Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 3PB

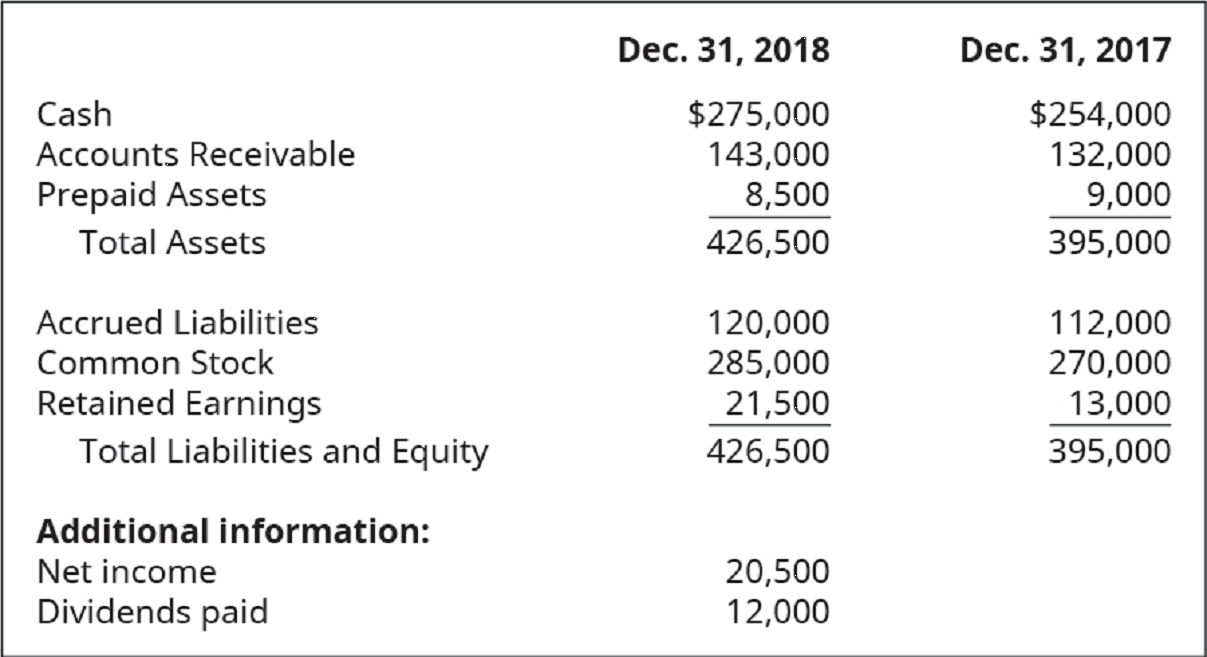

Use the following information from Honolulu Company’s financial statements to prepare the operating activities section of the statement of

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the accurate answer to this general accounting problem using appropriate methods.

None

Please provide the solution to this general accounting question with accurate financial calculations.

Chapter 16 Solutions

Principles of Accounting Volume 1

Ch. 16 - Which of the following statements is false? A....Ch. 16 - Which of these transactions would not be part of...Ch. 16 - Which is the proper order of the sections of the...Ch. 16 - Which of these transactions would be part of the...Ch. 16 - Which of these transactions would be part of the...Ch. 16 - Which of these transactions would be part of the...Ch. 16 - What is the effect on cash when current noncash...Ch. 16 - What is the effect on cash when current...Ch. 16 - What is the effect on cash when current noncash...Ch. 16 - What is the effect on cash when current...

Ch. 16 - Which of the following would trigger a subtraction...Ch. 16 - Which of the following represents a source of cash...Ch. 16 - Which of the following would be included in the...Ch. 16 - If beginning cash equaled $10,000 and ending cash...Ch. 16 - Which of the following is a stronger indicator of...Ch. 16 - What function does the statement of cash flows...Ch. 16 - Is it possible for a company to have significant...Ch. 16 - What categories of activities are reported on the...Ch. 16 - Describe three examples of operating activities,...Ch. 16 - Describe three examples of investing activities,...Ch. 16 - Describe three examples of financing activities,...Ch. 16 - Explain the difference between the two methods...Ch. 16 - Why is depreciation an addition in the operating...Ch. 16 - When preparing the operating section of the...Ch. 16 - If a company reports a gain/(loss) from the sale...Ch. 16 - Note payments reduce cash and are related to...Ch. 16 - Is there any significance that can be attributed...Ch. 16 - Would there ever be activities that relate to...Ch. 16 - What insight does the calculation of free cash...Ch. 16 - Why is using the direct method to prepare the...Ch. 16 - Provide journal entries to record each of the...Ch. 16 - In which section of the statement of cash flows...Ch. 16 - In which section of the statement of cash flows...Ch. 16 - Use the following information from Albuquerque...Ch. 16 - What adjustment(s) should be made to reconcile net...Ch. 16 - Use the following information from Birch Companys...Ch. 16 - Use the following information from Chocolate...Ch. 16 - Use the following information from Denmark...Ch. 16 - Use the following excerpts from Eagle Companys...Ch. 16 - Use the following excerpts from Fruitcake Companys...Ch. 16 - Use the following excerpts from Grenada Companys...Ch. 16 - Provide the missing piece of information for the...Ch. 16 - Provide the missing piece of information for the...Ch. 16 - Use the following excerpts from Kirsten Companys...Ch. 16 - Use the following excerpts from Franklin Companys...Ch. 16 - The following are excerpts from Hamburg Companys...Ch. 16 - Use the following excerpts from Algona Companys...Ch. 16 - Use the following excerpts from Huckleberry...Ch. 16 - Provide journal entries to record each of the...Ch. 16 - In which section of the statement of cash flows...Ch. 16 - In which section of the statement of cash flows...Ch. 16 - Use the following information from Hamlin Companys...Ch. 16 - What adjustment(s) should be made to reconcile net...Ch. 16 - Use the following excerpts from Indigo Companys...Ch. 16 - Use the following information from Jumper Companys...Ch. 16 - Use the following information from Kentucky...Ch. 16 - Use the following excerpts from Leopard Companys...Ch. 16 - Use the following information from Manuscript...Ch. 16 - Use the following excerpts from Nutmeg Companys...Ch. 16 - Provide the missing piece of information for the...Ch. 16 - Provide the missing piece of information for the...Ch. 16 - Use the following excerpts from Indira Companys...Ch. 16 - Use the following excerpts from Bolognese Companys...Ch. 16 - The following shows excerpts from Camole Companys...Ch. 16 - Use the following excerpts from Brownstone...Ch. 16 - Use the following excerpts from Jasper Companys...Ch. 16 - Provide journal entries to record each of the...Ch. 16 - Use the following information from Acorn Companys...Ch. 16 - Use the following information from Berlin Companys...Ch. 16 - Use the following information from Coconut...Ch. 16 - Use the following information from Dubuque...Ch. 16 - Use the following information from Eiffel Companys...Ch. 16 - Analysis of Forest Companys accounts revealed the...Ch. 16 - Use the following excerpts from Zowleski Companys...Ch. 16 - Use the following excerpts from Yardley Companys...Ch. 16 - Use the following excerpts from Wickham Companys...Ch. 16 - Use the following excerpts from Tungsten Companys...Ch. 16 - The following shows excerpts from financial...Ch. 16 - Use the following excerpts from Fromera Companys...Ch. 16 - Use the following excerpts from Victrolia Companys...Ch. 16 - Use the following cash transactions relating to...Ch. 16 - Provide journal entries to record each of the...Ch. 16 - Use the following information from Grenada...Ch. 16 - Use the following information from Honolulu...Ch. 16 - Use the following information from Isthmus...Ch. 16 - Use the following information from Juniper...Ch. 16 - Use the following excerpts from Kayak Companys...Ch. 16 - Analysis of Longmind Companys accounts revealed...Ch. 16 - Use the following excerpts from Stern Companys...Ch. 16 - Use the following excerpts from Unigen Companys...Ch. 16 - Use the following excerpts from Mountain Companys...Ch. 16 - Use the following excerpts from OpenAir Companys...Ch. 16 - The following shows excerpts from financial...Ch. 16 - Use the following excerpts from Swansea Companys...Ch. 16 - Use the following excerpts from Swahilia Companys...Ch. 16 - Use the following cash transactions relating to...Ch. 16 - Use a spreadsheet and the following financial...Ch. 16 - Consider the dilemma you might someday face if you...Ch. 16 - If you had $100,000 available for investing, which...

Additional Business Textbook Solutions

Find more solutions based on key concepts

1-13. Identify a product, either a good or a service, that will take advantage of this opportunity. Although yo...

Business Essentials (12th Edition) (What's New in Intro to Business)

To calculate the current WACC. Introduction: The weighted average cost of capital is defined as the expected av...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

An experimental composite engine block for an automobile will trim 20 pounds of weight compared with a traditio...

Engineering Economy (17th Edition)

The call option on the firm’s assets which leads to agency costs. Introduction: An option is a derivative that ...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

What is a qualitative forecasting model, and when is its use appropriate?

Operations Management

What is the relationship between management by exception and variance analysis?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License