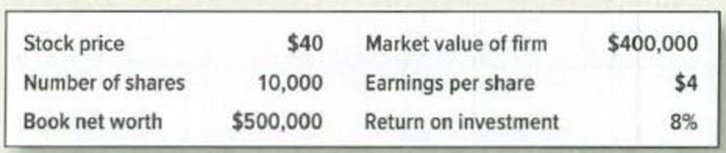

Dilution Here is recent financial data on Pisa Construction Inc.

Pisa has not performed spectacularly to date. However, it wishes to issue new shares to obtain $80,000 to finance expansion into a promising market. Pisa’s financial advisers think a stock issue is a poor choice because, among other reasons, “sale of stock at a price below book value per share can only depress the stock price and decrease shareholders’ wealth.” To prove the point they construct the following example: “Suppose 2,000 new shares are issued at $40 and the proceeds are invested. (Neglect issue costs.) Suppose

Thus, EPS declines, book value per share declines, and share price will decline proportionately to $38.70.”

Evaluate this argument with particular attention to the assumptions implicit in the numerical example.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Principles of Corporate Finance

- Can you explain the concept of net present value (NPV) and how it is used in investment decisions?i need answerarrow_forwardCan you explain the concept of net present value (NPV) and how it is used in investment decisions? need explarrow_forwardCan you explain the concept of net present value (NPV) and how it is used in investment decisions?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT