Concept explainers

1. and 2.

Prepare a schedule to show the impact of the assumed conversion of each convertible security on diluted earnings per share and also show the manner by which the securities that are included in the diluted earnings per share are ranked.

1. and 2.

Explanation of Solution

Earnings per share (EPS): The amount of net income available to each shareholder per common share outstanding is referred to as earnings per share (EPS).

Prepare a schedule to show the impact of the assumed conversion of each convertible security on diluted earnings per share.

| Convertible security | Impact in ($) | Ranking |

| 10.2% bonds (1) | $2.55 | 5 |

| 12.0% bonds (3) | $1.71 | 3 |

| 9.0% bonds (5) | $1.51 | 2 |

| 8.3% | $2.13 | 4 |

| 7.5% preferred stock (7) | $1.25 | 1 |

(Table 1)

Working notes:

(1) Calculate the impact of the 10.2% bonds on diluted earnings per share.

(2) Calculate the Premium on amortized bond for 20 year life:

(3) Calculate the impact of the 12.0% bonds on diluted earnings per share.

(4) Calculate the discount on amortized bond for 10 year life:

(5) Calculate the impact of the 9.0% bonds on diluted earnings per share.

(6) Calculate the impact of the 8.3% preferred stock on diluted earnings per share.

(7) Calculate the impact of the 7.5% preferred stock on diluted earnings per share.

3. and 4.

Calculate the basic earnings per share and diluted earnings per share.

3. and 4.

Explanation of Solution

Calculate the basic earnings per share and diluted earnings per share.

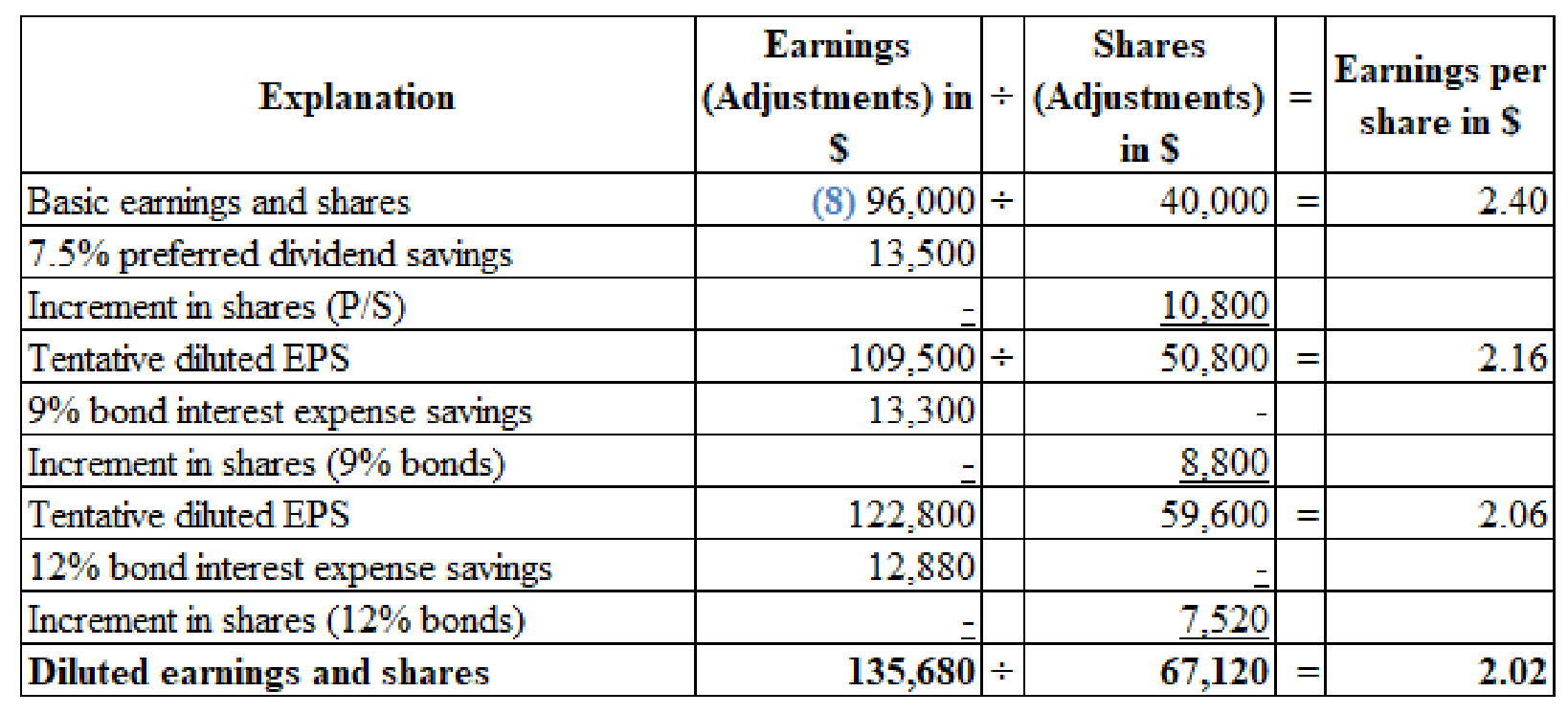

(Figure 1)

Working notes:

(8) Calculate the numerator for the basic earnings per share:

5.

Identify the amount that will be reported as basic and diluted earnings per share for the year 2016.

5.

Explanation of Solution

The Company W must report an amount of $2.40 as basic earnings per share and $2.20 as diluted earnings per share in its 2016 income statement.

Want to see more full solutions like this?

Chapter 16 Solutions

Intermediate Accounting: Reporting and Analysis (Looseleaf)

- Bruce Inc. began the year with stockholders' equity of $280,000. During the year, the company recorded revenues of $410,000 and expenses of $325,000, and the company paid dividends of $40,000. What was Bruce's stockholders' equity at the end of the year? Helparrow_forwardA local bakery sells 12,000 loaves of sourdough bread each year. The loaves are ordered from an outside supplier, and it takes 4 days for each shipment of loaves to arrive. Ordering costs are estimated at $18 per order. Carrying costs are $6 per loaf per year. Assume that the bakery is open 300 days a year. What is the maximum inventory of loaves held in a given ordering cycle? a. 180.02 b. 362.07 c. 268.33 d. 152.98arrow_forwardBruce Inc. began the year with stockholders' equity of $280,000. During the year, the company recorded revenues of $410,000 and expenses of $325,000, and the company paid dividends of $40,000. What was Bruce's stockholders' equity at the end of the year?arrow_forward

- What is the variable cost per unit processedarrow_forwardA proposed project has estimated sale units of 2,500, give or take 2 percent. The expected variable cost per unit is $12.79 and the expected fixed costs are $17,500. Cost estimates are considered accurate within a plus or minus 3 percent range. The depreciation expense is $2,850. The sale price is estimated at $15.40 a unit, give or take 3 percent. The company bases its sensitivity analysis on the expected case scenario. If a sensitivity analysis is conducted using a variable cost estimate of $13, what will be the total annual variable costs?arrow_forwardWhat is the maximum inventoryarrow_forward

- Financial Accountingarrow_forwardWhat is the company's plant wide overhead rate on these financial accounting question?arrow_forwardCharlotte's Cleaning Services began the year with total liabilities of $120,000 and stockholders' equity of $55,000. During the year, the company earned $140,000 in net income and paid $10,000 in dividends. Total liabilities at the end of the year were $260,000. How much are total assets at the end of the year? Provide answerarrow_forward

- Sunflower Oil Processors incurred the following plant maintenance costs: 65,000 units processed with maintenance costs of $92,000 48,000 units processed with maintenance costs of $75,000 What is the variable cost per unit processed?arrow_forwardAnswerarrow_forwardPlease provide answer the following requirements a and b on these financial accounting questionarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning