2 Semester Cengage Now, Warren Accounting

26th Edition

ISBN: 9781305662308

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 17, Problem 17.3CP

Vertical analysis

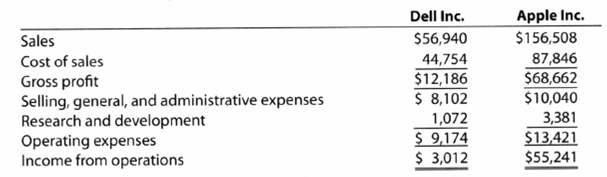

The condensed income statements through income from operations for Dell Inc. and Apple Inc. for recent fiscal years follow (numbers in millions of dollars):

Prepare comparative common-sized statements, rounding percents to one decimal place. Interpret the analyses.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting question with accurate accounting calculations?

Can you help me find the accurate solution to this financial accounting problem using valid principles?

Calculate the planwide factory overhead rate .

Chapter 17 Solutions

2 Semester Cengage Now, Warren Accounting

Ch. 17 - Prob. 1DQCh. 17 - Prob. 2DQCh. 17 - Prob. 3DQCh. 17 - How would the current and quick ratios of a...Ch. 17 - a. Why is it advantageous to have a high inventory...Ch. 17 - What do the following data, taken from a...Ch. 17 - a. How does the rate earned on total assets differ...Ch. 17 - Kroger, a grocery store, recently had a...Ch. 17 - Prob. 9DQCh. 17 - Prob. 10DQ

Ch. 17 - Horizontal analysis The comparative temporary...Ch. 17 - Prob. 17.1BPECh. 17 - Vertical analysis Income statement information for...Ch. 17 - Vertical analysis Income statement information for...Ch. 17 - Prob. 17.3APECh. 17 - Prob. 17.3BPECh. 17 - Accounts receivable analysis A company reports the...Ch. 17 - Accounts receivable analysis A company reports the...Ch. 17 - Inventory analysis A company reports the...Ch. 17 - Inventory analysis A company reports the...Ch. 17 - Prob. 17.6APECh. 17 - Prob. 17.6BPECh. 17 - Times interest earned A company reports the...Ch. 17 - Times interest earned A company reports the...Ch. 17 - Asset turnover A company reports the following:...Ch. 17 - Asset turnover A company reports the following:...Ch. 17 - Return on total assets A company reports the...Ch. 17 - Return on total assets A company reports the...Ch. 17 - Common stockholders profitability analysis A...Ch. 17 - Common stockholders profitability analysis A...Ch. 17 - Prob. 17.11APECh. 17 - Prob. 17.11BPECh. 17 - Prob. 17.1EXCh. 17 - Vertical analysis of income statement The...Ch. 17 - Common-sized income statement Revenue and expense...Ch. 17 - Vertical analysis of balance sheet Balance sheet...Ch. 17 - Prob. 17.5EXCh. 17 - Prob. 17.6EXCh. 17 - Prob. 17.7EXCh. 17 - Prob. 17.8EXCh. 17 - Accounts receivable analysis The following data...Ch. 17 - Accounts receivable analysis Xavier Scores Company...Ch. 17 - Inventory analysis The following data were...Ch. 17 - Prob. 17.12EXCh. 17 - Ratio of liabilities to stockholders equity and...Ch. 17 - Ratio of liabilities to stockholders equity and...Ch. 17 - Ratio of liabilities to stockholders equity and...Ch. 17 - Prob. 17.16EXCh. 17 - Profitability ratios The following selected data...Ch. 17 - Profitability ratios Ralph Lauren Corporation...Ch. 17 - Six measures of solvency or profitability The...Ch. 17 - Six measures of solvency or profitability The...Ch. 17 - Prob. 17.21EXCh. 17 - Prob. 17.22EXCh. 17 - Earnings per share, discontinued operations The...Ch. 17 - Prob. 17.24EXCh. 17 - Prob. 17.25EXCh. 17 - Prob. 17.26EXCh. 17 - Horizontal analysis of income statement For 2016,...Ch. 17 - Prob. 17.2APRCh. 17 - Prob. 17.3APRCh. 17 - Nineteen measures of solvency and profitability...Ch. 17 - Prob. 17.5APRCh. 17 - Prob. 17.1BPRCh. 17 - Prob. 17.2BPRCh. 17 - Effect of transactions on current position...Ch. 17 - Nineteen measures of solvency and profitability...Ch. 17 - Solvency and profitability trend analysis Crosby...Ch. 17 - Nike, Inc., Problem Financial Statement Analysis...Ch. 17 - Prob. 17.1CPCh. 17 - Prob. 17.2CPCh. 17 - Vertical analysis The condensed income statements...Ch. 17 - Prob. 17.4CPCh. 17 - Comprehensive profitability and solvency analysis...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- General accountingarrow_forwardLee Corporation had a Work-in-Process balance of $95,000 on January 1, 2023. The year-end balance of Work-in-Process was $110,000, and the Cost of Goods Manufactured was $680,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2023.arrow_forwardCalculate the direct labor rate variancearrow_forward

- Cornell Corporation plans to generate $960,000 of sales revenue if a capital project is implemented. Assuming a 30% tax rate, the sales revenue should be reflected in the analysis by: need Answerarrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI need help solving this financial accounting question with the proper methodology.arrow_forward

- Please explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardVistar Manufacturing bases its manufacturing overhead budget on budgeted direct labor-hours. The direct labor budget indicates that 8,200 direct labor-hours will be required in July. The variable overhead rate is $4.85 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $125,000 per month, which includes depreciation of $10,500. All other fixed manufacturing overhead costs represent current cash flows. What should be the July cash disbursements for manufacturing overhead on the manufacturing overhead budget?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License