Concept explainers

(1)

Other postretirement benefits: The postretirement benefits which are provided by employers, other than pensions, like medical insurance, life insurance, and legal services, and healthcare benefits, are referred to as other postretirement benefits.

Accumulated benefit obligation (ABO): This is the estimated present value of future retirement benefits, accumulated based on the current compensation levels.

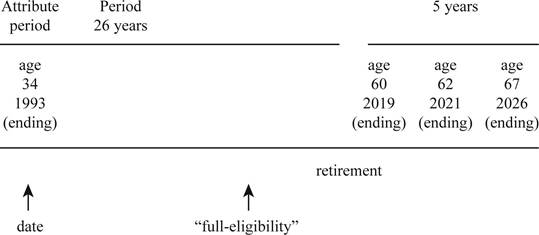

To draw: The time line that depicts S’s attribution period for retiree benefits and expected retirement period.

(1)

Explanation of Solution

Draw the timeline.

Figure (1)

(2)

To calculate: The present value of the net benefits as of expected retirement date.

(2)

Explanation of Solution

Calculate the

| Calculation of present value of net benefits | |||

| Year |

Net Cost (a) |

Present Value of $1 (n=1-5; i=6%) (b) |

Present value |

| 2022 | $4,000 | 0.94340 | $3,774 |

| 2023 | $4,400 | 0.89000 | $3,916 |

| 2024 | $2,300 | 0.83962 | $1,931 |

| 2025 | $2,500 | 0.79209 | $1,980 |

| 2026 | $2,800 | 0.74726 | $2,092 |

| Total | $13,693 | ||

Table (1)

Note: Refer Table 2 in Appendix for the present value factor of $1.

(3)

To calculate: Company’s expected postretirement benefit obligation at the end of 2016 with respect to S.

(3)

Explanation of Solution

The EPBO is the present value of lump-sum net benefits.

The present value of $1 at the rate of 6% for 5 periods is 0.74726 (Refer to Table 2 in Appendix).

(4)

To calculate: The Company’s accumulated postretirement benefit obligation at the end of 2016 with respect to S.

(4)

Explanation of Solution

Calculate the accumulated postretirement benefit obligation.

(5)

To calculate: Company’s accumulated postretirement benefit obligation at the end of 2017 with respect to S.

(5)

Explanation of Solution

Calculate APBO at the end of 2017.

Working Note:

Calculate company’s expected postretirement benefit obligation at the end of 2017.

The EPBO is the present value of lump-sum net benefits.

The present value of $1 at the rate of 6% for 4 periods is 0.79209 (Refer to Table 2 in Appendix).

Conclusion: Therefore, the accumulated postretirement benefit obligation(APBO) at the end of 2017 is$10,012.

(6)

To calculate: The service cost to be included in 2017 postretirement benefit expense.

(6)

Explanation of Solution

Calculate the service cost for 2017.

(7)

To calculate: The interest cost to be included in 2019 postretirement benefit expense.

(7)

Explanation of Solution

Calculate the interest cost for 2017.

(8)

To show: The changes APBO during 2017 by reconciling the beginning and ending balances.

(8)

Explanation of Solution

The following table shows the APBO at the end of 2017.

| Calculation of APBO | |

| APBO at the beginning of 2017 | $9,051 |

| Add: Service cost | $417 |

| Add: Interest cost | $543 |

| APBO at the end of 2017 | $10,011 |

Table (2)

Note: The difference of $1 in APBO at the end of 2017 is due to rounding. Refer to Requirements (4), (5), and (6) for APBO at the beginning, service cost, and interest cost.

Want to see more full solutions like this?

Chapter 17 Solutions

INTERMEDIATE ACCOUNTING W/CONNECT PLUS

- Accurate Answerarrow_forwardWhat is the final selling price to the consumer of this financial accounting question?arrow_forwardA company uses the FIFO method for inventory costing. At the start of the period the production department had 36,000 units in beginning Work in Process inventory which was 48% complete; the department completed and transferred 173,000 units. At the end of the period, 30,000 units were in the ending Work in Process inventory and are 75% complete. The production department had labor costs in the beginning goods in process inventory of $107,000 and total labor costs added during the period are $727,150. Compute the equivalent cost per unit for labor.arrow_forward

- Get correct solution this general accounting questionarrow_forwardMC Company made sales to two customers. Both sales were on credit terms of 2/10, n/30. Customer A purchased $30,000 of goods, returned none, and paid in 9 days. Customer B purchased $40,000 of goods, returned, and was given credit for $4,000 of goods and paid in 25 days. What was the net revenue from these two customers?a. $70,000 b. $66,000 c. $65,400 answerarrow_forwardCompute the manufacturing overhead rate for the yeararrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education