Concept explainers

Statement of

The comparative

| Dec. 31, 20Y2 | Dec. 31, 20Y1 | |

| Assets | ||

| Cash. | $ 918,000 | $ 964,800 |

| 828,900 | 761,940 | |

| Inventories | 1,268,460 | 1,162,980 |

| Prepaid expenses | 29,340 | 35,100 |

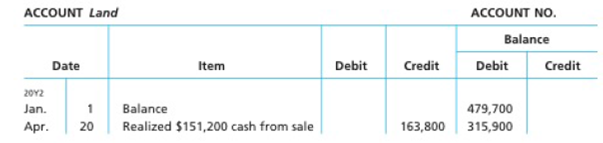

| Land | 315,900 | 479,700 |

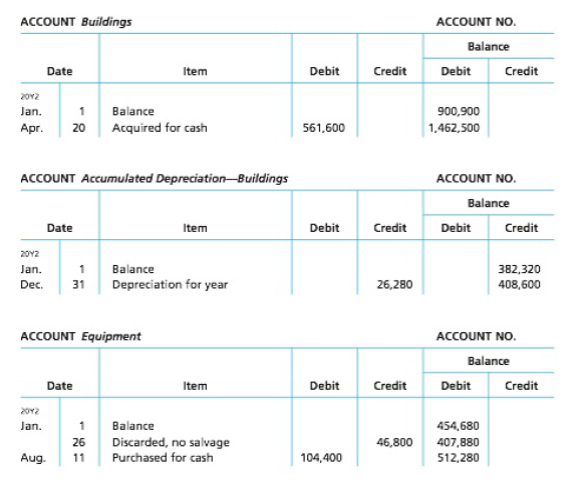

| Buildings | 1,462.500 | 900,900 |

| Accumulated |

(408,00) | (382,320) |

| Equipment | 512,280 | 454,680 |

| Accumulated depreciation—equipment | (141,300) | (158,760) |

| Total assets | $4,785,480 | $4,219,020 |

| Liabilities and |

||

| Accounts payable (merchandise creditors) | $ 922,500 | $ 958.320 |

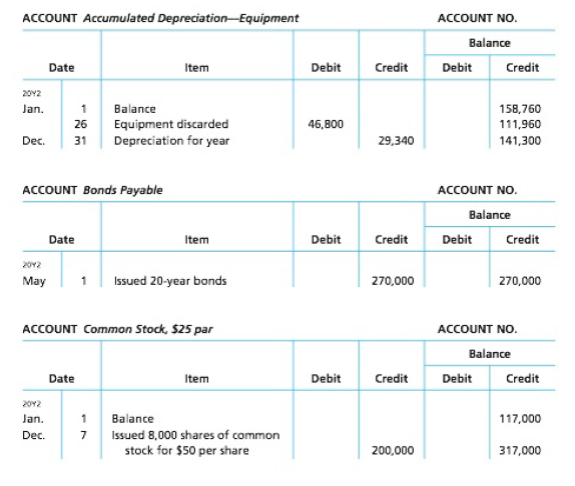

| Bonds payable | 270,000 | 0 |

| Common stock. $25 par | 317,000 | 117,000 |

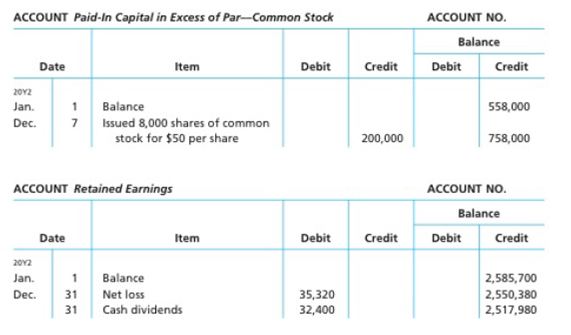

| Paid-in capital: Excess of issue price over par—common stock | 758,000 | 558,000 |

| 2,517,980 | 2,585,700 | |

| Total liabilities and stockholders' equity | $4,785,480 | $4,219,020 |

The noncurrent asset, noncurrent liability, and stockholders' equity accounts for 20Y2 are as follows:

Instructions

Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.

Statement of cash flows: It is one of the financial statement that shows the cash and cash equivalents of a company for a particular period. It determines the net changes in cash through reporting the sources and uses of cash due to the operating, investing, and financing activities of a company.

Indirect method: Under this method, the following amounts are to be adjusted from the Net Income to calculate the net cash provided from operating activities.

Cash flows from operating activities: These are the cash produced by the normal business operations.

The below table shows the way of calculation of cash flows from operating activities:

| Cash flows from operating activities (Indirect method) |

| Add: Decrease in current assets |

| Increase in current liability |

| Depreciation expense and amortization expense |

| Loss on sale of plant assets |

| Deduct: Increase in current assets |

| Decrease in current liabilities |

| Gain on sale of plant assets |

| Net cash provided from or used by operating activities |

Table (1)

Cash flows from investing activities: Cash provided by or used in investing activities is a section of statement of cash flows. It includes the purchase or sale of equipment or land, or marketable securities, which is used for business operations.

The below table shows the way of calculation of cash flows from investing activities:

| Cash flows from investing activities |

| Add: Proceeds from sale of fixed assets |

| Sale of marketable securities / investments |

| Interest received |

| Dividend received |

| Deduct: Purchase of fixed assets/long-lived assets |

| Purchase of marketable securities |

| Net cash provided from or used by investing activities |

Table (2)

Cash flows from financing activities: Cash provided by or used in financing activities is a section of statement of cash flows. It includes raising cash from long-term debt or payment of long-term debt, which is used for business operations.

The below table shows the way of calculation of cash flows from financing activities:

| Cash flows from financing activities |

| Add: Issuance of common stock |

| Proceeds from borrowings |

| Proceeds from issuance of debt |

| Issuance of bonds payable |

| Deduct: Payment of dividend |

| Repayment of debt |

| Interest paid |

| Redemption of debt |

| Repurchase of stock |

| Net cash provided from or used by financing activities |

Table (3)

To Prepare: A statement of cash flows using the indirect method for presenting cash flows from operating activities.

Answer to Problem 16.3APR

| Company W | ||

| Statement of Cash Flows | ||

| For the year ended December 31, 20Y2 | ||

| Details | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Net loss | 35,320 | |

| Adjustments to reconcile net income to net cash flow from operating activities: | ||

| Depreciation expense | 55,620 | |

| Loss on sales of land | 12,600 | |

| Changes in current operating assets and liabilities: | ||

| Increase in accounts receivable | (66,960) | |

| Increase in merchandised inventory | (105,480) | |

| Decrease in prepaid expenses | 5,760 | |

| Decrease in accounts payable | (35,820) | |

| Net cash provided by operating activities | 169,600 | |

| Cash flows from investing activities: | ||

| Cash from land sold | 151,200 | |

| Cash used for acquisition of building | (561,600) | |

| Cash used for purchase of equipment | (104,400) | |

| Net cash used for investing activities | ($514,800) | |

| Cash flows from financing activities: | ||

| Cash received from sale of common stock | 400,000 | |

| Cash received from issuance of bonds payable | 270,000 | |

| Cash used for dividends | (32,400) | |

| Net cash provided by financing activities | $637,600 | |

| Increase (decrease) in cash | ($46,800) | |

| Cash at the beginning of the year | 964,800 | |

| Cash at the end of the year | $918,000 | |

Table (4)

Explanation of Solution

Working note:

Prepare the schedule in the changes of current assets and liabilities.

| Schedule in the Change of Current Assets and Liabilities | ||||

| Details | Amount ($) | Effect on Operating Activities | ||

| Beginning Balance | Ending Balance |

Increase/ (Decrease) | ||

| Accounts receivable | 761,940 | 828,900 | (66,960) | Add |

| Merchandised inventories | 1,162,980 | 1,268,460 | 105,480 | Deduct |

| Prepaid expenses | 35,100 | 5,760 | 29,340 | Deduct |

| Accounts payable | 958,320 | 922,500 | 35,820 | Add |

Table (5)

Calculate the amount of cash received from common stock:

Therefore, the ending cash balance is $918,000.

Want to see more full solutions like this?

Chapter 16 Solutions

Working Papers, Chapters 18-26 for Warren/Reeve/Duchacâs Accounting, 27E

- I am searching for the right answer to this financial accounting question using proper techniques.arrow_forwardPlease help me solve this financial accounting question using the right financial principles.arrow_forwardCan you solve this financial accounting problem with appropriate steps and explanations?arrow_forward

- Can you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardI need assistance with this financial accounting problem using valid financial procedures.arrow_forward

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI need help with this financial accounting question using standard accounting techniques.arrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,