Concept explainers

Calculate income tax amounts under various circumstances

• LO16–1, LO16–2

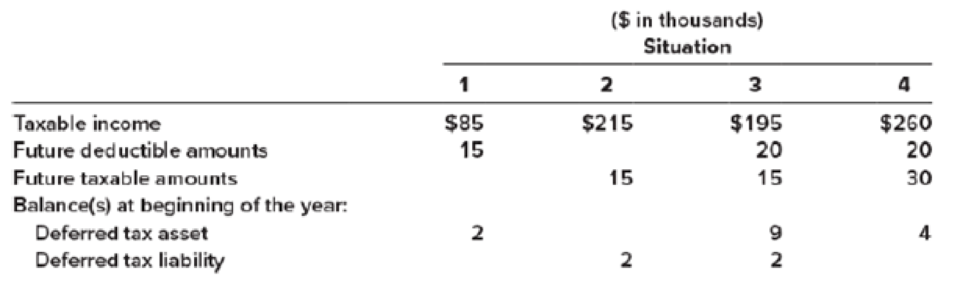

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:

The enacted tax rate is 40%.

Required:

For each situation, determine the:

a. Income tax payable currently

b.

c. Deferred tax asset—change (dr) cr

d.

e. Deferred tax liability—change (dr) cr

f. Income tax expense

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Intermediate Accounting w/ Annual Report; Connect Access Card

Additional Business Textbook Solutions

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Essentials of MIS (13th Edition)

Microeconomics

Horngren's Accounting (12th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- Calculate the standard cost per unit for direct materials direct labor and variable manufacturing overheadarrow_forwardI am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forward

- Please explain the correct approach for solving this general accounting question.arrow_forwardZebrix Ltd. has an inventory period of 55 days, an accounts receivable period of 10 days, and an accounts payable period of 6 days. The company's annual sales are $208,400. How many times per year does the company turn over its accounts receivable?arrow_forwardLika company issues 2,000 shares of $10 par value common stock for $25 per share. What amount should be credited to the Common Stock account and to the Additional Paid-in Capital account?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning