Concept explainers

(1)

Other postretirement benefits: The postretirement benefits which are provided by employers, other than pensions, like medical insurance, life insurance, and legal services, and healthcare benefits, are referred to as other postretirement benefits.

Accumulated benefit obligation (ABO): This is the estimated present value of future retirement benefits, accumulated based on the current compensation levels.

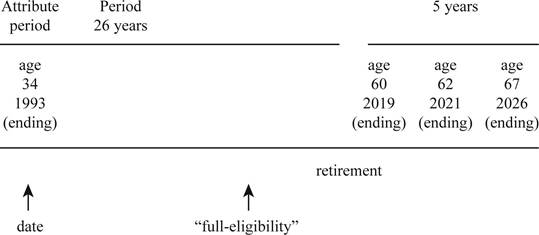

To draw: The time line that depicts S’s attribution period for retiree benefits and expected retirement period.

(1)

Explanation of Solution

Draw the timeline.

Figure (1)

(2)

To calculate: The present value of the net benefits as of expected retirement date.

(2)

Explanation of Solution

Calculate the

| Calculation of present value of net benefits | |||

| Year |

Net Cost (a) |

Present Value of $1 (n=1-5; i=6%) (b) |

Present value |

| 2022 | $4,000 | 0.94340 | $3,774 |

| 2023 | $4,400 | 0.89000 | $3,916 |

| 2024 | $2,300 | 0.83962 | $1,931 |

| 2025 | $2,500 | 0.79209 | $1,980 |

| 2026 | $2,800 | 0.74726 | $2,092 |

| Total | $13,693 | ||

Table (1)

Note: Refer Table 2 in Appendix for the present value factor of $1.

(3)

To calculate: Company’s expected postretirement benefit obligation at the end of 2016 with respect to S.

(3)

Explanation of Solution

The EPBO is the present value of lump-sum net benefits.

The present value of $1 at the rate of 6% for 5 periods is 0.74726 (Refer to Table 2 in Appendix).

(4)

To calculate: The Company’s accumulated postretirement benefit obligation at the end of 2016 with respect to S.

(4)

Explanation of Solution

Calculate the accumulated postretirement benefit obligation.

(5)

To calculate: Company’s accumulated postretirement benefit obligation at the end of 2017 with respect to S.

(5)

Explanation of Solution

Calculate APBO at the end of 2017.

Working Note:

Calculate company’s expected postretirement benefit obligation at the end of 2017.

The EPBO is the present value of lump-sum net benefits.

The present value of $1 at the rate of 6% for 4 periods is 0.79209 (Refer to Table 2 in Appendix).

Conclusion: Therefore, the accumulated postretirement benefit obligation(APBO) at the end of 2017 is$10,012.

(6)

To calculate: The service cost to be included in 2017 postretirement benefit expense.

(6)

Explanation of Solution

Calculate the service cost for 2017.

(7)

To calculate: The interest cost to be included in 2019 postretirement benefit expense.

(7)

Explanation of Solution

Calculate the interest cost for 2017.

(8)

To show: The changes APBO during 2017 by reconciling the beginning and ending balances.

(8)

Explanation of Solution

The following table shows the APBO at the end of 2017.

| Calculation of APBO | |

| APBO at the beginning of 2017 | $9,051 |

| Add: Service cost | $417 |

| Add: Interest cost | $543 |

| APBO at the end of 2017 | $10,011 |

Table (2)

Note: The difference of $1 in APBO at the end of 2017 is due to rounding. Refer to Requirements (4), (5), and (6) for APBO at the beginning, service cost, and interest cost.

Want to see more full solutions like this?

Chapter 17 Solutions

INTERMEDIATE ACCOUNTING

- Westlake Components planned to use $95 of material per unit but actually used $92 of material per unit. The company planned to produce 1,800 units but actually produced 1,400 units. What is the sales-volume variance?arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardNavarro Enterprises has a beginning retained earnings balance of $78,000. Net income for the year is $22,000, and cash dividends paid during the year amount to $12,500. What will be the ending retained earnings balance? a. $78,000 b. $87,500 c. $100,000 d. $65,500arrow_forward

- Determine the pre-paid insurance value for portman enterprises as this is the one unknown item.arrow_forwardCornell Corporation plans to generate $960,000 of sales revenue if a capital project is implemented. Assuming a 30% tax rate, the sales revenue should be reflected in the analysis by:arrow_forwardYour factory produces 165 electric bicycles per month. Direct costs are $1,890 per bicycle. The monthly overhead is $92,400. What is the average cost per electric bicycle with overhead?arrow_forward

- How does principle-based accounting differ from rule-based systems? (a) Detailed regulations cover every situation (b) Strict numerical thresholds determine all treatments (c) Professional judgment guides decisions rather than strict rules (d) Standard formulas solve all problems. MCQarrow_forwardI need help with this financial accounting question using standard accounting techniques.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education