Concept explainers

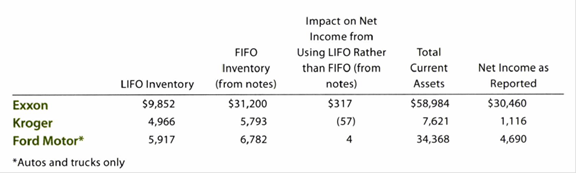

Under U.S. GAAP, LIFO is an acceptable inventory method. Financial statement information for three companies that use LIFO follows. All table numbers are in millions of dollars.

Assume these companies adopted IFRS, and thus were required to use FIFO, rather than LIFO.

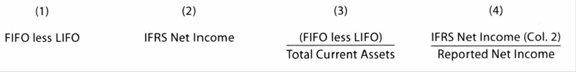

a. Prepare a table with the following columns:

(1) Difference between FIFO and LIFO

(2) Revised IFRS net income using FIFO.

(3) Difference between FIFO and LIFO inventory valuation as a percent of total current assets.

(4) Revised IFRS net income as a percent of the reported net income.

b. Complete the table for the three companies.

c. For which company would a change to IFRS for inventory valuation have the largest percentage impact on total current assets (Col. 3)?

d. For which company would a change to IFRS for inventory valuation have the largest percentage impact on net income (Col. 4)?

e. Why might Kroger have a negative impact on net income from using LIFO, while the other two companies have a positive impact on net income from using LIFO?

(a)

International Financial Reporting Standards (IFRS): IFRS are a set of international accounting standards which are framed, approved, and published by International Accounting Standards Board (IASB) for the preparation and disclosure of international financial reports.

Generally Accepted Accounting Principles (GAAP): These are the guidelines necessary to create accounting principles for the implementation of financial information reporting in the Country U.

First-in-First-Out(FIFO): In this method, items purchased initially are sold first. So, the value of the ending inventory consists the recent cost for the remaining unsold items.

Last-in-First-Out(LIFO): In this method, items purchased recently are sold first. So, the value of the ending inventory consists the initial cost for the remaining unsold items.

To draft: A table with the columns given in the problem

Explanation of Solution

Table is prepared as follows (amounts in millions of dollars):

| FIFO less LIFO | IFRS Net Income | |||

| Company E | ||||

| Company K | ||||

| Company F |

Table (1)

(b)

To complete: The table prepared in Part (a)

Explanation of Solution

Complete the table as follows (amounts in millions of dollars):

| FIFO less LIFO | IFRS Net Income | |||

| Company E | $21,348 | $30,143 | ||

| Company K | 827 | 1,173 | ||

| Company F | 865 | 4,686 |

Table (2)

Working Notes:

Compute FIFO less LIFO (amounts in millions of dollars).

| FIFO | LIFO | FIFO less LIFO | |

| Company E | $31,200 | $9,852 | $21,348 |

| Company K | 5,793 | 4,966 | 827 |

| Company F | 6,782 | 5,917 | 865 |

Table (3)

Deduct the LIFO value from FIFO value to get FIFO less LIFO.

Compute IFRS net income (amounts in millions of dollars).

| Net Income as Reported | Impact on Net Income From Using LIFO Rather Than FIFO | IFRS Net Income | |

| Company E | $30,460 | $317 | $30,143 |

| Company K | 1,116 | (57) | 1,173 |

| Company F | 4,690 | 4 | 4,686 |

Table (4)

Deduct the impact on net income value from net income reported value to get IFRS net income.

Compute FIFO less LIFO divided by total current assets (amounts in millions of dollars).

| FIFO less LIFO | Total Current Assets | ||

| Company E | $21,348 | $58,984 | 36% |

| Company K | 827 | 7,621 | 11% |

| Company F | 865 | 34,368 | 3% |

Table (5)

Divide FIFO less LIFO value by total current assets value to get the value in last column. Refer to Table (3) for value and computation of FIFO less LIFO value.

Compute IFRS net come divided by reported net income(amounts in millions of dollars).

| IFRS Net Income | Net Income as Reported | ||

| Company E | $30,143 | $30,460 | 99% |

| Company K | 1,173 | 1,116 | 105% |

| Company F | 4,686 | 4,690 | 100% |

Table (6)

Divide IFRS net income value by reported net income value to get the value in last column. Refer to Table (4) for value and computation of IFRS net income value.

(c)

To indicate: The company which would have the highest impact on total current assets due to change in inventory valuation method, if the company uses IFRS instead of GAAP

Answer to Problem 3IFRS

If the inventory valuation method is changed to reflect the use of IFRS, Company E would have greatest impact on total current assets.

Explanation of Solution

Refer to Table (5) for value and computation of impact of change in inventory valuation method on total current assets.

(d)

To indicate: The company which would have the highest impact on net income due to change in inventory valuation method, if the company uses IFRS instead of GAAP

Answer to Problem 3IFRS

If the inventory valuation method is changed to reflect the use of IFRS, Company K would have greatest impact on net income.

Explanation of Solution

Refer to Table (6) for value and computation of impact of change in inventory valuation method on net income.

(e)

To discuss: The reasons for negative impact on net income if LIFO is used rather than FIFO

Explanation of Solution

During inflation, the inventory purchased last will have higher price than the inventory purchased first. Thus, under LIFO method, the inventory purchased last with higher price will be sold first, thereby increasing the cost of goods sold. Increase in cost of goods sold decreases the net income.

Want to see more full solutions like this?

Chapter 15FSI Solutions

Bundle: Accounting, Chapters 1-13, 26th + Working Papers, Chapters 1-17 For Warren/reeve/duchac's Accounting, 26th And Financial Accounting, 14th + ... For Warren/reeve/duchac's Accounting, 26th

- Solve clearly with correct dataarrow_forwardPROBLEM E Mulles, the owner of a successful fertilizer business, felt that it is time to expand operations. Mulles offered to form a partnership with Lucena, the owner of a nearby warehouse. The partnership would be called Mulles & Lucena Storage and Sales. Lucena accepted Mulles' offer and the partnership was formed on July 1,2024. Presented below is the trial balance for Mulles Fertilizer Supply on June 30, 2024: Cash Accounts Receivable Allowance for Uncollectible Accounts. Inventory Prepaid Rent Store Equipment Accumulated Depreciation Notes Payable Accounts Payable Mulles, Capital Total P 229,500 2,103,000 P 117,000 1,012,500 29,250 390,000 P3,764,250 97,500 330,000 505,500 2,714,250 P3,764,250 The partners agreed to share profits and losses equally and decided to invest an equal amount in the partnership. Lucena and Mulles agreed that Lucena's land is worth P500,000 and his building P1,450,000. Lucena is to contribute cash in an amount sufficient to make his capital account…arrow_forwardPLEASE HELP. ALL RED CELLS ARE INCORRECT. NOTICE, REVENUE ACCOUNTS ARE IN THE DROPDOWN!arrow_forward

- Journalize these transactions, also post the transcations to T-accounts and determine month-end balances. Finally prepare a trail balance.arrow_forwardSuppose during 2023, BlueStar Shipping reported the following financial information (in millions): Net Sales: $40,000 Net Income: $150 Total Assets at Beginning of Year: $26,000 • Total Assets at End of Year: $24,800 Calculate the following: (a) Asset Turnover (b) Return on Assets (ROA) as a percentagearrow_forwardPlease fill all cells! I need helparrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning