Corporate Finance

3rd Edition

ISBN: 9780132992473

Author: Jonathan Berk, Peter DeMarzo

Publisher: Prentice Hall

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 17, Problem 10P

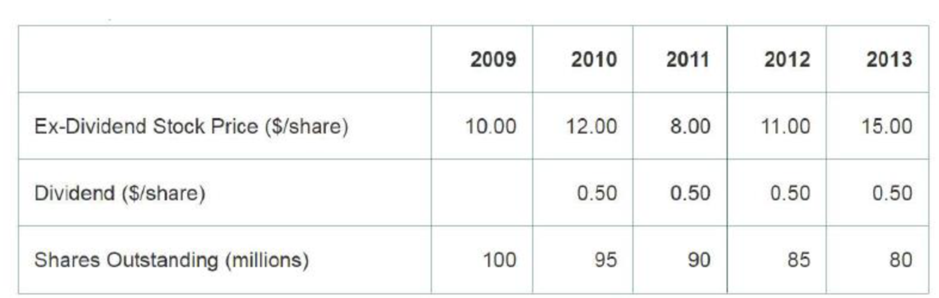

Suppose B&E Press paid dividends at the end of each year according to the schedule below. It also reduced its share count by repurchasing 5 million shares at the end of each year at the ex-dividend stock prices shown. (Assume perfect capital markets.)

- a. What is total market value of B&E’s equity, and what is the total amount paid out to shareholders, at the end of each year?

- b. If B&E had made the same total payouts using dividends only (and so kept is share count constant), what dividend would it have paid and what would its ex-dividend share price have been each year?

- c. If B&E had made the same total payouts using repurchases only (and so paid no dividends), what share count would it have had and what would its share price have been each year?

- d. Consider a shareholder who owns 10 shares of B&E initially, does not sell any shares, and reinvests all dividends at the ex-dividend share price. Would this shareholder have preferred the payout policy in (b), (c), or the original policy?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this financial accounting question

Hi expert please given correct answer with financial accounting question

Don't use ai given answer with financial accounting question

Chapter 17 Solutions

Corporate Finance

Ch. 17.1 - Prob. 1CCCh. 17.1 - Prob. 2CCCh. 17.2 - Prob. 1CCCh. 17.2 - In a perfect capital market, how important is the...Ch. 17.3 - Prob. 1CCCh. 17.3 - Prob. 2CCCh. 17.4 - Prob. 1CCCh. 17.4 - Prob. 2CCCh. 17.5 - Is there an advantage for a firm to retain its...Ch. 17.5 - Prob. 2CC

Ch. 17.6 - Prob. 1CCCh. 17.6 - Prob. 2CCCh. 17.7 - Prob. 1CCCh. 17.7 - Prob. 2CCCh. 17 - Prob. 1PCh. 17 - ABC Corporation announced that it will pay a...Ch. 17 - Prob. 3PCh. 17 - RFC Corp. has announced a 1 dividend. If RFCs...Ch. 17 - Prob. 5PCh. 17 - KMS Corporation has assets with a market value of...Ch. 17 - Natsam Corporation has 250 million of excess cash....Ch. 17 - Suppose the board of Natsam Corporation decided to...Ch. 17 - Prob. 9PCh. 17 - Suppose BE Press paid dividends at the end of each...Ch. 17 - The HNH Corporation will pay a constant dividend...Ch. 17 - Prob. 12PCh. 17 - Prob. 13PCh. 17 - Prob. 14PCh. 17 - Suppose that all capital gains are taxed at a 25%...Ch. 17 - Prob. 16PCh. 17 - Prob. 17PCh. 17 - Prob. 18PCh. 17 - Prob. 19PCh. 17 - A stock that you know is held by long-term...Ch. 17 - Clovix Corporation has 50 million in cash, 10...Ch. 17 - Assume capital markets are perfect. Kay Industries...Ch. 17 - Redo Problem 22., but assume that Kay must pay a...Ch. 17 - Harris Corporation has 250 million in cash, and...Ch. 17 - Redo Problem 22, but assume the following: a....Ch. 17 - Prob. 26PCh. 17 - Prob. 27PCh. 17 - Explain under which conditions an increase in the...Ch. 17 - Why is an announcement of a share repurchase...Ch. 17 - AMC Corporation currently has an enterprise value...Ch. 17 - Prob. 31PCh. 17 - Prob. 32PCh. 17 - Explain why most companies choose to pay stock...Ch. 17 - Prob. 34PCh. 17 - Prob. 35P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 15. Unearned Revenue is classified as a:A. RevenueB. AssetC. LiabilityD. Contra Revenuearrow_forwardGet correct answer with financial accounting questionarrow_forwardDarla owes the government $1,800 in taxes this year. She earns a tax credit for childcare for $1, 500, $678 for earned income tax, and $250 for an energy-efficient home. How much will Darla owe the government for taxes this year?arrow_forward

- I need help with financial accounting questionarrow_forwardGiven the solution and financial accounting questionarrow_forwardReflection on how public budgets influence community outcomes (e.g., housing, education, public safety). Identify one real city, school district, or agency where budget decisions have created inequities or made a positive impact.arrow_forward

- 19. A company’s weighted average cost of capital (WACC) includes:A. Only equityB. Only debtC. Both equity and debtD. Only retained earnings need helparrow_forwardA company’s weighted average cost of capital (WACC) includes:A. Only equityB. Only debtC. Both equity and debtD. Only retained earningsarrow_forwardNo AI A company’s weighted average cost of capital (WACC) includes:A. Only equityB. Only debtC. Both equity and debtD. Only retained earningsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Dividend explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Wy7R-Gqfb6c;License: Standard Youtube License