Concept explainers

1.

Prepare a statement of

1.

Explanation of Solution

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Indirect method: Under indirect method, net income is reported first, and then non-cash expenses, losses from fixed assets, and changes in opening balances and ending balances of current assets are adjusted to reconcile the net income balance.

Prepare a statement of cash flows of Incorporation I for the year ended June 30, 2019 under indirect method.

| Incorporation I | ||

| Statement of cash flows – Indirect method | ||

| For the year ended June 30, 2019 | ||

| Particulars | Amount | Amount |

| Cash flow from operating activities: | ||

| Net Income | $99,510 | |

| Adjustment to reconcile net income to net cash provided by operating activities: | ||

| Income statement items not affecting cash: | ||

| Add: | $58,600 | |

| Less: Gain on sale of equipment | ($2,000) | |

| Changes in current assets and liabilities (Refer Table (2)) | ||

| Add: Decrease in inventory | $22,700 | |

| Add: Decrease in prepaid expense | $1,000 | |

| Less: Increase in accounts receivable | ($14,000) | |

| Less: Decrease in accounts payable | ($5,000) | |

| Less: Decrease in wages payable | ($9,000) | |

| Less: Decrease in income taxes payable | ($400) | |

| Net cash provided by operating activities | $151,410 | |

| Cash flow from investing activities: | ||

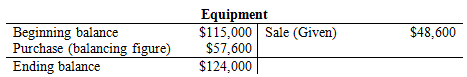

| Cash proceeds from sale of equipment (Refer Table (3)) | $10,000 | |

| Less: Cash paid for acquiring new equipment (2) | ($57,600) | |

| Net cash used in investing activities | ($47,600) | |

| Cash flow from financing activities: | ||

| Issuance of common stock | $60,000 | |

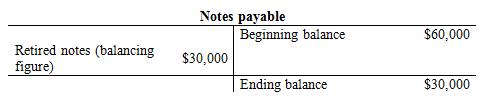

| Less: Cash paid for retired notes (3) | ($30,000) | |

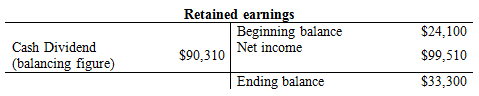

| Less: Payments of cash dividends (4) | ($90,310) | |

| Net cash used in financing activities | ($60,310) | |

| Net increase in cash | $43,500 | |

| Cash balance at the beginning | $44,000 | |

| Cash balance at the end | $87,500 | |

Table (1)

Working Note:

1. Determine the changes in current assets and Liabilities.

| Schedule in the changes of assets and liabilities | |||

| Particulars | Amount | ||

|

Current year (June 30, 2019) |

Previous year (June 30, 2018) | Increase/(Decrease) | |

| Accounts receivable | $65,000 | $51,000 | $14,000 |

| Inventory | $63,800 | $86,500 | ($22,700) |

| Prepaid expenses | $4,400 | $5,400 | ($1,000) |

| Accounts payable | $25,000 | $30,000 | ($5,000) |

| Wages payable | $6,000 | $15,000 | ($9,000) |

| Income taxes payable | $3,400 | $3,800 | ($400) |

Table (2)

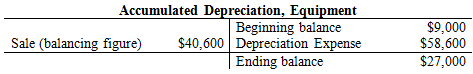

2. Determine the cash proceeds from the sale of equipment.

Compute the

…… (1)

Now, determine the cash proceeds from the sale of equipment.

| Cash proceeds from the sale of equipment | |

| Cost of equipment sold | $48,600 |

| Less: Accumulated depreciation of equipment sold (1) | ($40,600) |

| Book value of equipment sold | $8,000 |

| Add: Gain on sale of equipment (Given) | $2,000 |

| Cash proceeds from sale of equipment | $10,000 |

Table (3)

3. Determine the cash paid for acquiring new equipment.

…… (2)

4. Determine the cash paid for retired notes

…… (3)

5. Determine the cash dividends paid during the year.

…… (4)

2.

Compute the cash flow to total assets ratio of Incorporation I for its fiscal year 2019.

2.

Explanation of Solution

Cash flow to total assets ratio: Cash flow to total assets ratio is used to measure the actual

Compute the cash flow to total assets ratio of Incorporation I for its fiscal year 2019.

| Ratios | 2019 |

| Beginning total assets June 30, 2018 (A) | $292,900 |

| Ending total assets June 30, 2019 (B) | $317,700 |

| Average total assets (C) | $305,300 |

| Operating cash flows (D) | $151,410 |

| Cash flow to total assets | 49.6% |

Table (4)

Therefore, the cash flow to total assets ratio of Incorporation I for its fiscal year 2019 is 49.6%.

Want to see more full solutions like this?

Chapter 16 Solutions

Principles of Financial Accounting.

- A delivery van cost $64,300 when purchased and has a $58,700 balance in the accumulated depreciation account. If the van is discarded, Tread line Logistics will record: (1) Loss on disposal, $5,600 (2) Gain on disposal, $2,000 (3) No gain or loss because it was discarded (4) Loss of $58,700arrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardAccurate Value Hardware began in 2019 with a credit balance of $47,000 in the allowance for sales returns account. Sales and cash collections from customers during the year were $663,000 and $615,000, respectively. Accurate Value estimates that 7.2% of all sales will be returned. In 2019, customers returned merchandise for a credit of $36,000 to their accounts. Accurate Value's 2019 income statement would report net sales of__.arrow_forward

- What is the ending total asset balance?arrow_forwardHow much was the equity of Aurum Resources Ltd worth ??arrow_forwardRaytheon Ltd. bought furniture for $10,000 and paid an additional $500 for delivery and $300 for installation. The company also spent $200 on repairs after purchase. Calculate the capitalized cost of the furniture.arrow_forward

- Banksy Corp uses predetermined overhead rates based on labor hours. The monthly budgeted overhead is $360,000 and the budgeted labor hours were 60,000. During the month the company worked a total of 50,000 labor hours and actual overheads totaled $280,000. The overhead at the end of the month would therefore be $___?arrow_forwardPlease provide correct solution and accounting questionarrow_forwardWhat is the largest possible total contribution margin that can be realized each period?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning