Concept explainers

1.

Compute the basic earnings per share for Company M.

1.

Explanation of Solution

Earnings per share (EPS):

The amount of net income available to each shareholder per common share outstanding is referred to as earnings per share (EPS).

Compute the basic earnings per share for Company M.

Working notes:

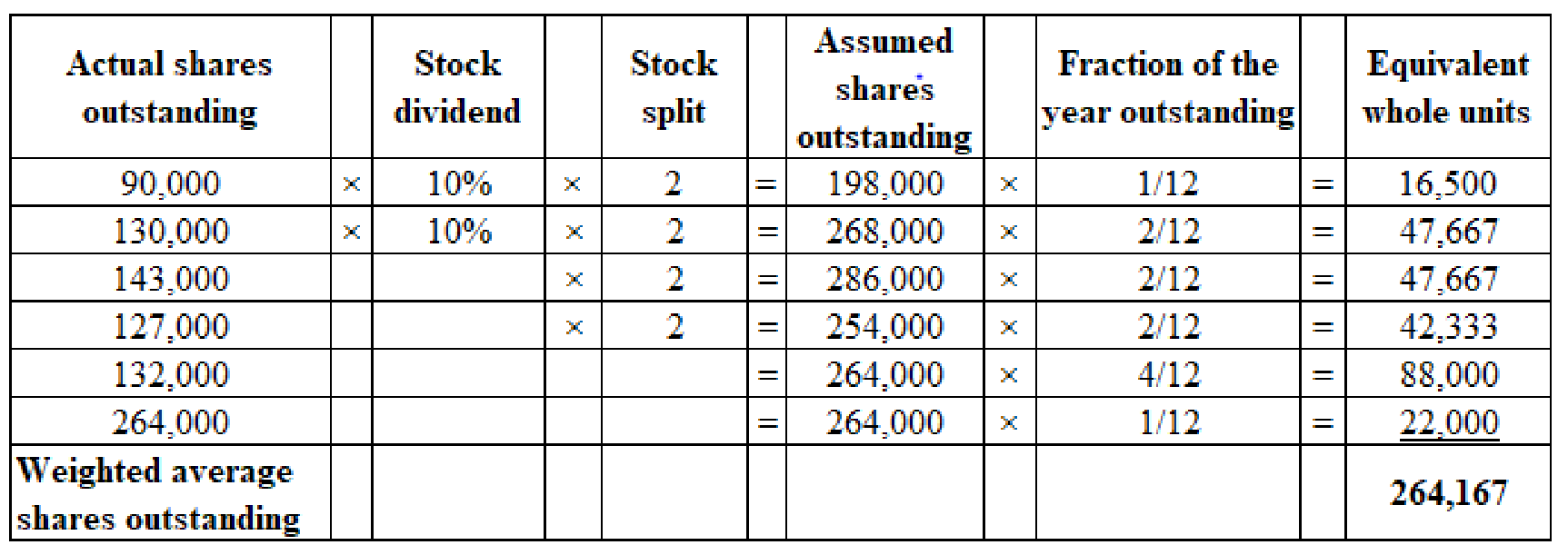

(1) Calculation of weighted average shares outstanding:

(Figure 1)

2.

Compute the tentative and incremental dilutive earnings per share for each dilutive security.

2.

Explanation of Solution

Compute tentative diluted EPS for stock options.

Compute the incremental diluted EPS for stock options.

Compute the incremental diluted EPS for convertible bonds.

Compute the incremental diluted EPS of convertible preferred stock.

Compute tentative diluted EPS assuming for 12% convertible preferred stock.

Compute tentative diluted EPS assuming, exercisable options, 9% convertible bonds, and 12% convertible preferred stock.

Working notes:

(1) Calculate the value of exercisable options:

(2) Compute the number of shares required:

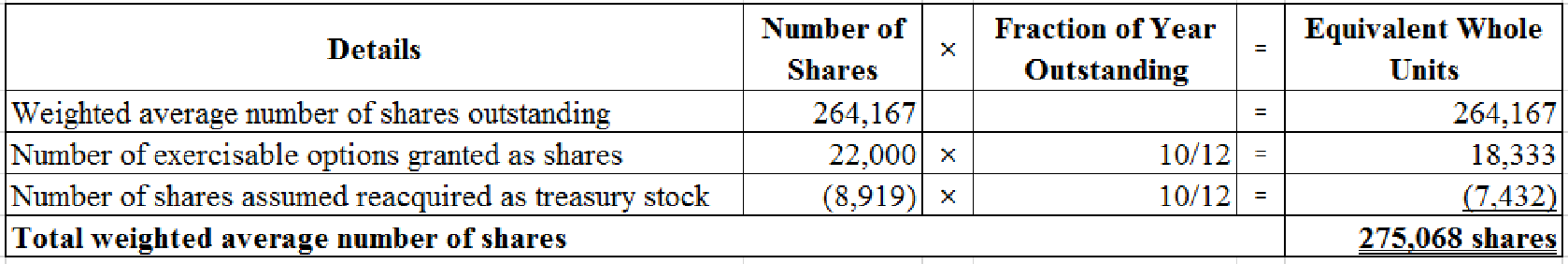

(3) Compute the total weighted average number of common shares.

(Figure 2)

(4) Compute the amount of interest expense, net of income tax on 9% bonds.

(5) Compute the number of common shares due to conversion of 9% bonds.

(6) Compute the number of common shares due to conversion of preferred shares.

3.

Identify the amount that will be reported as basic and diluted earnings per share for the year 2019.

3.

Explanation of Solution

The Company M must report an amount of $1.95 as basic earnings per share and $1.64 as diluted earnings per share in its 2019 income statement.

Want to see more full solutions like this?

Chapter 16 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

- On December 31, calculated the payroll, which indicates gross earnings for wages ($460,000), payroll deductions for income tax ($48,000), payroll deductions for FICA ($40,000), payroll deductions for United Way ($6,000), employer contributions for FICA (matching), and state and federal unemployment taxes ($4,000). Employees were paid in cash, but payments for the corresponding payroll deductions have not been made and employer taxes have not yet been recorded. Collected rent revenue of $2,100 on December 10 for office space that Sandler rented to another business. The rent collected was for 30 days from December 12 to January 10 and was credited in full to Deferred Revenue. Required: 1. & 2. Prepare the entries required on December 31 to record payroll, the collection of rent on December 10 and adjusting journal entry on December 31. 3. Show how any liabilities related to these items should be reported on the company’s balance sheet at December 31arrow_forwardBrihteres problem i have to need answer.arrow_forwardSolve it by using proper methodarrow_forward

- Jbl company problem sopve it.arrow_forwardHow much intrest bank collect?arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.]XYZ declared a $1 per share dividend on August 15. The date of record for the dividend was September 1 (the stock began selling ex-dividend on September 2). The dividend was paid on September 10. Ellis is a cash-method taxpayer. Determine if he must include the dividends in gross income under the following independent circumstances. b. Ellis bought 100 shares of XYZ stock on August 1 for $21 per share. Ellis sold his XYZ shares on September 5 for $23 per share. Ellis received the $100 dividend on September 10 (note that even though Ellis didn’t own the stock on September 10, he still received the dividend because he was the shareholder on the record date).arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning