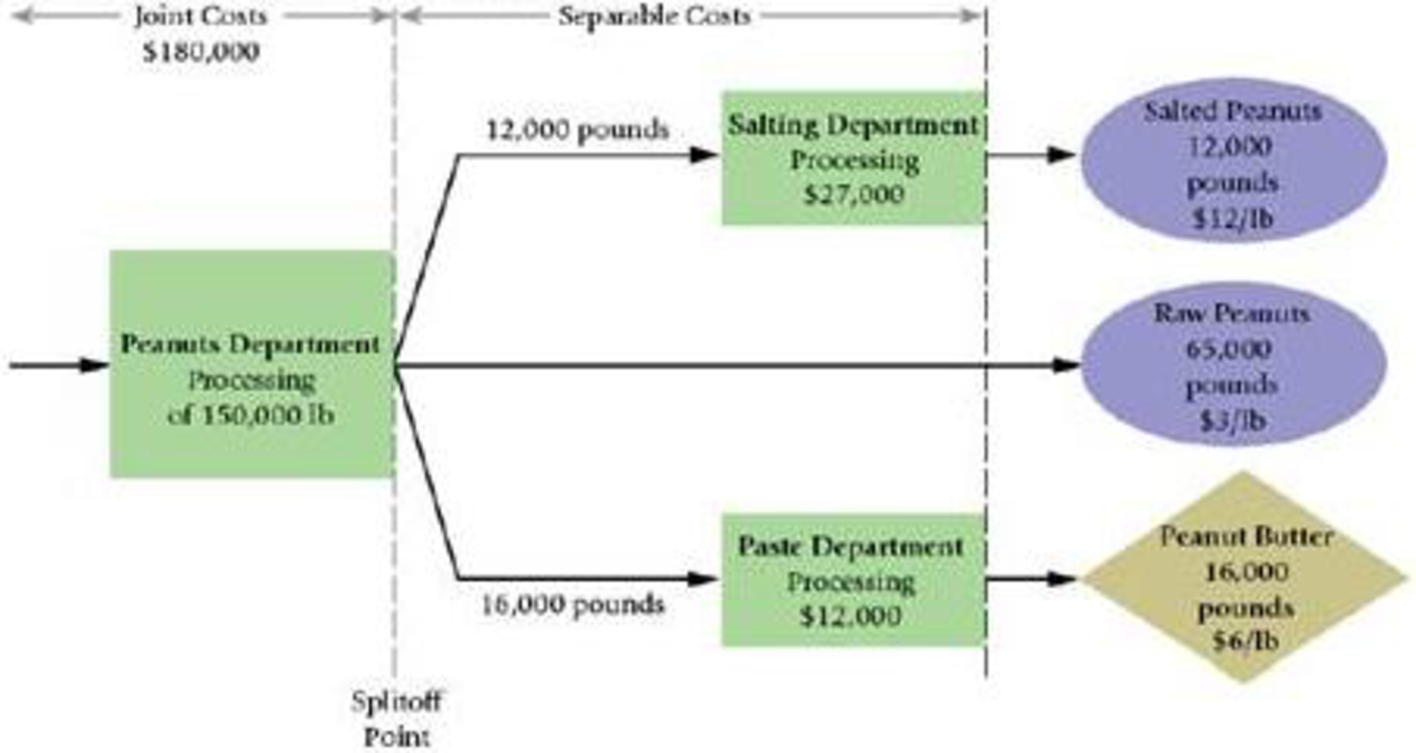

Joint costs and byproducts. (W. Crum adapted) Royston, Inc., is a large food-processing company. It processes 150,000 pounds of peanuts in the peanuts department at a cost of $180,000 to yield 12,000 pounds of product A, 65,000 pounds of product B, and 16,000 pounds of product C.

- Product A is processed further in the salting department at a cost of $27,000. It yields 12,000 pounds of salted peanuts, which are sold for $12 per pound.

- Product B (raw peanuts) is sold without further processing at $3 per pound.

- Product C is considered a byproduct and is processed further in the paste department at a cost of $12,000. It yields 16,000 pounds of peanut butter, which are sold for $6 per pound.

The company wants to make a gross margin of 10% of revenues on product C and needs to allow 20% of revenues for marketing costs on product C. An overview of operations follows:

- 1. Compute unit costs per pound for products A, B, and C, treating C as a byproduct. Use the NRV method for allocating joint costs. Deduct the NRV of the byproduct produced from the joint cost of products A and B.

Required

- 2. Compute unit costs per pound for products A, B, and C, treating all three as joint products and allocating joint costs by the NRV method.

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 16 Solutions

Cost Accounting: A Managerial Emphasis, 15th Edition

Additional Business Textbook Solutions

Managerial Accounting (5th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Horngren's Accounting (12th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Fundamentals of Management (10th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentneedarrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit RevenueCorrectarrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenuecorrectarrow_forward

- GAP Corp. is a calendar year S corporation with three shareholders. George and Anna each own 49 percent of the stock. Peter owns 2 percent of the stock. The corporation was formed on January 2, Year 1, and has been an S corporation since its inception. Using the exhibits, prepare a schedule of GAP's income, gain, loss, and deduction items for Year 2. In column B, enter the amount for federal income tax purposes. In column C, enter the amount included in GAP's Form 1120S ordinary business income (OBI) or loss. In column D, enter the amount included on GAP's Schedule K as a taxable or deductible separately stated item. Each item may have amounts entered in ordinary business income, separately stated items, or both. Enter income and gain amounts as positive numbers. Enter losses and deductions as negative numbers. If the amount is zero, enter a zero (0). A B C D 1 Income, Gain, Loss, and Deduction Items Amount for Federal Income Tax Purposes Ordinary Business Income…arrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenue need helparrow_forwardDennis Green and Peter Olinto are equal partners in Foxy Partnership. Peter is an active general partner. Dennis is a limited partner and is not involved in the operations of the business. Foxy Partnership's Year 2 financial statements are provided in the exhibits. Using the information provided, enter the appropriate amounts to be reported on page 1 of Foxy Partnership's income tax return in the table below. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). A B 1 Gross receipts or sales 2 Cost of goods sold 3 Salaries and wages 4 Guaranteed payments to partners 5 Repairs and maintenance 6 Bad debts 7 Rent 8 Depreciation 9 Other deductions 10 Ordinary business income (loss)arrow_forward

- Dennis Green and Peter Olinto are equal partners in Foxy PartneDennis Green and Peter Olinto are equal partners in Foxy Partnership. Peter is an active general partner. Dennis is a limited partner and is not involved in the operations of the business. Foxy Partnership's Year 2 financial statements are provided in the exhibits. Using the information provided, enter the appropriate amounts to be reported on page 1 of Foxy Partnership's income tax return in the table below. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). 2. Cost of goods sold 3. Salaries and wages 4. Guaranteed payments to partners 5. Repairs and maintenance 6. Bad debts 7. Rent 8. Depreciation 9. Other deductions 10. Ordinary business income (loss)arrow_forwardIf a business pays off a loan, which of the following will occur?A. Assets and liabilities increaseB. Assets and liabilities decreaseC. Only liabilities increaseD. Equity decreasesarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementneedarrow_forward

- No chatgpt! Which financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings StatementNo Aiarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,