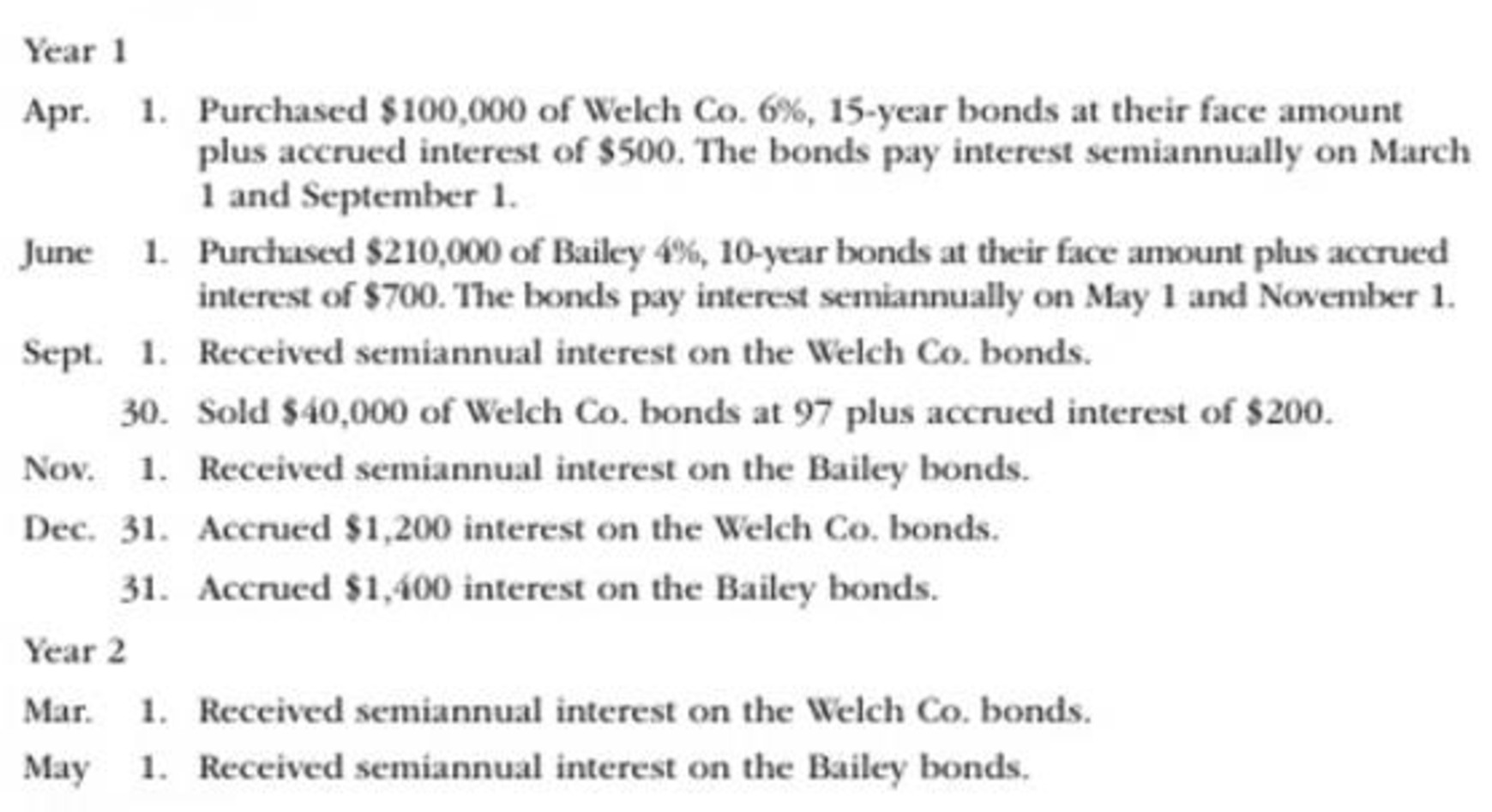

Soto Industries Inc. is an athletic footware company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Soto Industries Inc., which has a fiscal year ending on December 31:

Instructions

- 1.

Journalize the entries to record these transactions. - 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?

(1)

Journalize the bond investment transactions in the books of Company G.

Explanation of Solution

Bond investment: Bond investments are debt securities which pay a fixed interest revenue to the investor.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entry for purchase of $100,000 bonds of Company W, at face amount with an accrued interest of $500.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| April | 1 | Investments–Company W Bonds | 100,000 | ||

| Interest Receivable | 500 | ||||

| Cash | 100,500 | ||||

| (To record purchase of Company W bonds for cash) | |||||

Table (1)

- Investments–Company W Bonds is an asset account. Since bonds investments are purchased, asset value increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received has increased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Prepare journal entry for purchase of $210,000 bonds of Company B, at face amount with an accrued interest of $700.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| June | 1 | Investments–Company B Bonds | 210,000 | ||

| Interest Receivable | 700 | ||||

| Cash | 210,700 | ||||

| (To record purchase of Company B bonds for cash) | |||||

Table (2)

- Investments–Company B Bonds is an asset account. Since bonds investments are purchased, asset value increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received has increased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Prepare journal entry to record the interest revenue received from Company W bonds.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| September | 1 | Cash | 3,000 | ||

| Interest Receivable | 500 | ||||

| Interest Revenue | 2,500 | ||||

| (To record receipt of interest revenue) | |||||

Table (3)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received is received, asset value decreased, and a decrease in asset is credited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of interest received from Company W.

Prepare journal entry for $40,000 bonds of Company W sold at 97%, with an accrued interest of $200.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| September | 30 | Cash | 39,000 | ||

| Loss on Sale of Investments | 1,200 | ||||

| Interest Revenue | 200 | ||||

| Investments–Company W Bonds | 40,000 | ||||

| (To record sale of M City bonds) | |||||

Table (3)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Loss on Sale of Investments is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

- Investments–Company W Bonds is an asset account. Since bond investments are sold, asset value decreased, and a decrease in asset is credited.

Working Notes:

Calculate the cash received from the sale of bonds.

| Particulars | Amount ($) |

| Cash proceeds from sale of $40,000 bonds | 38,800 |

| Add: Accrued interest revenue | 200 |

| Cash received | $39,000 |

Table (4)

Calculate the realized gain (loss) on sale of $40,000 bonds.

| Particulars | Amount ($) |

| Cash proceeds from sale of $40,000 bonds | 38,800 |

| Cost of bonds sold | (40,000) |

| Gain (loss) on sale of bonds | $(1,200) |

Table (5)

Prepare journal entry to record the interest revenue received from Company B bonds.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| November | 1 | Cash | 4,200 | ||

| Interest Receivable | 700 | ||||

| Interest Revenue | 3,500 | ||||

| (To record receipt of interest revenue) | |||||

Table (6)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received is received, asset value decreased, and a decrease in asset is credited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of interest received from Company B.

Prepare journal entry for accrued interest.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| December | 31 | Interest Receivable | 1,200 | ||

| Interest Revenue | 1,200 | ||||

| (To record interest accrued) | |||||

Table (7)

- Interest Receivable is an asset account. Since interest to be received has increased, asset value increased, and an increase in asset is debited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Prepare journal entry for accrued interest.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| December | 31 | Interest Receivable | 1,400 | ||

| Interest Revenue | 1,400 | ||||

| (To record interest accrued) | |||||

Table (8)

- Interest Receivable is an asset account. Since interest to be received has increased, asset value increased, and an increase in asset is debited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Prepare journal entry to record the interest revenue received from Company W bonds.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 2 | |||||

| May | 1 | Cash | 1,800 | ||

| Interest Receivable | 1,200 | ||||

| Interest Revenue | 600 | ||||

| (To record receipt of interest revenue) | |||||

Table (9)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received is received, asset value decreased, and a decrease in asset is credited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of interest received from Company W.

Prepare journal entry to record the interest revenue received from Company B bonds.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 2 | |||||

| May | 1 | Cash | 4,200 | ||

| Interest Receivable | 1,400 | ||||

| Interest Revenue | 1,800 | ||||

| (To record receipt of interest revenue) | |||||

Table (10)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received is received, asset value decreased, and a decrease in asset is credited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of interest received from Company B.

(2)

Explain the impact of bonds, if the portfolio is classified as available-for-sale investment.

Explanation of Solution

Available-for-sale investments are reported at fair value. If the bond portfolio is classified as available-for-sale investment, the bond portfolio should be reported at fair value. The changes in the cost and fair value would be adjusted using the valuation account and unrealized gain (loss) account.

Want to see more full solutions like this?

Chapter 15 Solutions

Financial Accounting

- An asset that can quickly be converted into cash is known as a(n): 1. Intangible asset 2. Fixed asset 3. Liquid asset 4. Contra-assetarrow_forwardDeluxe Industries used direct materials totaling $78,350; direct labor incurred totaled $217,600; manufacturing overhead totaled $389,200; Work in Process Inventory on January 1, 2022, was $195,400; and Work in Process Inventory on December 31, 2022, was $204,300. What is the cost of goods manufactured for the year ended December 31, 2022?arrow_forwardFinancial accounting question?arrow_forward

- I need help with this general accounting question using the proper accounting approach.arrow_forwardPlease help me solve this general accounting problem with the correct financial process.arrow_forwardI need help with this financial accounting question using accurate methods and procedures.arrow_forward

- Can you explain the correct approach to solve this general accounting question?arrow_forwardBeachside Hotel has sales of $1,250,000 and a profit margin of 10%. The annual depreciation expense is $135,000. What is the amount of the operating cash flow if the company has no long-term debt?need helparrow_forward5 PTSarrow_forward

- Tansen Industries bases its manufacturing overhead budget on budgeted machine-hours. The production budget indicates that 8,200 machine-hours will be required in July. The variable overhead rate is $6.75 per machine-hour. The company's budgeted fixed manufacturing overhead is $145,000 per month, which includes depreciation of $17,500. All other fixed manufacturing overhead costs represent current cash flows. What should be the July cash disbursements for manufacturing overhead on the manufacturing overhead budget?arrow_forwardThe unit cost of direct material isarrow_forwardNeed Helparrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning