Horngren's Accounting: The Managerial Chapters, Student Value Edition (12th Edition)

12th Edition

ISBN: 9780134491509

Author: MILLER-NOBLES, Tracie L., Mattison, Brenda L., Matsumura, Ella Mae

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 6QC

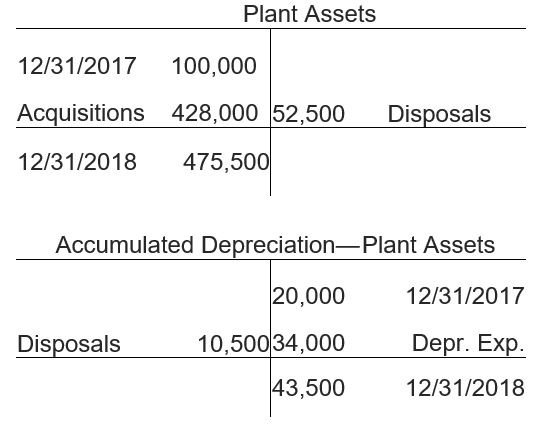

The Plant Assets account and

Learning Objective 2

Star Media sold plant assets at an $11.000 loss. Where on the statement of

- Financing cash flows—cash receipt of $42,000

- Investing cash flows—cash receipt of $53,000

- Investing cash flows—cash receipt of $31,000

- Investing cash flows—cash receipt of $42,000

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the solution to this general accounting question with accurate financial calculations.

I am looking for the correct answer to this general accounting question with appropriate explanations.

Can you help me solve this general accounting problem with the correct methodology?

Chapter 16 Solutions

Horngren's Accounting: The Managerial Chapters, Student Value Edition (12th Edition)

Ch. 16 - Prob. 1QCCh. 16 - Prob. 2QCCh. 16 - Prob. 3QCCh. 16 - Prob. 4QCCh. 16 - Prob. 5QCCh. 16 - The Plant Assets account and Accumulated...Ch. 16 - Mountain Water Corp issued common stock of $28,000...Ch. 16 - Prob. 8QCCh. 16 - Maxwell Furniture Center had accounts receivable...Ch. 16 - Prob. 10BQC

Ch. 16 - Prob. 1RQCh. 16 - Prob. 2RQCh. 16 - Prob. 3RQCh. 16 - Prob. 4RQCh. 16 - Prob. 5RQCh. 16 - Prob. 6RQCh. 16 - Prob. 7RQCh. 16 - Prob. 8RQCh. 16 - Prob. 9RQCh. 16 - Prob. 10RQCh. 16 - Prob. 11RQCh. 16 - Prob. 12RQCh. 16 - Prob. 13RQCh. 16 - Prob. 14RQCh. 16 - Prob. 15ARQCh. 16 - Prob. 16BRQCh. 16 - Prob. S16.1SECh. 16 - S16-2 Classifying items on the statement of cash...Ch. 16 - Prob. S16.3SECh. 16 - Prob. S16.4SECh. 16 - Prob. S16.5SECh. 16 - Prob. S16.6SECh. 16 - Prob. S16.7SECh. 16 - Prob. S16.8SECh. 16 - Prob. S16.9SECh. 16 - Prob. S16.10SECh. 16 - Preparing a statement of cash flows using the...Ch. 16 - Prob. S16A.12SECh. 16 - Prob. S16A.13SECh. 16 - Prob. S16A.14SECh. 16 - Prob. S16B.15SECh. 16 - Prob. E16.16ECh. 16 - Prob. E16.17ECh. 16 - Classifying items on the indirect statement of...Ch. 16 - Prob. E16.19ECh. 16 - Prob. E16.20ECh. 16 - Preparing the statement of cash flows—indirect...Ch. 16 - Prob. E16.22ECh. 16 - E16-23 Computing the cash effect Learning...Ch. 16 - Preparing the statement of cash flows—indirect...Ch. 16 - Identifying and reporting non-cash transactions...Ch. 16 - Prob. E16.26ECh. 16 - Prob. E16A.27ECh. 16 - Prob. E16A.28ECh. 16 - Computing cash flow items—direct method Learning...Ch. 16 - Prob. E16A.30ECh. 16 - Prob. E16B.31ECh. 16 - Prob. P16.32APGACh. 16 - Prob. P16.33APGACh. 16 - Prob. P16.34APGACh. 16 - Prob. P16.35APGACh. 16 - Preparing the statement of cash flows—direct...Ch. 16 - Prob. P16A.37APGACh. 16 - Prob. P16B.38APGACh. 16 - Prob. P16.39BPGBCh. 16 - Prob. P16.40BPGBCh. 16 - Prob. P16.41BPGBCh. 16 - Prob. P16.42BPGBCh. 16 - Prob. P16A.43BPGBCh. 16 - Prob. P16A.44BPGBCh. 16 - Prob. P16B.45BPGBCh. 16 - Prob. P16.46CTCh. 16 - Prob. P16.47CPCh. 16 - Prob. 16.1TIATCCh. 16 - Decision Case 16-1 Theater by Design and Show...Ch. 16 - Ethical Issue 16-1 Moss Exports is having a bad...Ch. 16 - Prob. 16.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Asset impairment explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=lWMDdtHF4ZU;License: Standard Youtube License