MANAGERIAL ACCT. LL-W/CONNECT >CUSTOM<

17th Edition

ISBN: 9781266576690

Author: Garrison

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15.A, Problem 2E

EXERCISE 14A-2 Net Cash Provided by Operating Activities LO14-4

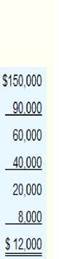

Wiley Company’s income statement for Year 2 follows:

The company’s selling and administrative expense for Year 2 includes $7,500 of

Required:

- Using the direct method, convert the company’s income statement to a cash basis.

- Assume that during Year 2 Wiley had a $9,000 gain on sale of investments and a $3,000 loss on the sale of equipment. Explain how these two transactions would affect your computations in (1) above.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need financial accounting question answer

Accounting?

Subject- general accounting

Chapter 15 Solutions

MANAGERIAL ACCT. LL-W/CONNECT >CUSTOM<

Ch. 15.A - Prob. 1ECh. 15.A - EXERCISE 14A-2 Net Cash Provided by Operating...Ch. 15.A - Prob. 3ECh. 15.A - Prob. 4ECh. 15.A -

PROBLEM 14A-5 Prepare and Interpret a Statement...Ch. 15.A - Prob. 6PCh. 15.A - PROBLEM 14A-7 Prepare and Interpret a Statement of...Ch. 15 - Prob. 1QCh. 15 - Prob. 2QCh. 15 - Prob. 3Q

Ch. 15 - Prob. 4QCh. 15 - Prob. 5QCh. 15 - Prob. 6QCh. 15 - Prob. 7QCh. 15 - Prob. 8QCh. 15 - Prob. 9QCh. 15 -

14-10 If the Accounts Receivable balance...Ch. 15 - Prob. 11QCh. 15 - Prob. 12QCh. 15 - Prob. 1F15Ch. 15 - Ravenna Company is a merchandiser that uses the...Ch. 15 - Prob. 3F15Ch. 15 - Prob. 4F15Ch. 15 - Prob. 5F15Ch. 15 - Prob. 6F15Ch. 15 - Ravenna Company is a merchandiser that uses the...Ch. 15 - Prob. 8F15Ch. 15 - Prob. 9F15Ch. 15 - Prob. 10F15Ch. 15 - Prob. 11F15Ch. 15 - Prob. 12F15Ch. 15 - Prob. 13F15Ch. 15 - Prob. 14F15Ch. 15 - Prob. 15F15Ch. 15 - Prob. 1ECh. 15 - EXERCISE 14-2 Net Cash Provided by Operating...Ch. 15 - Prob. 3ECh. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - Prob. 6ECh. 15 - Prob. 7PCh. 15 - Prob. 8PCh. 15 - Prob. 9PCh. 15 - Prob. 10PCh. 15 - Prob. 11PCh. 15 - Prob. 12PCh. 15 - Prob. 13PCh. 15 - Prob. 14P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forwardPlease provide the accurate solution to this financial accounting question using valid calculations.arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forward

- Please provide the correct solution to this financial accounting question using valid principles.arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License