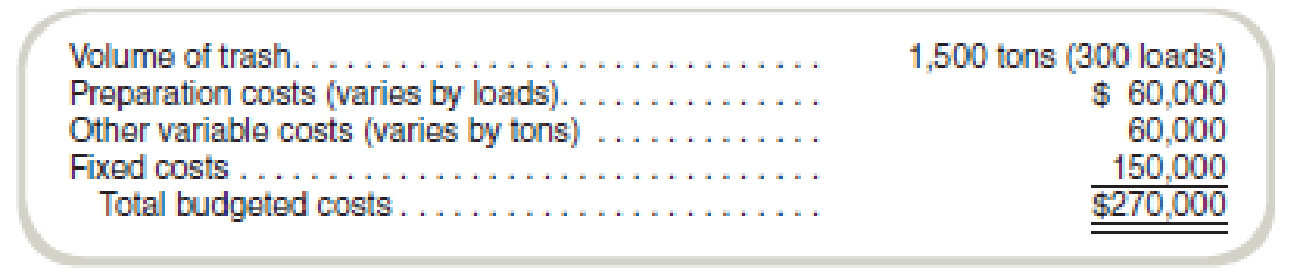

Mathes Corporation manufactures paper products. The company operates a landfill, which it uses to dispose of nonhazardous trash. The trash is hauled from the two nearby manufacturing facilities in trucks that can carry up to five tons of trash in a load. The landfill operation requires certain preparation activities regardless of the amount of trash in a truck (i.e., for each load). The budget for the landfill for next year follows:

Mathes is considering making the landfill a profit center and charging the manufacturing plants for disposal of the trash. The landfill has sufficient capacity to operate for at least the next 20 years. Other landfills are available in the area (both private and municipal), and each plant would be free to decide which landfill to use.

Required

- a. What transfer pricing rule should Mathes implement at the landfill so that its plant managers would independently make decisions regarding landfill use that would be in the company’s best interests?

- b. Illustrate your rule by computing the transfer price that would be applied to a four-ton load of trash from one of the plants.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Fundamentals of Cost Accounting

- Please need answer the general accounting questionarrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forwardMeena manufacturing company has budgeted overhead costs of $750,000 and expected machine hours of 25,000. During the period, actual overhead costs were $765,000 and actual machine hours were 24,000. Calculate the amount of over or underapplied overhead.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning