Fundamental Accounting Principles

24th Edition

ISBN: 9781259916960

Author: Wild, John J., Shaw, Ken W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 16, Problem 4BPSB

To determine

Concept Introduction:

Cash Flow statement:

The Cash flow statement shows the movement of cash during a particular period. The

- Cash flows from operating activities

- Cash Flows from investing activities

- Cash flows from financing activities

(Note: Cash flows from operating activities can be prepared using direct or indirect method)

To Prepare:

The Cash Flow statement using the indirect method and Analysis of changes

Expert Solution & Answer

Answer to Problem 4BPSB

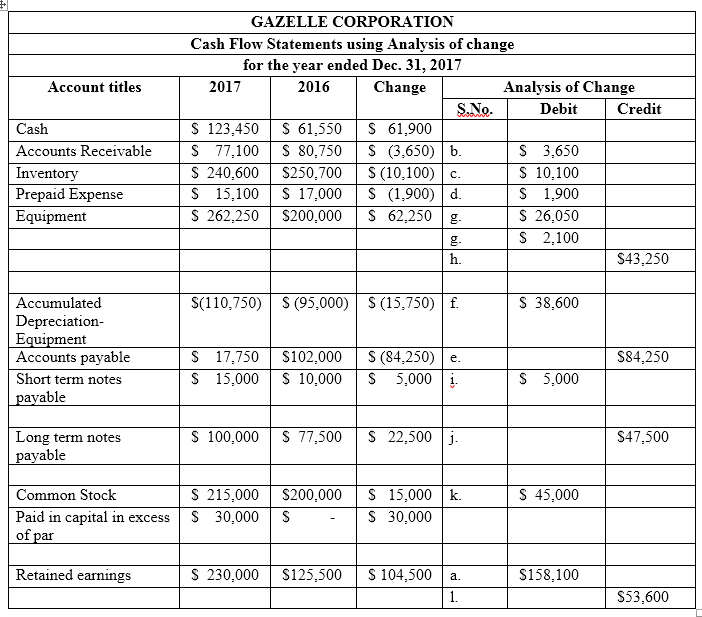

The Cash Flow statement using the indirect method and Analysis of changes is as follows:

| GAZELLE CORPORATION | ||

| Cash Flow Statements | ||

| for the year ended Dec. 31, 2017 | ||

| Cash flows from operating activities: | ||

| Net income | $ 158,100 | |

| Add: | $ 38,600 | |

| Add: Loss on sale of equipment | $ 2,100 | |

| Add: Decrease in | $ 3,650 | |

| Add: Decrease in Inventory (250700-240600) | $ 10,100 | |

| Add: Decrease in Prepaid Expense (17000-15100) | $ 1,900 | |

| Less: Decrease in Accounts Payable (102000-17750) | $ (84,250) | |

| Cash provided by operating activities | $ 130,200 | |

| Cash Flows from investing activities: | ||

| Cash Received from Sale of Equipment | $ 26,050 | |

| Cash paid for Purchase of Equipment | $ (43,250) | |

| Cash used by investing activities: | $ (17,200) | |

| Cash flows from financing activities: | ||

| Cash Receipts from Short term notes payable | $ 5,000 | |

| Cash Paid to reduce long term notes payable | $ (47,500) | |

| Cash Receipts from Issuance of Stock (3000 Shares*$15) | $ 45,000 | |

| Cash Dividends paid | $ (53,600) | |

| Cash used by financing activities: | $ (51,100) | |

| Net Cash Flows | $ 61,900 | |

| Add: Beginning Balance of Cash | $ 61,550 | |

| Ending Balance of Cash | $ 123,450 | |

Explanation of Solution

The Cash Flow statement using the indirect method and Analysis of changes is explained as follows:

| GAZELLE CORPORATION | ||

| Cash Flow Statements | ||

| for the year ended Dec. 31, 2017 | ||

| Cash flows from operating activities: | ||

| Net income | $ 158,100 | |

| Add: Depreciation Expense | $ 38,600 | |

| Add: Loss on sale of equipment | $ 2,100 | |

| Add: Decrease in Accounts receivables (80750-77100) | $ 3,650 | |

| Add: Decrease in Inventory (250700-240600) | $ 10,100 | |

| Add: Decrease in Prepaid Expense (17000-15100) | $ 1,900 | |

| Less: Decrease in Accounts Payable (102000-17750) | $ (84,250) | |

| Cash provided by operating activities | $ 130,200 | |

| Cash Flows from investing activities: | ||

| Cash Received from Sale of Equipment | $ 26,050 | |

| Cash paid for Purchase of Equipment | $ (43,250) | |

| Cash used by investing activities: | $ (17,200) | |

| Cash flows from financing activities: | ||

| Cash Receipts from Short term notes payable | $ 5,000 | |

| Cash Paid to reduce long term notes payable | $ (47,500) | |

| Cash Receipts from Issuance of Stock (3000 Shares*$15) | $ 45,000 | |

| Cash Dividends paid | $ (53,600) | |

| Cash used by financing activities: | $ (51,100) | |

| Net Cash Flows | $ 61,900 | |

| Add: Beginning Balance of Cash | $ 61,550 | |

| Ending Balance of Cash | $ 123,450 | |

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

I need help finding the accurate solution to this financial accounting problem with valid methods.

??!!

Please provide the solution to this general accounting question using proper accounting principles.

Chapter 16 Solutions

Fundamental Accounting Principles

Ch. 16 - Prob. 1DQCh. 16 - Prob. 2DQCh. 16 - What are some financing activities reported on the...Ch. 16 - Prob. 4DQCh. 16 - Prob. 5DQCh. 16 - Prob. 6DQCh. 16 - Prob. 7DQCh. 16 - Prob. 8DQCh. 16 - Prob. 9DQCh. 16 - Prob. 10DQ

Ch. 16 - Prob. 11DQCh. 16 - Prob. 12DQCh. 16 - Prob. 13DQCh. 16 - Prob. 14DQCh. 16 - Prob. 15DQCh. 16 - Transaction classification by activity C1 Classify...Ch. 16 - Prob. 2QSCh. 16 - QS 16-3 Indirect: Computing cash flows from...Ch. 16 - QS 16-4 Indirect: Computing cash flows from...Ch. 16 - QS 16-5 Indirect: Computing cash flows from...Ch. 16 - QS 16-6 Indirect: Computing cash from operations...Ch. 16 - QS 16-7 Indirect: Computing cash from operations...Ch. 16 - QS 16-8 Computing cash from asset sales P3

The...Ch. 16 - Prob. 9QSCh. 16 - QS 16-10 Computing investing cash flows P3

The...Ch. 16 - QS 16-11 Computing investing cash flows P3

Refer...Ch. 16 - Computing cash flows flow investing P3 Compute...Ch. 16 - QS 16-13 Computing cash from asset sales P3 Q...Ch. 16 - QS 16-14 Computing financing cash flows...Ch. 16 - Prob. 15QSCh. 16 - Prob. 16QSCh. 16 - Prob. 17QSCh. 16 - QS 16-18 Indirect: Preparing statement of cash...Ch. 16 - Ma rice la Yahtzee Cluedu

Cash provided (used) by...Ch. 16 - QS 16-20A Recording entries in a spreadsheet P4

A...Ch. 16 - QS 16-21B Direct: Computing cash receipts from...Ch. 16 - QS 16-22B Direct: Computing cash payments to...Ch. 16 - QS 16-23B Direct: Computing cash paid for...Ch. 16 - Prob. 24QSCh. 16 - Prob. 25QSCh. 16 - Prob. 26QSCh. 16 - Prob. 27QSCh. 16 - Prob. 1ECh. 16 - Prob. 2ECh. 16 - Exercise 16-3

Indirect: Reporting and interpreting...Ch. 16 - Exercise 16-4 Indirect: Cash flows from operating...Ch. 16 - Exercise 16-5 Indirect: Cash flows from operating...Ch. 16 - Exercise 16-6 Indirect: Cash flows from operating...Ch. 16 - Exercise 16-7 Indirect: Reporting cash flows from...Ch. 16 - Prob. 8ECh. 16 - Exercise 16-8

Cash flows from financing...Ch. 16 - Exercise 16-10 Reconstructed entries P3

For each...Ch. 16 - Exercise 16-11 Indirect: Preparing statement of...Ch. 16 - Exercise 16-12 Indirect: Preparing statement of...Ch. 16 - Exercise 16-13 Analyzing cash flow on total assets...Ch. 16 - Exercise 16-14A Indirect: Cash flows spreadsheet...Ch. 16 - Exercise 16-14

Direct Cash flow...Ch. 16 - Exercise 16-16BDirect: Computing cash flows P5 For...Ch. 16 - Exercise 16-17B Direct: Preparing statement of...Ch. 16 - Prob. 18ECh. 16 - Prob. 19ECh. 16 - Prob. 20ECh. 16 - Prob. 1APSACh. 16 - Prob. 2APSACh. 16 - Prob. 3APSACh. 16 - Prob. 4APSACh. 16 - Prob. 5APSACh. 16 - Prob. 6APSACh. 16 - Prob. 7APSACh. 16 - Prob. 8APSACh. 16 - Problem 16-1B Indirect Computing cash flows from...Ch. 16 - Prob. 2BPSBCh. 16 - Prob. 3BPSBCh. 16 - Prob. 4BPSBCh. 16 - Prob. 5BPSBCh. 16 - Prob. 6BPSBCh. 16 - Prob. 7BPSBCh. 16 - Problem 16-8BBDirect: Statement of cash flows P5...Ch. 16 - Prob. 16SPCh. 16 - Prob. 1AACh. 16 - Prob. 2AACh. 16 - Prob. 3AACh. 16 - Prob. 1BTNCh. 16 - Prob. 2BTNCh. 16 - BTN 16-3 Access the April 14. 2016. filing of the...Ch. 16 - BTN 16-6 Team members are to coordinate and...Ch. 16 - Prob. 5BTNCh. 16 - Prob. 6BTNCh. 16 - Prob. 7BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- general accountingarrow_forwardDuring 2022, Crystal Resort reported revenue of $45,000. Total expenses for the year were $29,000. Crystal Resort ended the year with total assets of $34,000, and it owed debts totaling $12,500. At year-end 2021, the business reported total assets of $28,600 and total liabilities of $11,000. A. Compute Crystal Resort's net income for 2022. B. Did Crystal Resort's stockholders' equity increase or decrease during 2022? By how much?arrow_forwardWhat is gamma's direct labor price variance ?arrow_forward

- Financial Accountingarrow_forwardWhat is the operating cycle?arrow_forwardHalle Manufacturing has an overhead application rate of 125% and allocates overhead based on direct materials. During the current period, direct labor is $78,000, and direct materials used are $112,000. Determine the amount of overhead Halle Manufacturing should record in the current period. a. $78,000 b. $97,500 c. $112,000 d. $140,000 e. $190,000 help.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License