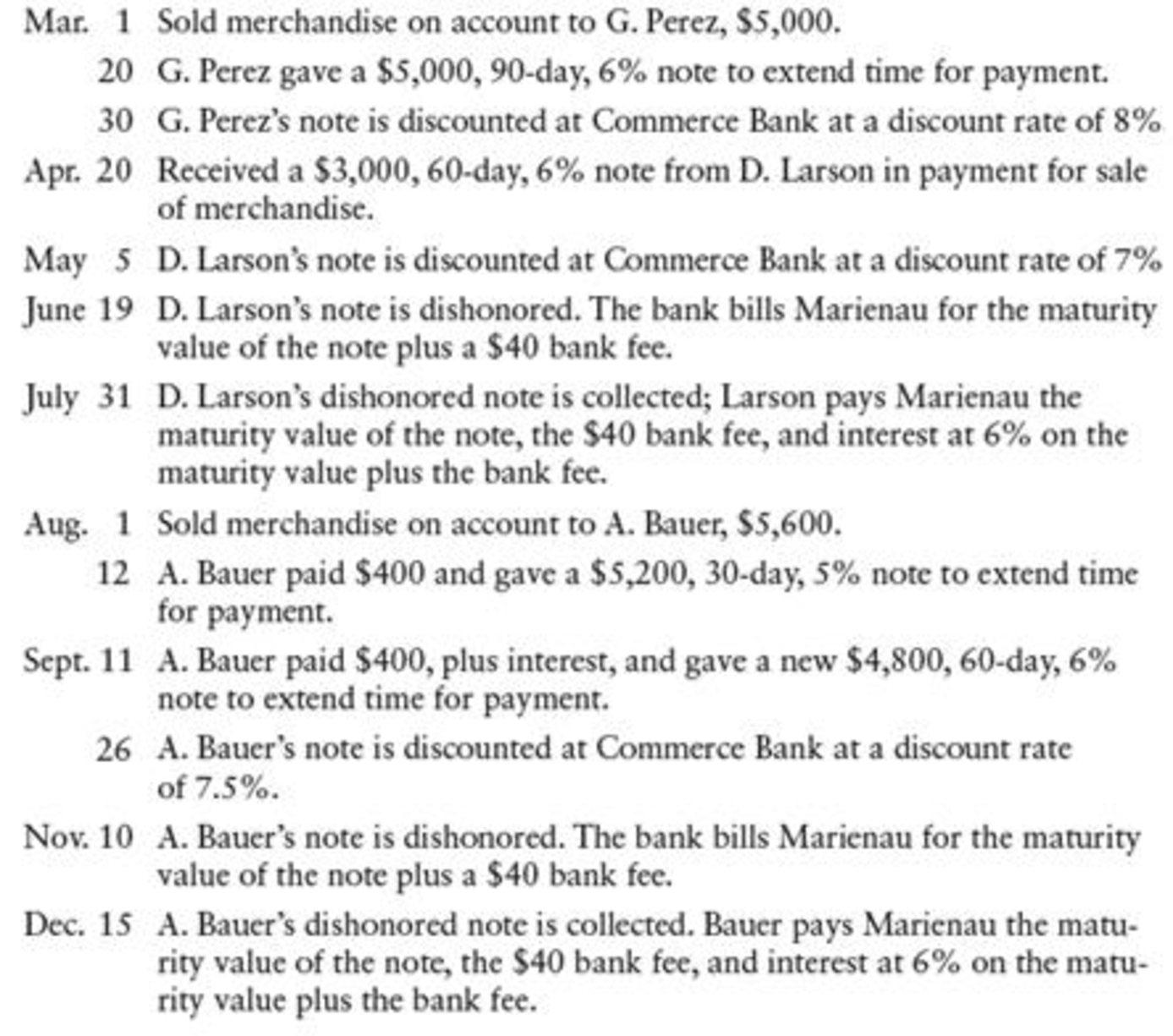

NOTES RECEIVABLE DISCOUNTING Marienau Suppliers had the following transactions:

REQUIRED

Record the transactions in a general journal.

Prepare a journal entry to record Suppliers M.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

| Date | Account titles and Explanation | Debit | Credit |

| March 1 | Accounts receivable -G.P | $5,000 | |

| Sales | $5,000 | ||

| (To record sale made on account) | |||

| March 20 | Notes receivable | $5,000 | |

| Accounts receivable - G.P | $5,000 | ||

| (To record received note to settle account) | |||

| March 30 | Cash (1) | $4,984.78 | |

| Interest expense (2) | $15.22 | ||

| Notes receivable | $5,000 | ||

| (To record discount on notes receivable) | |||

| April 20 | Notes receivable | $3,000 | |

| Sales | $3,000 | ||

| (To record received note for merchandise sale) | |||

| May 5 | Cash (3) | $3,003.49 | |

| Notes receivable | $3,000 | ||

| Interest revenue (4) | $3.49 | ||

| (To record received payment of note with interest) | |||

| June 19 | Accounts receivable - D. L | $3,070 | |

| Cash | $3,070 | ||

| (To record cash paid for dishonoured note) | |||

| July 31 | Cash | $3,091.49 | |

| Accounts receivable - D. L | $3,070 | ||

| Interest revenue (5) | $21.49 | ||

| (To record Collected dishonoured note with interest) | |||

| August 1 | Accounts receivable - A.B | $5,600 | |

| Sales | $5,600 | ||

| (To record sale made on account) | |||

| August 12 | Cash | $400 | |

| Notes receivable | $5,200 | ||

| Accounts receivable - A.B | $5,600 | ||

| (To record cash received and note to settle account) | |||

| September 11 | Cash (6) | $421.67 | |

| Notes receivable (new note) | $4,800 | ||

| Notes receivable (old note) | $5,200 | ||

| Interest revenue (7) | $21.67 | ||

| (To record received new note plus interest on old note) | |||

| September 26 | Cash | $4,802.55 | |

| Notes receivable | $4,800 | ||

| Interest revenue | $2.55 | ||

| (To record received payment of note with interest) | |||

| November 10 | Accounts receivable - A.B | $4,888 | |

| Cash | $4,888 | ||

| (To record cash paid for dishonoured note) | |||

| December 15 | Cash | $4,916.51 | |

| Accounts receivable - A.B | $4,888 | ||

| Interest revenue (8) | $28.51 | ||

| (To record Collected dishonoured note with interest) |

Table (1)

Working notes:

(1) Calculate cash proceeds.

(2) Calculate interest expense.

(3) Calculate cash proceeds.

(4) Calculate interest revenue.

(5) Calculate interest revenue.

(6) Calculate interest revenue.

(6) Calculate cash proceeds.

(7) Calculate interest revenue.

(8) Calculate interest revenue.

Want to see more full solutions like this?

Chapter 17 Solutions

EP CENGAGENOWV2 FOR HEINTZ/PARRY'S COLL

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardPlease help me solve this financial accounting problem with the correct financial process.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning