Concept explainers

1. and 2.

Prepare a schedule to show the impact of the assumed conversion of each convertible security on diluted earnings per share and also show the manner by which the securities that are included in the diluted earnings per share are ranked.

1. and 2.

Explanation of Solution

Earnings per share (EPS): The amount of net income available to each shareholder per common share outstanding is referred to as earnings per share (EPS).

Prepare a schedule to show the impact of the assumed conversion of each convertible security on diluted earnings per share.

| Convertible security | Impact in ($) | Ranking |

| 10.2% bonds (1) | $2.55 | 5 |

| 12.0% bonds (3) | $1.71 | 3 |

| 9.0% bonds (5) | $1.51 | 2 |

| 8.3% | $2.13 | 4 |

| 7.5% preferred stock (7) | $1.25 | 1 |

(Table 1)

Working notes:

(1) Calculate the impact of the 10.2% bonds on diluted earnings per share.

(2) Calculate the Premium on amortized bond for 20 year life:

(3) Calculate the impact of the 12.0% bonds on diluted earnings per share.

(4) Calculate the discount on amortized bond for 10 year life:

(5) Calculate the impact of the 9.0% bonds on diluted earnings per share.

(6) Calculate the impact of the 8.3% preferred stock on diluted earnings per share.

(7) Calculate the impact of the 7.5% preferred stock on diluted earnings per share.

3. and 4.

Calculate the basic earnings per share and diluted earnings per share.

3. and 4.

Explanation of Solution

Calculate the basic earnings per share and diluted earnings per share.

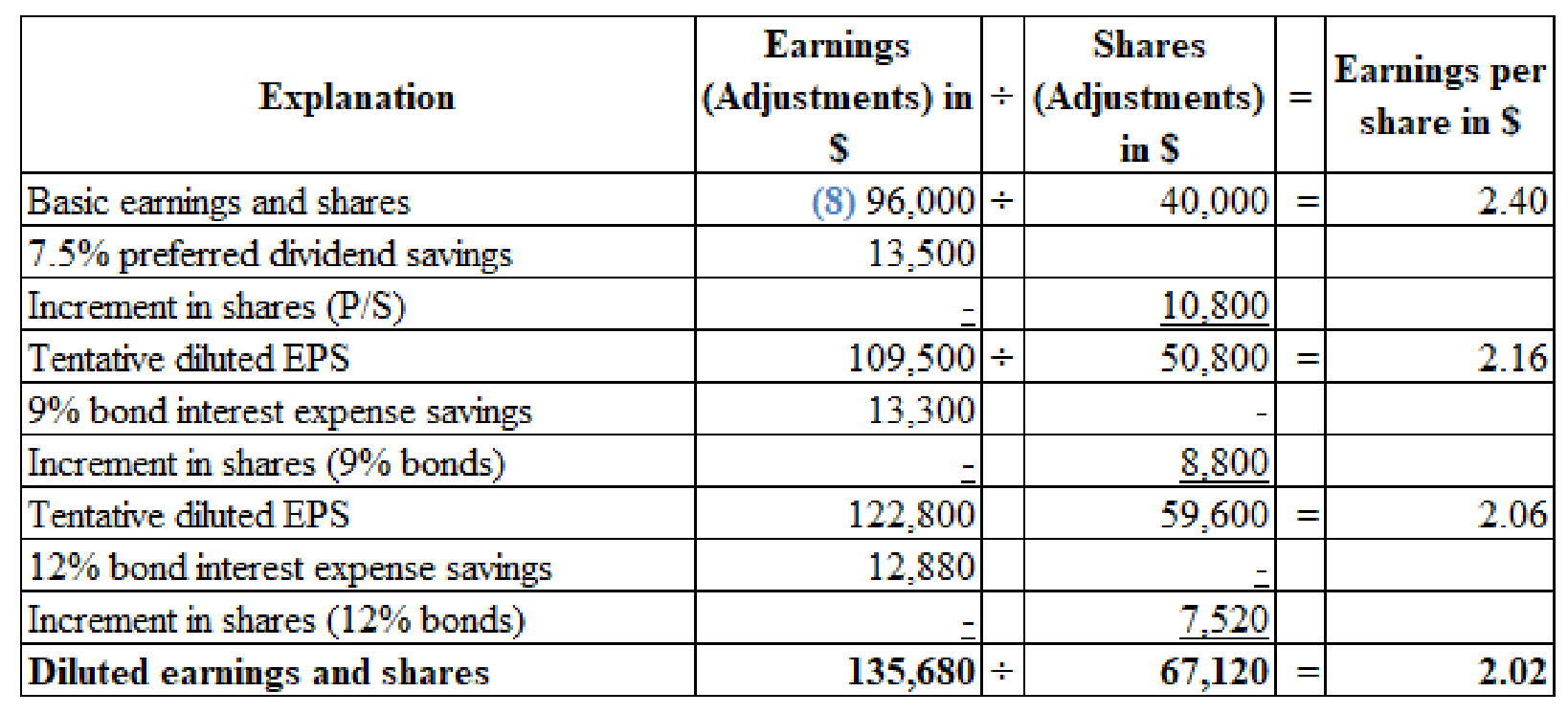

(Figure 1)

Working notes:

(8) Calculate the numerator for the basic earnings per share:

5.

Identify the amount that will be reported as basic and diluted earnings per share for the year 2016.

5.

Explanation of Solution

The Company W must report an amount of $2.40 as basic earnings per share and $2.20 as diluted earnings per share in its 2016 income statement.

Want to see more full solutions like this?

Chapter 16 Solutions

Cengagenowv2, 1 Term Printed Access Card For Wahlen/jones/pagach’s Intermediate Accounting: Reporting And Analysis, 2017 Update, 2nd

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning