Concept explainers

(1)

Other postretirement benefits: The postretirement benefits which are provided by employers, other than pensions, like medical insurance, life insurance, and legal services, and healthcare benefits, are referred to as other postretirement benefits.

Accumulated benefit obligation (ABO): This is the estimated present value of future retirement benefits, accumulated based on the current compensation levels.

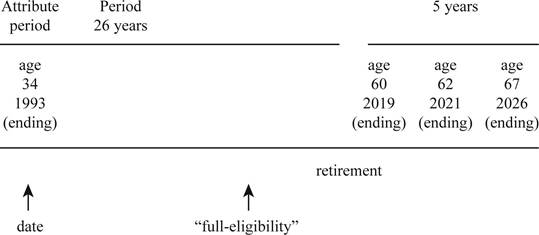

To draw: The time line that depicts S’s attribution period for retiree benefits and expected retirement period.

(1)

Explanation of Solution

Draw the timeline.

Figure (1)

(2)

To calculate: The present value of the net benefits as of expected retirement date.

(2)

Explanation of Solution

Calculate the

| Calculation of present value of net benefits | |||

| Year |

Net Cost (a) |

Present Value of $1 (n=1-5; i=6%) (b) |

Present value |

| 2022 | $4,000 | 0.94340 | $3,774 |

| 2023 | $4,400 | 0.89000 | $3,916 |

| 2024 | $2,300 | 0.83962 | $1,931 |

| 2025 | $2,500 | 0.79209 | $1,980 |

| 2026 | $2,800 | 0.74726 | $2,092 |

| Total | $13,693 | ||

Table (1)

Note: Refer Table 2 in Appendix for the present value factor of $1.

(3)

To calculate: Company’s expected postretirement benefit obligation at the end of 2016 with respect to S.

(3)

Explanation of Solution

The EPBO is the present value of lump-sum net benefits.

The present value of $1 at the rate of 6% for 5 periods is 0.74726 (Refer to Table 2 in Appendix).

(4)

To calculate: The Company’s accumulated postretirement benefit obligation at the end of 2016 with respect to S.

(4)

Explanation of Solution

Calculate the accumulated postretirement benefit obligation.

(5)

To calculate: Company’s accumulated postretirement benefit obligation at the end of 2017 with respect to S.

(5)

Explanation of Solution

Calculate APBO at the end of 2017.

Working Note:

Calculate company’s expected postretirement benefit obligation at the end of 2017.

The EPBO is the present value of lump-sum net benefits.

The present value of $1 at the rate of 6% for 4 periods is 0.79209 (Refer to Table 2 in Appendix).

Conclusion: Therefore, the accumulated postretirement benefit obligation(APBO) at the end of 2017 is$10,012.

(6)

To calculate: The service cost to be included in 2017 postretirement benefit expense.

(6)

Explanation of Solution

Calculate the service cost for 2017.

(7)

To calculate: The interest cost to be included in 2019 postretirement benefit expense.

(7)

Explanation of Solution

Calculate the interest cost for 2017.

(8)

To show: The changes APBO during 2017 by reconciling the beginning and ending balances.

(8)

Explanation of Solution

The following table shows the APBO at the end of 2017.

| Calculation of APBO | |

| APBO at the beginning of 2017 | $9,051 |

| Add: Service cost | $417 |

| Add: Interest cost | $543 |

| APBO at the end of 2017 | $10,011 |

Table (2)

Note: The difference of $1 in APBO at the end of 2017 is due to rounding. Refer to Requirements (4), (5), and (6) for APBO at the beginning, service cost, and interest cost.

Want to see more full solutions like this?

Chapter 17 Solutions

INTERMEDIATE ACCT.-CONNECT PLUS ACCESS

- EXCELSIOR COMMUNITY COLLEGE HOSPITALITY MANAGEMENT ACCOUNING MID-SEMESTER ACCT4301 UNIT 2 Section A of this assessment is to be done on Canvas Section B Answer all questions in this section - round off your answers to two decimal places Instructions: Responses should be written on paper. Take a CLEAR, WELL-LIGHTED picture of each page, the upload to Canvas. 1. The following information relates to Moonlight Hotel 2018 2019 $ change % change Net sales 1,818,500 1,750,000 Cost of Goods Sold 1,005,500 996,000 Operating profit 813,000 754,000 Selling and administrative expenses 506,000 479,000 Income from operations 307,000 275,000 Other expenses and losses Interest expenses 18,000 19,000 Income before income taxes 289,000 256,000 Income tax expenses 86,700 77,000 Net Income 202,300 179,000 Required: i. Use the above information to prepare the comparative analysis income statement.arrow_forwardComplete the table below with the infomation given - FlagStaff Ltd has a defined benefit pension plan for its employees. The company is considering introducing a defined benefit contribution plan, which will be available to all incoming staff. Although the defined benefit plan is now closed to new staff, the fund is active for all employees who have tenure with the company. In 2020, the following actuarial report was received for the defined benefit plan: 2020/$ Present value of the defined benefit obligation 31 December 2019 18 000 000 Past Service Cost 4 000 000 Net interest ? Current service cost 600 000 Benefits paid 2 000 000 Actuarial gain/loss on DBO ? Present value of the defined benefit obligation 31 December 2020 21 000 000 Fair value of plan assets at 31 December 2019 17 000 000 Return on plan assets ? Contributions paid to the plan during the year 1 500 000 Benefits paid by the plan during the year 2 000 000 Fair value of plan assets at 31 December…arrow_forwardAnswer the following requirement of this general accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education