Advanced Accounting

14th Edition

ISBN: 9781260247824

Author: Joe Ben Hoyle, Thomas F. Schaefer, Timothy S. Doupnik

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 27P

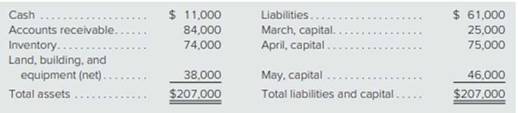

March, April, and May have been in

Prepare

- a. Sold all inventory for $56,000 cash.

- b. Paid $7,500 in liquidation expenses.

- c. Paid $40,000 of the partnership’s liabilities.

- d. Collected $45,000 of the

accounts receivable . - e. Distributed safe cash balances: the partners anticipate no further liquidation expenses.

- f. Sold remaining accounts receivable for 30 percent of face value.

- g. Sold land, building, and equipment for $17,000.

- h. Paid all remaining liabilities of the partnership.

- i. Distributed cash held by the business to the partners.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hello, can u give correct answer

What was the cost of goods manufactured?

Can you explain this general accounting question using accurate calculation methods?

Chapter 15 Solutions

Advanced Accounting

Ch. 15 - Prob. 1QCh. 15 - Prob. 2QCh. 15 - Prob. 3QCh. 15 - Prob. 4QCh. 15 - What is the purpose of a statement of liquidation?...Ch. 15 - Prob. 1PCh. 15 - Prob. 2PCh. 15 - Prob. 3PCh. 15 - Prob. 4PCh. 15 - A partnership is considering possible liquidation...

Ch. 15 - What is a predistribution plan? a. A list of the...Ch. 15 - Prob. 7PCh. 15 - Prob. 8PCh. 15 - Prob. 9PCh. 15 - Prob. 10PCh. 15 - Prob. 11PCh. 15 - Prob. 12PCh. 15 - Prob. 13PCh. 15 - Prob. 14PCh. 15 - Prob. 15PCh. 15 - Prob. 16PCh. 15 - Prob. 17PCh. 15 - Prob. 18PCh. 15 - Prob. 25PCh. 15 - Prob. 26PCh. 15 - March, April, and May have been in partnership for...Ch. 15 - Prob. 28PCh. 15 - Prob. 29P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need guidance with this financial accounting problem using the right financial principles.arrow_forwardCan you explain the process for solving this financial accounting problem using valid standards?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- Direct labour cost variance: Northstar Manufacturing produces metal components. It takes 3 hours of direct labor to produce a component. Northstar's standard labor cost is $15 per hour. During August, Northstar produced 8,000 components and used 25,200 hours of direct labor at a total cost of $365,400. What is Northstar's labor rate variance for August?arrow_forwardHow much was Kaiser's net salesarrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License