(A)

Adequate Information:

The

To calculate:

The fraction of the portfolio, fraction in equity and the stock portfolio if falls by 3%.

Introduction:

Portfolio involves financial asset grouping viz. currencies, commodities, bonds, stocks and cash equivalents. It also comprises of fund counterparts such as closed funds, exchange traded funds and mutual funds. Non-publicly tradable securities such as private, art and real estate investment are also part of portfolios.

Explanation of Solution

Fractions of portfolio invested in T-bills and equity can be calculated based on the Black-Scholes

model. The value of

to T-bills and equity can be known for value of

Formula for

Substitute values to calculate

Calculate the Black-Scholes hedge ratio

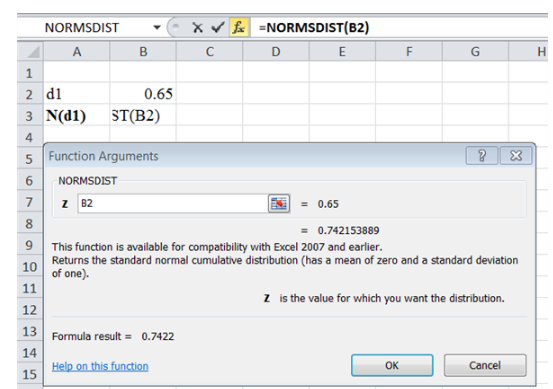

"NORMSDIST" function are as follows:

- First, go to the Menu bar of Excel and select 'Formulas' option

- Select Insert Function '(fx)

- Then select a category as Financial

- Then select "NORMSDIST" and click OK

- Then the Function Argument window will open. Now, input the given data in the required field

- Click OK

- The formula will display the final answer as 0.7422

Therefore,

Calculate the put delte as follows:

Hence, place 25.785 of the portfolio in T-bills and 74.22%

Hence, place 25.785 of the portfolio in T-bills and 74.22%

(B)

Adequate information:

To calculate:

Fractions of portfolio divided into bills and equity If stock prices fall by 3% on the first day of trading. It means

Introduction:

Portfolio involves financial asset grouping viz. currencies, commodities, bonds, stocks and cash equivalents. It also comprises of fund counterparts such as closed funds, exchange traded funds and mutual funds. Non-publicly tradable securities such as private, art and real estate investment are also part of portfolios.

Explanation of Solution

Fractions of portfolio invested in T-bills and equity can be calculated based on the Black-Scoles model. The value of

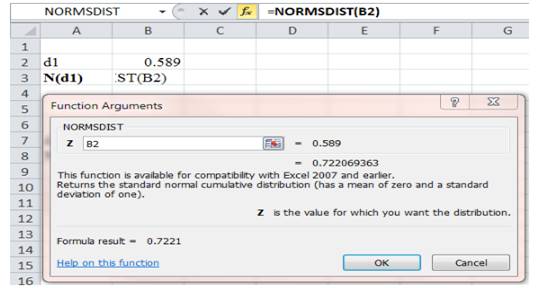

Substitute values to calculate

Calculate the Black-Scholes hedge ratio

Hence,

Calculate the put delta as follows:

Hence, place 27.79% of the portfolio in T-bills and 72.21%

Want to see more full solutions like this?

Chapter 16 Solutions

ESSENTIALS OF INVESTMENTS - CONNECT ACCE

- 7. What is a par value of a bond?* The amount borrowed by the issuer of the bond and returned to the investors when the bond matures The overall return earned by the bond investor when the bond matures The difference between the amount borrowed by the issuer of bond and the amount returned to investors at maturity The size of the coupon investors receive on an annual basisarrow_forwardWhat is an annuity?* An investment that has no definite end and a stream of cash payments that continues forever A stream of cash flows that start one year from today and continue while growing by a constant growth rate A series of equal payments at equal time periods and guaranteed for a fixed number of years A series of unequal payments at equal time periods which are guaranteed for a fixed number of yearsarrow_forwardIf you were able to earn interest at 3% and you started with $100, how much would you have after 3 years?* $91.51 $109.27 $291.26 $103.00arrow_forward

- A proxy is an authorization that doesn’t allows one shareholder to vote on behalf of another shareholder. TRUE OR FALSEarrow_forwardNon-Investment-grade bonds are rated at least BBB by Standard and Poor’s. TRUE OR FALSEarrow_forwardNon-Investment-grade bonds are rated at least BBB by Standard and Poor’s. TRUE OR FALSEarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education