(A)

To Compute:

If the desired put option were traded. How much would it cost to purchase?

Introduction:

The value of put option is calculated using the formula given below.

Explanation of Solution

a) Computation of value of put:

Here, the investor would hold a put position. The current price is $100. This price could either

increase or decrease by 10%

Factor by which stock increases is u

Factor by which stock decreases is d

Calculation of option value

The two possible stock prices are

since, the exercise price is $100, and the corresponding two possible put values are

Calculation of the hedge ratio (H)

The hedge ratio can be calculated by using the following formula:

Here,

The value of the call option in case of in-the-money scenario is

The value of the call option in case of out-of-the-money scenario is

Factor by which stock increases u.

Factor by which stock decreases is d.

Stock price in case stock price increases is

Stock price in case stock price decreases is

Substitute:

Hence, the hedge ratio is -.5

The portfolio combining of two puts and one share brings an assured payoff $ 110 making it a riskless portfolio.

Calculation of the present value of certain stock price of $110 with a one-year interest rate of 5%:

Hence, the present value of certain stock price of $110 with a one-year interest rate of 5% $104.76

Comparing the protective put strategy and present value of stock we get,

One stock and two put options

Solve for the value of put (P):

Hence, the value of put option is $2.38.

Hence, the value of put option is $2.38.

(B)

To Compute:

What would have been the cost of the protective put portfolio? Introduction: The cost of protective put portfolio that comes out is calculated based on the given formula below.

Explanation of Solution

(b) Computation of cost of protective put portfolio:

The cost of the protective put portfolio is the cost of one share plus the cost of one put. It

can be calculated by using the following formula:

Hence, the cost of protective put portfolio comes out to be $102.38.

Hence, the cost of protective put portfolio comes out to be $102.38.

(C)

To Compute:

What portfolio position in stock and T-bills ill ensure you a payoff equal to the payoff that would be provided by a protective put with X-$100? Show that the payoff to this portfolio and

the cost of establishing the portfolio match those of the desired protective put.

Introduction:

The strategy is calculated in the table to determine the pay-off using the below calculation.

Explanation of Solution

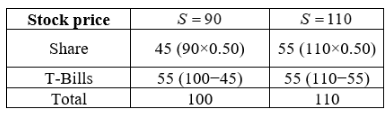

To ensure equal pay-off in stock and T-bills and protective put is as follows

The hedge ratio is 0.50. The investor will invest 0.50 in stocks which costs $50 and

remaining in T-bills to earn 5% interest.

The above strategy will give same pay-off as the protective put option.

The above strategy will give same pay-off as the protective put option.

Want to see more full solutions like this?

Chapter 16 Solutions

ESS. OF INVESTMENTS - ETEXT ACCESS CARD

- Define Fair Value? explain.arrow_forwardAP Associates needs to raise $35 million. The investment banking firm of Squeaks, Emmie, andChippy will handle the transaction.a. If stock is used, 1,800,000 shares will be sold to the public at $21.30 per share. The corporation willreceive a net price of $20 per share. What is the percentage underwriting spread per share?b. If bonds are utilized, slightly over 37,500 bonds will be sold to the public at $1,000 per bond. Thecorporation will receive a net price of $980 per bond. What is the percentage of underwritingspread per bond? (Relate the dollar spread to the public price.)c. Which alternative has the larger percentage of spread?arrow_forwardGracie’s Dog Vests currently has 5,200,000 shares of stock outstanding and will report earnings of$8.8 million in the current year. The company is considering the issuance of 1,500,000 additionalshares that will net $28 per share to the corporation.a. What is the immediate dilution potential for this new stock issue?b. Assume that Grace’s Dog Vests can earn 8 percent on the proceeds of the stock issue in time toinclude them in the current year’s results. Calculate earnings per share. Should the new issuebe undertaken based on earnings per share?arrow_forward

- You plan to contribute seven payments of $2,000 a year, with the first payment made today (beginning of year 0) and the final payment made at the beginning of year 6, earning 11% annually. How much will you have after 6 years? a. $12,000 b.$21,718 c.$19,567 d.$3,741arrow_forwardNo AI i need help in this finance question..arrow_forwardplease help me in this finance question.arrow_forward

- How can you help in this finance question ? Please tell me.arrow_forwardWhat is the full form of "CTO"? a.Central Trading Operation b.Capital take Over c.Chief Technology Officer d.Commerce Trade Officerarrow_forwardExplain. What is the full form of "EPS"? a.Exchange per Share b.Equity Private Selling c.Earnings per share d.Earning Preferred Stockarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education