Judgment Case 2: Impact of Judgment in Accounting for Stock Dividends

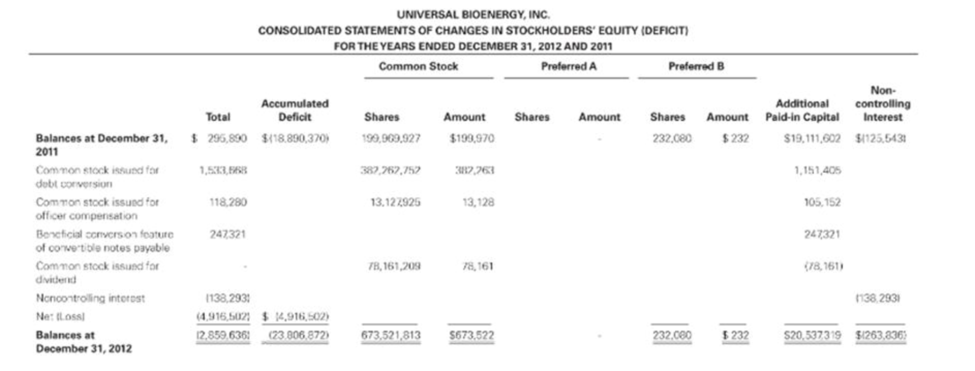

On June 6, 2012. Universal Bioenergy, Inc. declared a 20% stock dividend. Because it is a 20% dividend, it had the flexibility to account for this as a small or large stock dividend. Its common stock was trading at $0.01 per share at that time. Excerpts from its 10-K follow the questions.

- 1. What

journal entry did Universal Bioenergy record on June 6? What journal entry did it record on July 20? Did Universal Bioenergy account for this stock dividend as a small or large stock dividend? You may find ASC 505-20-30-5 helpful in understanding this entity’s approach. - 2. What would be the impact on the accounts if Universal Bioenergy did not use the alternative treatment permitted for closely held entities?

- 3. What would be the impact on the accounts if Universal Bioenergy did not use the alternative treatment permitted for closely held entities and chose a different basic treatment? That is, if the company recorded it as a small stock dividend, how would the accounts change?

Discussion of the stock dividend included in ITEM 1 in the 10-K

Approval of Stock Dividend

Universal Bioenergy uses the phrase “10 for 2 basis” in its financial statements when describing the stock dividend —that is, the company issued 2 shares for every 10 shares held.

On June 6, 2012, our Board of Directors passed a resolution and declared a stock dividend to distribute to all registered shareholders of record on or before July 13, 2012, on a 10 for 2 basis. On July 20, 2012, our transfer agent issued 78,161,209 shares of common stock to all registered shareholders of record in accordance with the resolution and declaration.

Excerpts from financial statements

| UNIVERSAL BIOENERGY, INC. CONSOLIDATED |

||

| Assets: | December 31, 2012 | December 31, 2011 |

| Current Assets: | ||

| Cash | $ 2,274 | $ 3,706 |

| 4,800,967 | 10,004,123 | |

| Other loans | 600 | — |

| Total current assets | 4,803,841 | 10,007829 |

| Property and Equipment - net | 6,989 | 8,951 |

| UNIVERSAL BIOENERGY, INC. CONSOLIDATED BALANCE SHEETS | |||||

| Assets: | December 31, 2012 |

December 31, 2011 | |||

| Other Assets: Accounts receivable - other |

10,050 | 10,050 | |||

| Investments | 2,919,500 | 889,500 | |||

| Intangible assets | 250,000 | 250,000 | |||

| Deposit | 7,453 | 46,516 | |||

| Total other assets | 3,187,7003 | 1,196,066 | |||

| Total Assets | $7,997,833 | $11,212,846 | |||

| Liabilities and Stockholder’s Equity (Deficit): | |||||

| Current Liabilities | |||||

| Accounts payable | $ 4,983,318 | $ 10,099,502 | |||

| Other accounts payable and accrued expenses | 185,422 | 208,848 | |||

| Accrued interest payable | 468,572 | 101,860 | |||

| Line of credit | 7,942 | 7,850 | |||

| Current portion of long-term debt | 248,395 | 172,560 | |||

| Derivative liability | 350,237 | – | |||

| Advances from affiliates | 4,250 | 4,250 | |||

| Total current liabilities | 6.248,136 | 10,594,870 | |||

| Long-term Debt | |||||

| Notes payable | $ 2,261,406 | $ 131,086 | |||

| Notes payable- related parties | 934,729 | 191,000 | |||

| Total Long-term Debt | 3,196,135 | 322,086 | |||

| Total Liabilities | 9,444,270 | 10,916,956 | |||

| Preferred stock. $.001 par value. 10,000,000 shares authorized. Preferred stock Series A, zero issued and outstanding shares | – | – | |||

| December 31. 2012 and December 31. 2011, respectively | |||||

| Preferred stock Series B, 232,080 issued and outstanding shares December 31, 2012 and December 31, 2011, respectively | 232 | 232 | |||

| Common stock. $.001 par value. 3,000,000.000 shares authorized; 673,521,813 and 199,969,927 issued and outstanding as of December 31, 2012 and December 31, 2011, respectively | 673,522 | 199.970 | |||

| Additional paid-in capital | 20,546,023 | 19,111,601 | |||

| Noncontrolling interest | (263,836) | (125,543) | |||

| Accumulated deficit | (22,402,379) | (18,890,370) | |||

| Total stockholders’ equity (deficit) | (1,466,438) | 295,890 | |||

| Total Liabilities and Stockholders’ Equity | $ 7,997,832 | $ 11,212,846 | |||

Excerpt from the notes to the financial statements follow:

NOTE 4 Equity

On December 26, 2012, the Company amended its Articles of Incorporation, and increased the authorized shares of common stock from 1,000,000,000 to 3,000,000,000 shares at $. 001 par value. There are 673,521,813 shares of common stock issued and outstanding as of December 30, 2012.

On June 6, 2012, our Board of Directors passed a resolution and declared a stock dividend to distribute to all registered shareholders of record on, or before, July 13, 2012, on a 10 for 2 basis. On July 20, 2012, our transfer agent issued 78,161,209 shares of common stock to all registered shareholders of record in accordance with the resolution and declaration.

The Company has authorized a total of 10,000,000

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Intermediate Accounting (2nd Edition)

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning