Concept explainers

1. and 2.

Calculate the basic earnings per share and diluted earnings per share.

1. and 2.

Explanation of Solution

Calculate the basic earnings per share and diluted earnings per share.

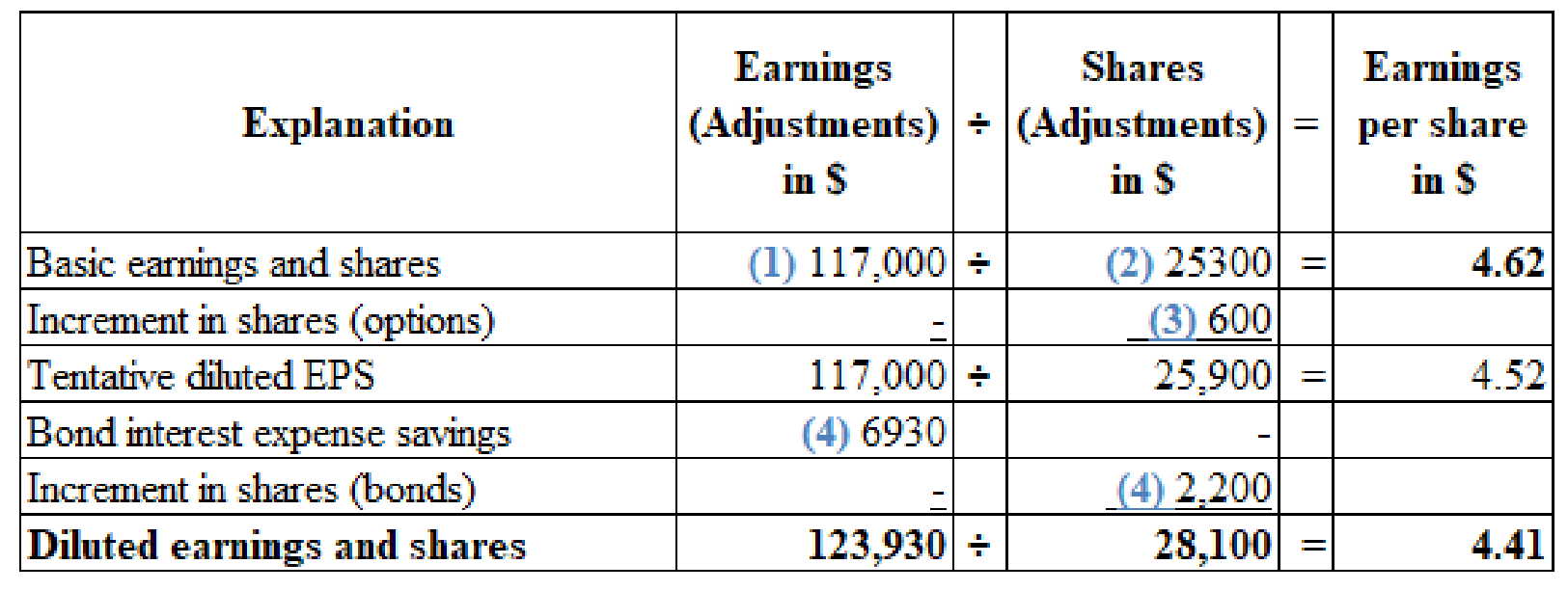

(Figure 1)

Working notes:

(1) Calculate the numerator for the basic earnings per share:

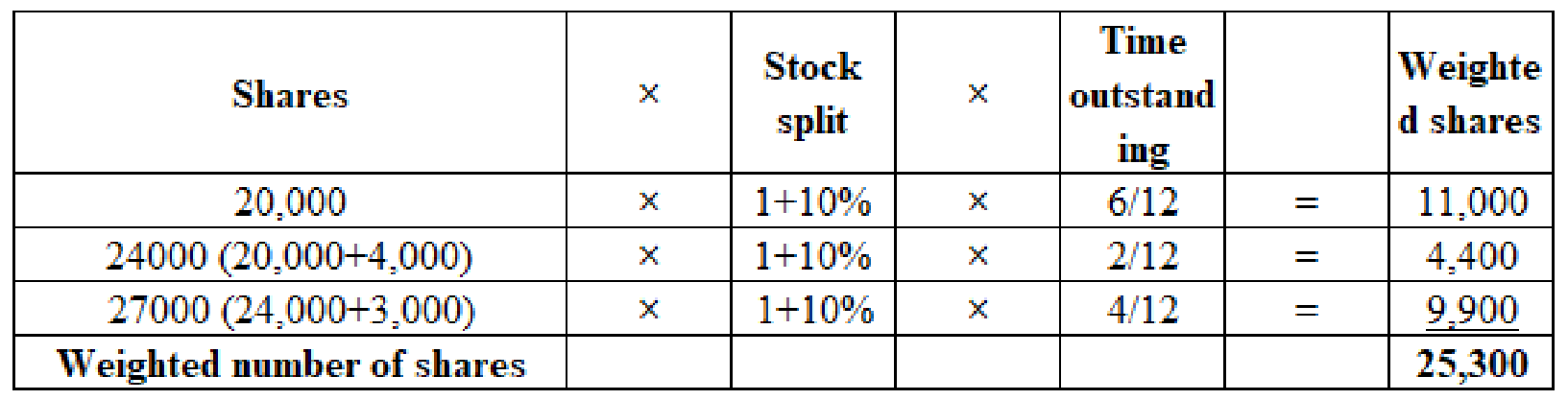

(2) Calculate the number of shares used in computing the basic earnings per share:

(Figure 2)

(3) Calculate the increase in the share options:

(4) Calculate the impact of 8% preferred on diluted earnings per share and ranking:

(5) Calculate the impact of 9.6% bonds on diluted earnings per share and ranking:

Note:

- The Company has occurred loss form the discontinuing operations, the impact of the convertible security is compared with earnings per share that is related to income from continuing operations.

- The percentage of stock dividend that is required to identify the assumed shared outstanding is ascertained using below formula :

3.

Identify whether basic or diluted earnings per share will be reported by the Company R on its 2016 income statement.

3.

Explanation of Solution

The Company R must report an amount of (6) $4.23 as basic earnings per share and (7) $4.05 as diluted earnings per share in its 2016 income statement.

Working notes:

(6) Calculate the basic earnings per share after deducting loss from discontinuing operations:

(7) Calculate the basic earnings per share after deducting loss from discontinuing operations:

Notes to financial statement:

Note 1: Basic earnings per share of the company are based on average common shares outstanding; 7% and 8% preferred dividends are deducted from net income to ascertain the earnings available to common shareholders. Diluted earnings per share are obtained from 600 shares of stock options and 2,200 shares of bonds that are convertible. Diluted earnings available to common shareholders are assumed to have no interest expense of $6,930 on the converted bonds.

Want to see more full solutions like this?

Chapter 16 Solutions

Intermediate Accounting: Reporting and Analysis, 2017 Update

- Bright Orange, Inc., uses direct labor hours to allocate overhead costs. If Bright Orange estimates $50,000 of overhead and 60,000 hours of direct labor this period, the overhead applied when 5,000 direct labor hours are used should be___.arrow_forwardPlz correct answer??? In this question??arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning