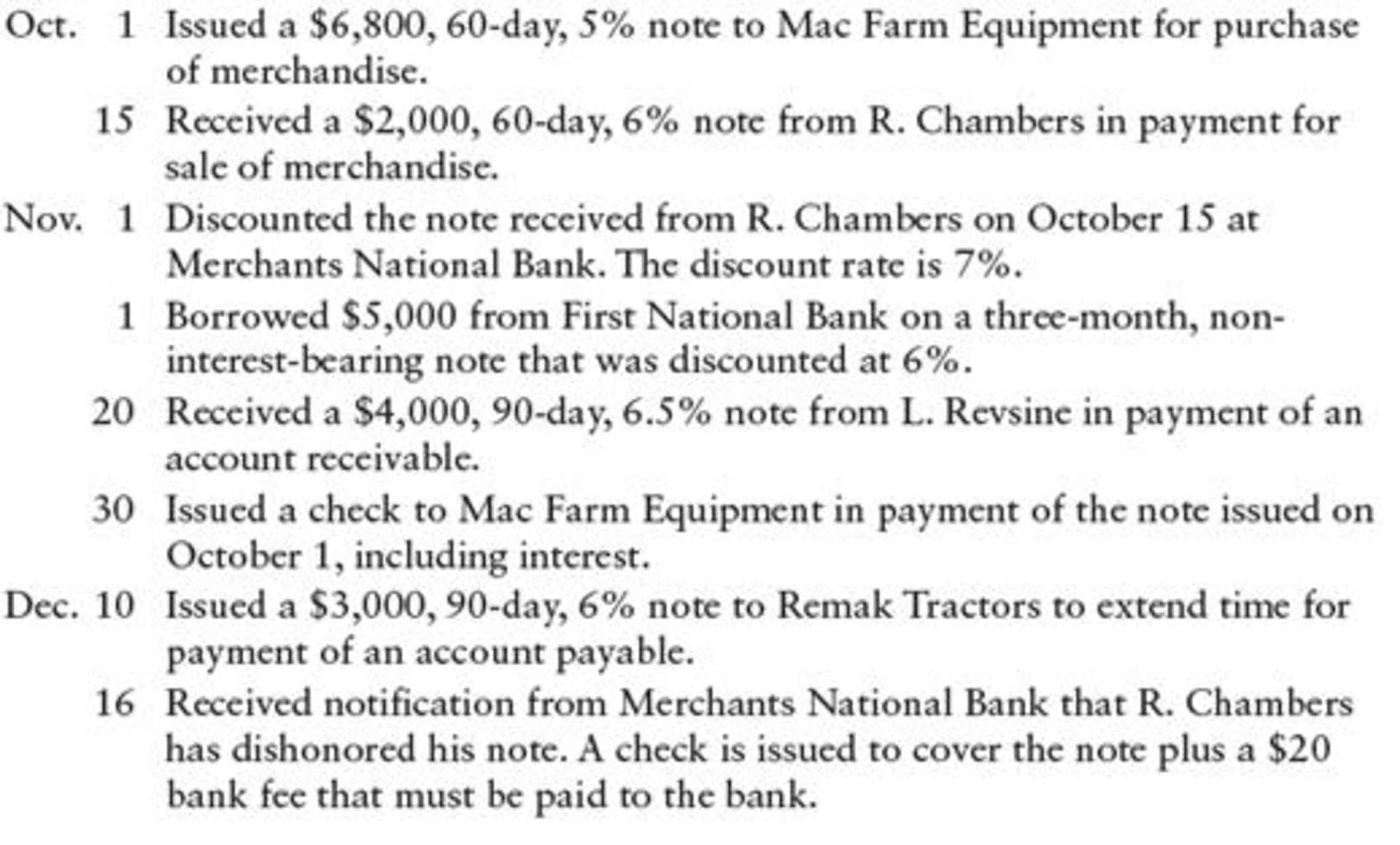

Eddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--:

REQUIRED

- 1. Prepare general

journal entries for the transactions. - 2. Prepare necessary

adjusting entries for the notes outstanding on December 31.

1.

Prepare journal entry to record the following transactions.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

Prepare journal entry to record the following transactions.

| Date | Account titles and Explanation | Debit | Credit |

| October 1 | Purchases | $6,800 | |

| Notes payable | $6,800 | ||

| (To record note issued for inventory purchases) | |||

| October 15 | Notes receivable | $2,000 | |

| Sales | $2,000 | ||

| (To record note received for merchandise for sale) | |||

| November 1 | Cash (1) | $2,003.11 | |

| Notes receivable | $2,000 | ||

| Interest revenue (2) | $3.11 | ||

| (To record discount on notes receivable) | |||

| November 1 | Cash (4) | $4,925 | |

| Discount on notes payable (3) | $75 | ||

| Notes payable | $5,000 | ||

| (To record issued note for bank loan) | |||

| November 20 | Notes receivable | $4,000 | |

| Accounts receivable - L.R | $4,000 | ||

| (To record received note to settle account) | |||

| November 30 | Notes payable | $6,800 | |

| Interest expense (5) | $56.67 | ||

| Cash | $6,856.67 | ||

| (To record paid note with interest at maturity) | |||

| December 10 | Accounts payable - RT | $3,000 | |

| Notes payable | $3,000 | ||

| (To record issued note to settle account) | |||

| December 16 | Accounts receivable - R.C (6) | $2,040 | |

| Cash | $2,040 | ||

| (To record paid bank for dishonoured note) |

Table (1)

Working notes:

(1) Calculate cash proceeds.

(2) Calculate interest expense.

(3) Calculate discount on notes payable.

(4) Calculate cash proceeds.

(5) Calculate interest expenses.

(6) Calculate accounts receivable.

2.

Prepare adjusting entries for the notes outstanding on 31st December.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Prepare adjusting entries for the notes outstanding on 31st December.

| Date | Account titles and Explanation | Debit | Credit |

| December 31 | Interest expense (7) | $50 | |

| Discount on notes payable | $50 | ||

| (To record adjusting entry for interest expense) | |||

| December 31 | Interest expense (8) | $10.50 | |

| Accrued interest payable | $10.50 | ||

| (Record adjusting entry for interest expense) | |||

| December 31 | Accrued interest receivable | $29.61 | |

| Interest revenue (9) | $29.61 | ||

| (To record adjusting entry for interest revenue) |

Table (2)

Working notes:

(7) Calculate interest expense.

(8) Calculate interest expense.

(9) Calculate interest revenue.

Want to see more full solutions like this?

Chapter 17 Solutions

Study Guide for Working Papers for Heintz/Parry's College Accounting, Chapters 16-27, 23rd

- In June, one of the processing departments at Amy Manufacturing had beginning work in process inventory of $45,000 and ending work in process inventory of $21,000. During the month, the cost of units transferred out from the department was $632,000. In the department's cost reconciliation report for June, the total cost to be accounted for under the weighted-average method would be____.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

- Can you help me solve this general accounting problem with the correct methodology?arrow_forwardUsing the information below for sapphirearrow_forwardOakridge Manufacturing applies overhead to jobs using a predetermined rate of 125% of direct labor cost. At year-end, the company had actual overhead costs of $487,500, while applied overhead totaled $512,500. The company's unadjusted cost of goods sold was $1,250,000. If the company closes any over- or underapplied overhead to cost of goods sold, what is the adjusted cost of goods sold? Need helparrow_forward

- Martin Manufacturing prepared a fixed budget of 85,000 direct labor hours, with estimated overhead costs of $425,000 for variable overhead and $120,000 for fixed overhead. Martin then prepared a flexible budget of 78,000 labor hours. How much are total overhead costs at this level of activity?arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardUse this information to determine the dollar amount of the FY 2023 Beginning work in process inventory.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning