Concept explainers

1.

Prepare a statement of

1.

Explanation of Solution

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Indirect method: Under indirect method, net income is reported first, and then non-cash expenses, losses from fixed assets, and changes in opening balances and ending balances of current assets are adjusted to reconcile the net income balance.

Prepare a statement of cash flows of Incorporation I for the year ended June 30, 2019 under indirect method.

| Incorporation I | ||

| Statement of cash flows – Indirect method | ||

| For the year ended June 30, 2019 | ||

| Particulars | Amount | Amount |

| Cash flow from operating activities: | ||

| Net Income | $99,510 | |

| Adjustment to reconcile net income to net cash provided by operating activities: | ||

| Income statement items not affecting cash: | ||

| Add: | $58,600 | |

| Less: Gain on sale of equipment | ($2,000) | |

| Changes in current assets and liabilities (Refer Table (2)) | ||

| Add: Decrease in inventory | $22,700 | |

| Add: Decrease in prepaid expense | $1,000 | |

| Less: Increase in accounts receivable | ($14,000) | |

| Less: Decrease in accounts payable | ($5,000) | |

| Less: Decrease in wages payable | ($9,000) | |

| Less: Decrease in income taxes payable | ($400) | |

| Net cash provided by operating activities | $151,410 | |

| Cash flow from investing activities: | ||

| Cash proceeds from sale of equipment (Refer Table (3)) | $10,000 | |

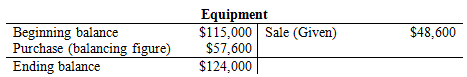

| Less: Cash paid for acquiring new equipment (2) | ($57,600) | |

| Net cash used in investing activities | ($47,600) | |

| Cash flow from financing activities: | ||

| Issuance of common stock | $60,000 | |

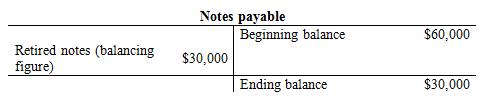

| Less: Cash paid for retired notes (3) | ($30,000) | |

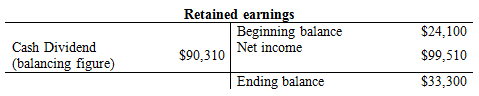

| Less: Payments of cash dividends (4) | ($90,310) | |

| Net cash used in financing activities | ($60,310) | |

| Net increase in cash | $43,500 | |

| Cash balance at the beginning | $44,000 | |

| Cash balance at the end | $87,500 | |

Table (1)

Working Note:

1. Determine the changes in current assets and Liabilities.

| Schedule in the changes of assets and liabilities | |||

| Particulars | Amount | ||

|

Current year (June 30, 2019) |

Previous year (June 30, 2018) | Increase/(Decrease) | |

| Accounts receivable | $65,000 | $51,000 | $14,000 |

| Inventory | $63,800 | $86,500 | ($22,700) |

| Prepaid expenses | $4,400 | $5,400 | ($1,000) |

| Accounts payable | $25,000 | $30,000 | ($5,000) |

| Wages payable | $6,000 | $15,000 | ($9,000) |

| Income taxes payable | $3,400 | $3,800 | ($400) |

Table (2)

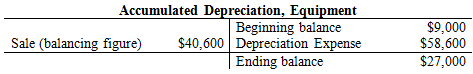

2. Determine the cash proceeds from the sale of equipment.

Compute the

…… (1)

Now, determine the cash proceeds from the sale of equipment.

| Cash proceeds from the sale of equipment | |

| Cost of equipment sold | $48,600 |

| Less: Accumulated depreciation of equipment sold (1) | ($40,600) |

| Book value of equipment sold | $8,000 |

| Add: Gain on sale of equipment (Given) | $2,000 |

| Cash proceeds from sale of equipment | $10,000 |

Table (3)

3. Determine the cash paid for acquiring new equipment.

…… (2)

4. Determine the cash paid for retired notes

…… (3)

5. Determine the cash dividends paid during the year.

…… (4)

2.

Compute the cash flow to total assets ratio of Incorporation I for its fiscal year 2019.

2.

Explanation of Solution

Cash flow to total assets ratio: Cash flow to total assets ratio is used to measure the actual

Compute the cash flow to total assets ratio of Incorporation I for its fiscal year 2019.

| Ratios | 2019 |

| Beginning total assets June 30, 2018 (A) | $292,900 |

| Ending total assets June 30, 2019 (B) | $317,700 |

| Average total assets (C) | $305,300 |

| Operating cash flows (D) | $151,410 |

| Cash flow to total assets | 49.6% |

Table (4)

Therefore, the cash flow to total assets ratio of Incorporation I for its fiscal year 2019 is 49.6%.

Want to see more full solutions like this?

Chapter 16 Solutions

Principles of Financial Accounting.

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardIf the average age of inventory is 80 days, the average age of accounts payable is 55 days, and the average age of accounts receivable is 70 days, the number of days in the cash flow cycle is__.arrow_forwardAnswerarrow_forward

- Can you help me solve this financial accounting question using the correct financial procedures?arrow_forwardWhat is the direct labor time variance?arrow_forwardSunset Crafts Company sells handmade scarves for $28.50 per scarf. In FY 2023, total fixed costs are expected to be $185,000, and variable costs are estimated at $19.75 a unit. Sunset Crafts Company wants to have an FY 2023 operating income of $92,000. Use this information to determine the number of units of scarves that Sunset Crafts Company must sell in FY 2023 to meet this goal. (Don't round-up unit calculation)arrow_forward

- Please explain the correct approach for solving this general accounting question.arrow_forwardQuestion: 22 - Hader company has actual sales of $82,000 in April and $63,000 in May. It expects sales of $78,000 in June and $92,000 in July and in August. Assuming that sales are the only source of cash inflows and that half of them are for cash and the remainder are collected evenly over the following 2 months, what are the firm's expected cash receipts for June, July, and August?arrow_forwardCalculate the sales revenue to achieve a target profit of 375000arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning