Accounting

27th Edition

ISBN: 9781337272094

Author: WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 16.3BPR

Statement of

The comparative

| Dec. 31, 20Y2 | Dec. 31, 20Y1 | |

| Assets | ||

| Cash | $ 300,600 | $ 337,800 |

| 704,400 | 609,600 | |

| Inventories | 918,600 | 865,800 |

| Prepaid expenses | 18,600 | 26,400 |

| Land | 990,000 | 1,386,000 |

| Buildings | $1,980,000 | $ 990,000 |

| Accumulated |

(397,200) | (366,000) |

| Equipment | 660,600 | 529,800 |

| Accumulated depreciation—equipment | (133,200) | (162,000) |

| Total assets | $5,042,400 | $4,217,400 |

| Liabilities and |

||

| Accounts payable | $ 594,000 | $ 631,200 |

| Income taxes payable | 26,400 | 21,600 |

| Bonds payable | 330,000 | 0 |

| Common stock, $20 par | 320,000 | 180,000 |

| Paid in capital: Excess of issue price over par—common stock | 950,000 | 810,000 |

| 2,822,000 | 2,574,600 | |

| Total liabilities and stockholders' equity | $5,042,400 | $4,217,400 |

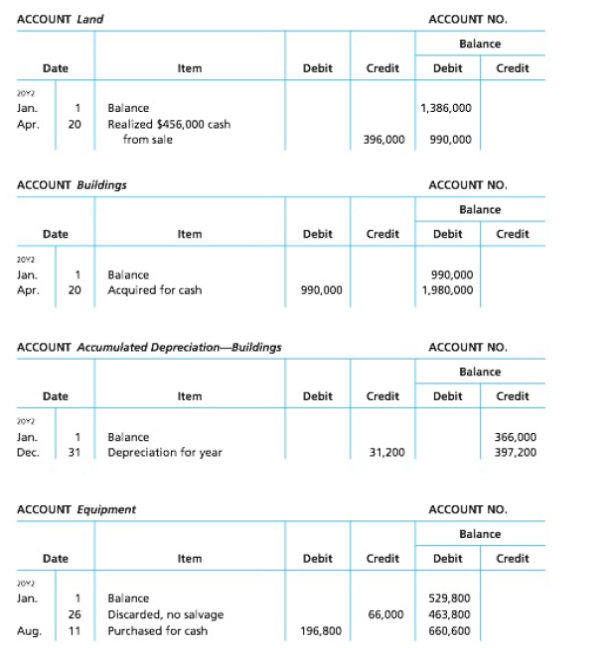

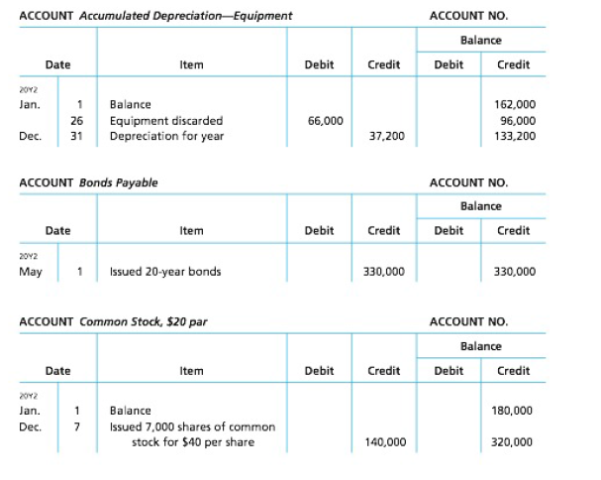

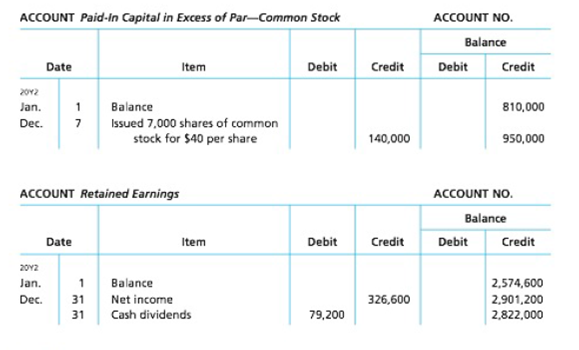

The noncurrent asset, noncurrent liability, and stockholders’ equity accounts for 20Y2 are as follows:

Instructions

Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the amount of total assets? Accounting question

I need help finding the accurate solution to this general accounting problem with valid methods.

I am searching for the correct answer to this general accounting problem with proper accounting rules.

Chapter 16 Solutions

Accounting

Ch. 16 - Prob. 1DQCh. 16 - Prob. 2DQCh. 16 - A corporation issued 2,000,000 of common stock in...Ch. 16 - A retail business, using the accrual method of...Ch. 16 - Prob. 5DQCh. 16 - A long-term investment in bonds with a cost of...Ch. 16 - A corporation issued 2,000,000 of 20-year bonds...Ch. 16 - Fully depreciated equipment costing 50,000 is...Ch. 16 - Prob. 9DQCh. 16 - Name five common major classes of operating cash...

Ch. 16 - Prob. 16.1APECh. 16 - Prob. 16.1BPECh. 16 - Adjustments to net incomeindirect method Ripley...Ch. 16 - Prob. 16.2BPECh. 16 - Changes in current operating assets and...Ch. 16 - Changes in current operating assets and...Ch. 16 - Prob. 16.4APECh. 16 - Prob. 16.4BPECh. 16 - Land transactions on the statement of cash flows...Ch. 16 - Land transactions on the statement of cash flows...Ch. 16 - Prob. 16.6APECh. 16 - Prob. 16.6BPECh. 16 - Cash payments for merchandisedirect method The...Ch. 16 - Cash payments for merchandisedirect method The...Ch. 16 - Prob. 16.8APECh. 16 - Prob. 16.8BPECh. 16 - Prob. 16.1EXCh. 16 - Effect of transactions on cash flows State the...Ch. 16 - Classifying cash flows Identify the type of cash...Ch. 16 - Cash flows from operating activitiesindirect...Ch. 16 - Cash flows from operating activitiesindirect...Ch. 16 - Prob. 16.6EXCh. 16 - Prob. 16.7EXCh. 16 - Determining cash payments to stockholders The...Ch. 16 - Reporting changes in equipment on statement of...Ch. 16 - Prob. 16.10EXCh. 16 - Reporting land transactions on statement of cash...Ch. 16 - Prob. 16.12EXCh. 16 - Reporting land acquisition for cash and mortgage...Ch. 16 - Reporting issuance and retirement of longterm debt...Ch. 16 - Prob. 16.15EXCh. 16 - Prob. 16.16EXCh. 16 - Prob. 16.17EXCh. 16 - Statement of cash flowsindirect method The...Ch. 16 - Prob. 16.19EXCh. 16 - Prob. 16.20EXCh. 16 - Determining selected amounts for cash flows from...Ch. 16 - Prob. 16.22EXCh. 16 - Cash flows from operating activitiesdirect method....Ch. 16 - Prob. 16.24EXCh. 16 - Free cash flow The financial statement for Nike,...Ch. 16 - Free cash flow Lovato Motors Inc. has cash flows...Ch. 16 - Statement of cash flowsindirect method The...Ch. 16 - Prob. 16.2APRCh. 16 - Statement of cash flowsindirect method The...Ch. 16 - Prob. 16.4APRCh. 16 - Prob. 16.5APRCh. 16 - Prob. 16.1BPRCh. 16 - Statement of cash flowsindirect method The...Ch. 16 - Statement of cash flowsindirect method The...Ch. 16 - Statement of cash flowsdirect method The...Ch. 16 - Statement of cash flowsdirect method applied to PR...Ch. 16 - Ethics in Action Lucas Hunter, president of...Ch. 16 - Prob. 16.3CPCh. 16 - Using the statement of cash flows You are...Ch. 16 - Dillip Lachgar is the president and majority...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forwardPlease explain this financial accounting problem by applying valid financial principles.arrow_forward

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forward

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardNo AI What is the Weighted Average Cost of Capital (WACC), and why is it important for a company?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License